The United States, the European Union, and the United Kingdom face two main difficulties when imposing sanctions aimed at disrupting Russia’s military production. First, it is not always clear which goods are being imported specifically for military use. Second, when one company is sanctioned, a substitute soon appears in its place, and while new Western restrictions are being introduced, the Russian military-industrial complex has time to adapt. But there is a way to solve this problem. After studying data on domestic supplies and comparing them with customs data, The Insider has identified 160 companies that make purchases specifically for the Kremlin’s military-industrial complex. If these were all to be added to sanctions lists at the same time, it could deal a serious blow to Russia’s military production efforts.

Content

How the suppliers were identified

Irreplaceable

The tip of the import iceberg

Old-timers, giants, contractors, and speculators

A list of the most important companies trading with the Russian military-industrial complex can be found on GitHub.

How the suppliers were identified

Enterprises in Russia’s defense industry rarely import products themselves. As a rule, they rely on intermediaries to purchase raw materials, blanks, machines, equipment, and spare parts. These are mostly small and mid-sized companies that are fully owned by private individuals — unlike defense firms, where the state traditionally holds a significant or controlling stake.

Such structures can more easily bypass bureaucratic hurdles, and they often have the funds and risk aversion necessary to overcome Russian customs barriers using informal means. The market-driven nature of this sector, combined with intense competition, is one of the main reasons for the resilience of Russia’s defense industry.

The Insider regularly reports on specific intermediary operations (individual Greek smugglers or German factories, for example) and on the structure of this foreign-trade intermediary market. Reporting has been done both in individual sectors, such as deliveries of Taiwanese machine tools, and more broadly, taking a wider look at shipments from Europe in a range of spheres.

The chain of transactions that can be traced from the foreign manufacturer to the Russian buyer typically stops once an imported good reaches Russia. After that, only indirect evidence can lead to the conclusion that the goods have ultimately ended up at a military production facility. This often becomes clear only after the fact, when Western components are found in the remains of missiles and drones used to attack Ukraine.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

Debris from the Russian Kh-101 cruise missile with American components

However, new investigative methods have finally allowed The Insider to reconstruct these chains on a large scale.

Using data on domestic-market transactions (which, in the interests of the investigation, The Insider is not disclosing) and comparing them with customs records, The Insider was able to analyze which foreign-trade participants struck deals in 2024 with leading enterprises in Russia’s military-industrial complex. Using this method, we were able to identify around 160 key firms.

The 160 companies selected are an important part of the defense-industrial complex, but the actual number of intermediaries is far larger. The Insider’s analysis so far covers only the tip of the iceberg and marks only the beginning of the investigation.

Customs data show that in 2024 about 10,000 Russian companies imported sanctioned products worth more than $22 billion. More than 2,000 of those companies were contractors for leading defense-industry enterprises. According to data obtained by The Insider, those contractors made direct deliveries to major military-industrial firms worth more than 80 billion rubles, or about $1 billion.

The total value of sanctioned goods imported into Russia by defense-industry contractors exceeded $5 billion — a tally that includes only shipments with a value of $20,000 or more. (Not all of those products necessarily ended up in the military-industrial complex, however, as a significant share is also in demand in the civilian sector.)

Deliveries also often do not take the most direct route, instead moving through a network of intermediaries. Among the leading defense-industry enterprises examined by The Insider, only around half deal directly with importers of sanctioned goods.

Irreplaceable

A significant portion of sanctioned components cannot be replaced with analogues, and their absence would cause critical problems for Russia's defense industry.

For example, Japanese SMC Corporation laser plasma chemical etching equipment is in demand in the field of domestic electronics that are manufactured in Zelenograd (just outside Moscow) and installed in military products. In 2024, Kontrakt Holding imported such a system for the well-known Russian microchip manufacturer Mikron, an army supplier that is under sanctions. Microchips are needed in virtually all modern weapons.

In addition, FPGAs, which serve as the “brains” of any system whose navigation is based on terrain recognition, are vital for military equipment. As such, they are used in a number of modifications of Russian Geran drones. The company Uniserv LLC imported Xilinx FPGAs into Russia in 2024, supplying such goods to the drone manufacturer STC LLC (ООО «СТЦ»), which is under sanctions.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

Geran drones require Xilinx FPGAs

Measuring machine sensors are used in the military industry for the precision manufacturing of parts. Such sensors from the British company Renishaw, whose products are the global market leaders in terms of quality, were imported in 2024 by Intratool LLC (ООО «ГК «Интратул»), which traded with the sanctioned engine manufacturer PJSC UEC Saturn (ПАО «ОДК Сатурн»).

The tip of the import iceberg

Even a single transaction between an importer of sanctioned goods and a military plant is already a red flag that calls for closer scrutiny. In order to weed out very small transactions, The Insider selected from the list of importers that serve as counterparties to leading defense enterprises, evaluating only those that supplied military plants with goods worth more than 1 million rubles (around $13,000). More than 300 such importers were identified. Their transactions with leading defense plants totaled 11 billion rubles ($142.3 million), while their overall imports totaled about $2 billion.

For example, imports by Rustakt, a manufacturer of drones and importer of lithium-ion batteries for drones, amounted to 30 billion rubles ($388.2 million). Deals with the defense industry that The Insider was able to confirm totaled 13 million rubles ($168,000).

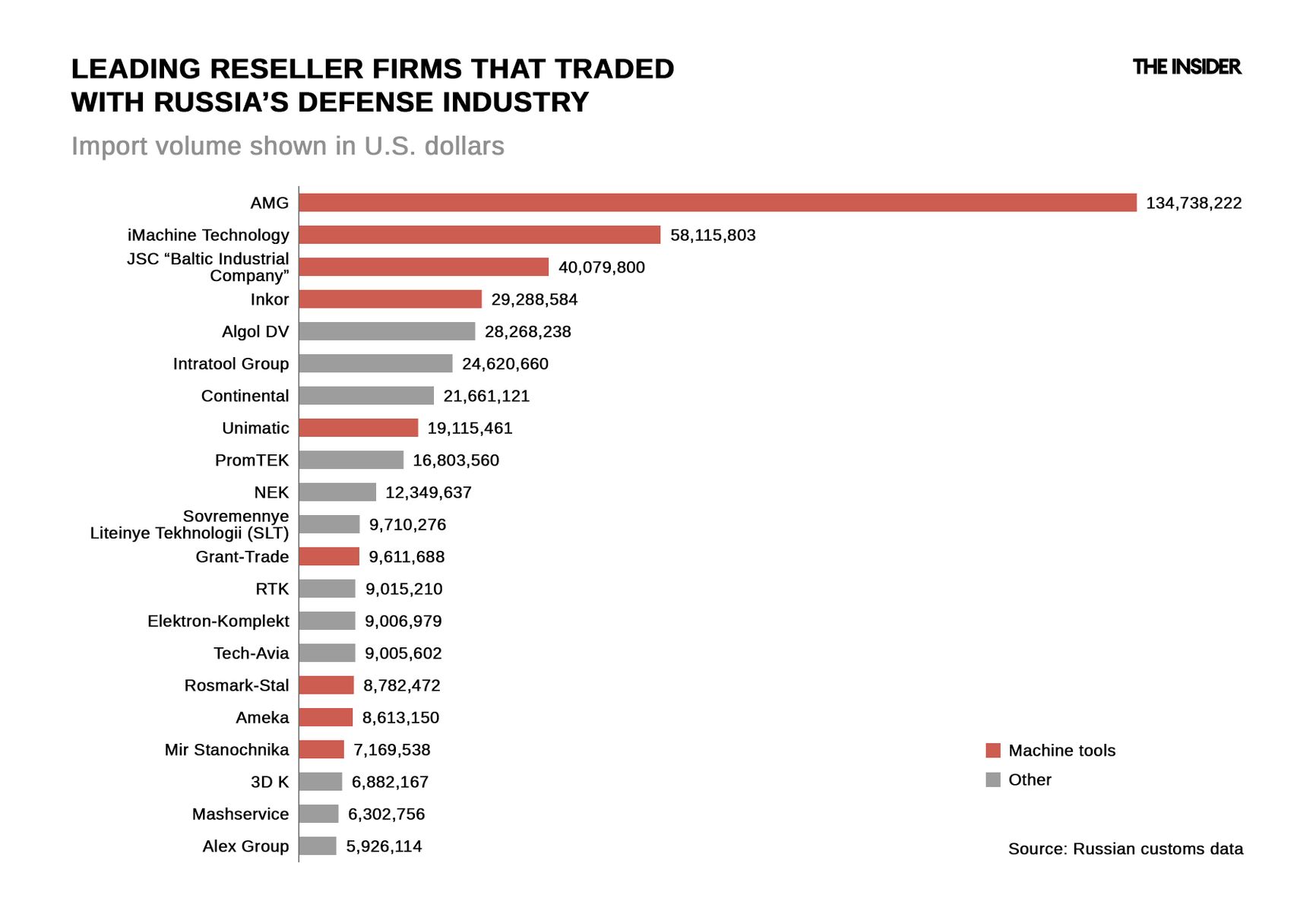

A number of companies import milling and turning machines, some of which are supplied to the military-industrial complex. Among them are Mir Stanochnika, iMachine Technology, AMG, Promservice, and the Baltic Industrial Company. The Insider has previously reported on some of them, establishing their cooperation with the defense sector.

It is clear that it is the enterprises of Russia’s military-industrial complex that are now most in need of an upgrade to their metalworking machine tool fleet. The Insider was able to confirm only a limited number of deals. However, given the real needs of the sector, there are likely to be many more.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

It is the enterprises of the Russian military-industrial complex that are now most in need of an upgrade to their metalworking machine tool fleets.

High-precision oscilloscopes and signal generators are in demand for electronic warfare devices. They are supplied by the Dipaul group (as detailed here). According to information obtained by The Insider, Dipaul is a regular supplier to the military-industrial complex.

Old-timers, giants, contractors, and speculators

Importers that trade with Russia’s defense industry can be divided into four groups.

The first includes manufacturers that buy sanctioned goods directly, without intermediaries. These are fully or partly state-owned, long-established defense industry plants that both conduct foreign trade and produce items that are later sold inside Russia’s own defense sector.

Specific companies falling in the first group include KRET, UEC, the Ural Optical-Mechanical Plant, the United Instrument-Making Corporation, and the Kazan Helicopter Plant. However, companies that engage in both foreign trade and military-industrial production are largely an exception. In general, defense enterprises do not deal with foreign suppliers directly. (Bureaucracy at large factories, along with international sanctions, make such arrangements difficult.)

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

Due to bureaucracy and sanctions, enterprises of the Russian military-industrial complex enterprises rarely conduct business with foreign countries directly.

The second group of buyers of sanctioned parts consists of industrial giants that produce bulk commodities such as steel, pig iron, aluminum, and petroleum products. For the defense industry, these producers are critical; however, the defense industry is not critical for them, as they will have plenty of civilian buyers, a list that includes builders, road construction contractors, mining companies, and automakers.

Many companies of the second group are not under sanctions — this despite their scale and economic importance to Putin’s Russia. That appears to be a deliberate policy by Western powers, which would lose more from higher prices for the goods produced by these giants than they would gain from reducing the volume of their operations.

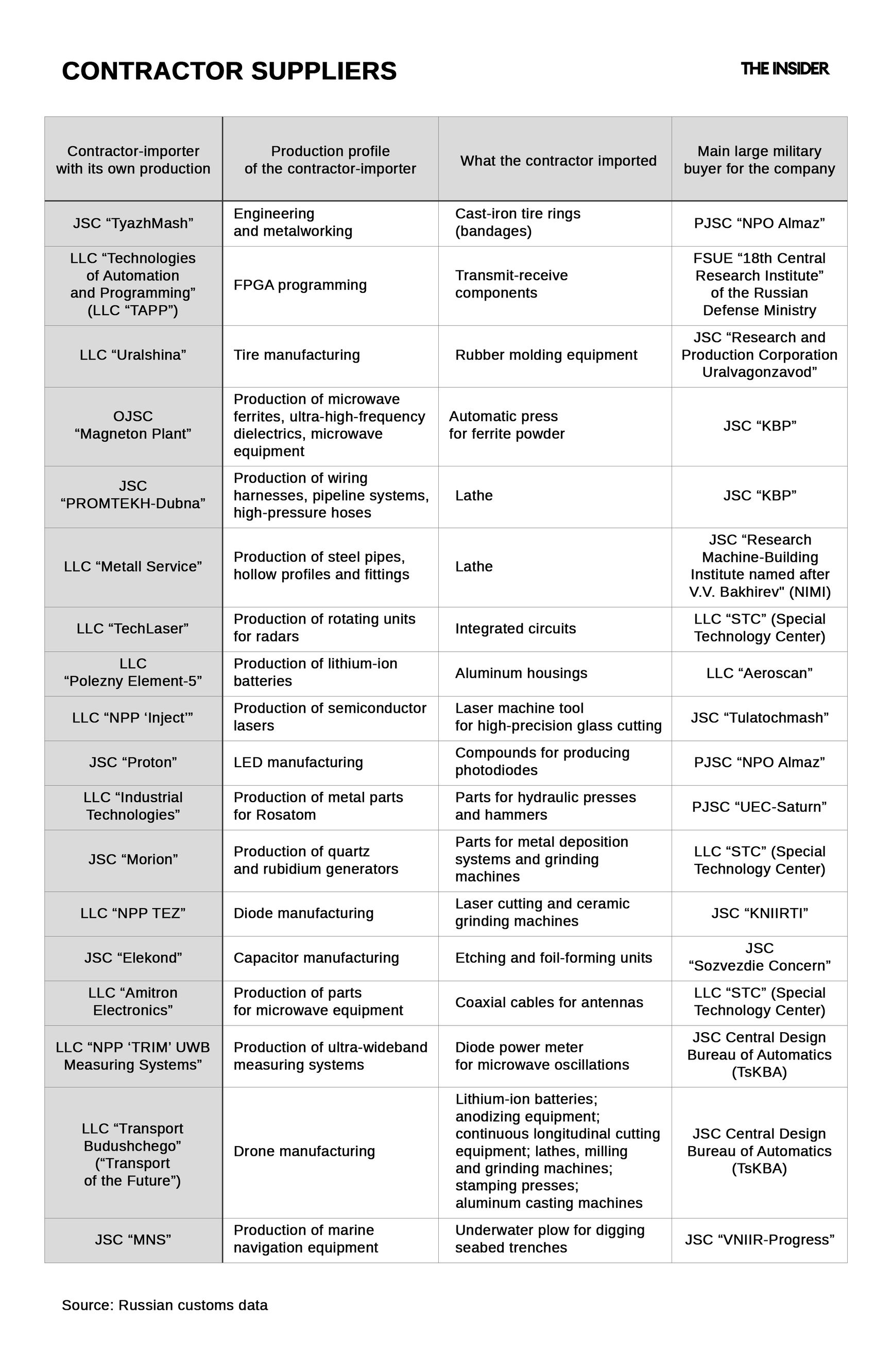

The third group includes contractors or “adjacent” suppliers — i.e. companies in Russia that produce important individual units, blocks, or assemblies for the defense industry but depend heavily on imports of raw materials and components. This is the most interesting group of private importers doing business with the defense sector. Examples of such companies and their products, listed in descending order of their trade volume with the defense industry, can be found in the table below.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

These adjacent suppliers are mostly private businesses that are flexible enough to import the parts and components they need on their own. At the same time, they take risks when they go to foreign markets as they understand they could become “visible.” If they are hit with sanctions, they would have to look for intermediaries to handle foreign trade. Given that they typically boast hundreds of employees, complex property holdings, and an array of licenses and certificates, these firms cannot simply shut down and reopen from scratch.

Finally, the fourth — and largest — group of importers consists of reseller firms. These classic intermediaries are typically private limited-liability companies with a small number of employees. They specialize in wholesale trade in a fairly narrow sector, for example metalworking, electronics, or measuring tools.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.

Among resellers, there are a few large retail chains whose customers include individuals and companies in the civilian sector while also fielding orders from the defense industry.

The biggest group of resellers are suppliers of metalworking machine tools and the spare parts for such units. In addition to the machine-tool firms already mentioned above, top resellers include Unimatic, Ameka, Promarsenal, Rosmark-Stal, Soyuz Engineering, Ipr Oborudovanie, MT Machinery, STS Technology, Grant-Trade, and Inkor.

Resellers of electronics, circuit boards, microchips, radio parts, connectors, telecom equipment, and industrial automation systems are less visible, in part because Russian customs officials began concealing data on some electronic components starting in 2024.

These include Trimiks, Uniservis, Radiofid Systems, and Bi Pitron. This category features both suppliers of finished foreign products (mainly Chinese-made) and firms that take orders in Russia to manufacture electronics to a Russian company’s specifications.

Some resellers, such as Bi Pitron, also produce their own products, as was described by company representative Vasily Malyshev at Russia’s Army 2024 forum. According to Malyshev, Bi Pitron has developed an import-substituting optical signal converter for the military. (Nevertheless, any claims that “all” elements of the communications line are made from Russian components raise serious doubts.)

Of particular interest are companies whose import turnover roughly matches their turnover from deals with the defense industry. Bi Pitron, which uses shell firms in Indonesia to supply wires and cables, is one of them. A near one-to-one ratio between imports and deal turnover, as well as the near total absence of these firms in the public space (typically they have no offline stores and no clear websites with catalogs) suggests that they are little more than shell companies for military plants.

Western countries have only added a portion of the largest reseller-importers (by volume of deals with the defense industry) to their sanctions lists. Medium and small resellers (again in terms of their deal volume with the defense sector) are mostly not under sanctions at all.

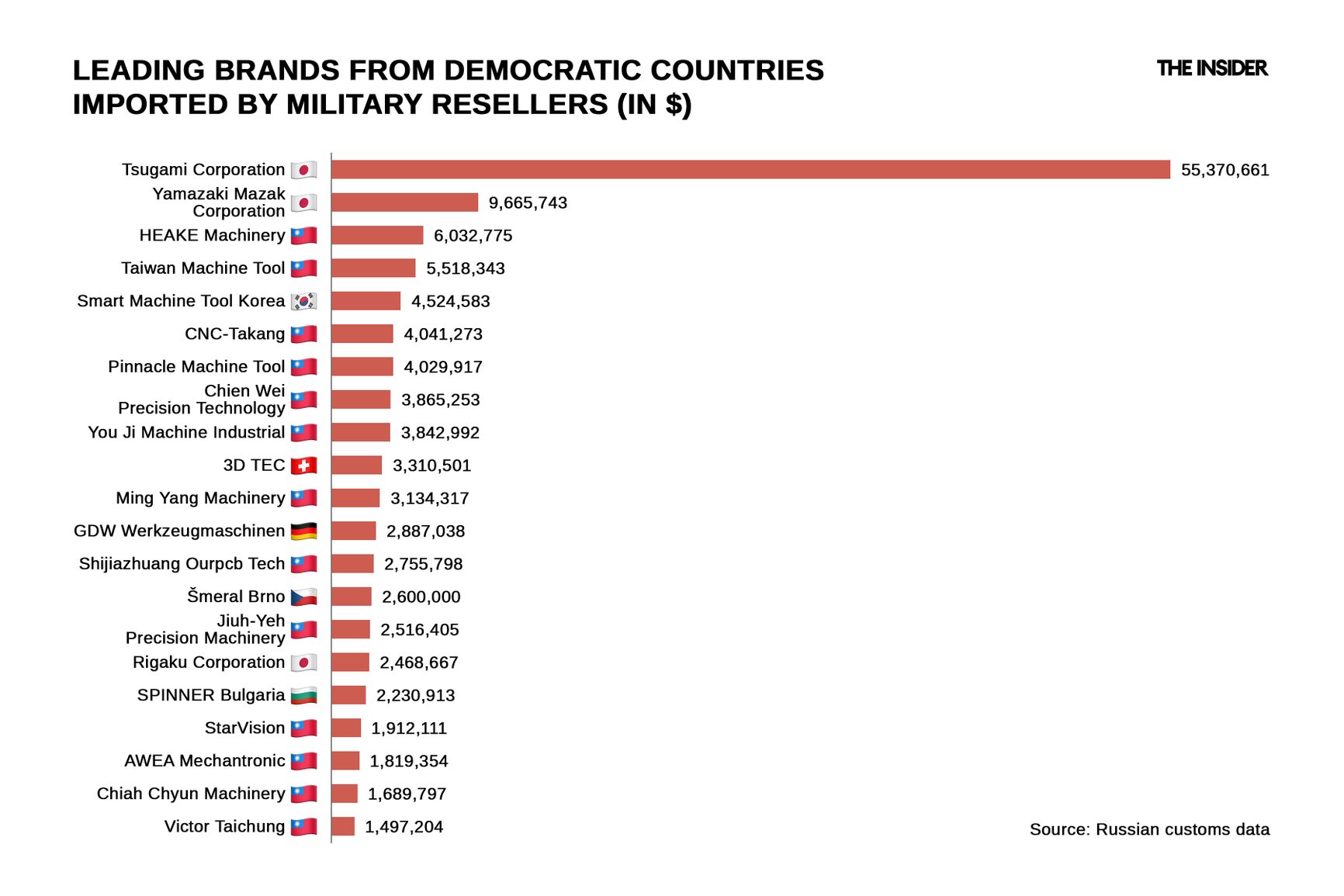

Resellers import not only Chinese equipment. The leading “Western” brand still finding its way into Russia has been Japan’s Tsugami, which makes machine tools. Taiwan, South Korea, and Switzerland are also leading country-of-origin suppliers.

A field-programmable gate array (FPGA) is an electronic component (an integrated circuit) used to build configurable digital electronic circuits.

Geran drones are Russian-localized, Iranian-designed attack («kamikaze») UAVs, primarily based on the Shahed series.