Now that India has begun to eliminate its dependence on Russian oil, China remains one of the last key players preventing Western sanctions from fully isolating Moscow. The Insider’s analysis shows that Beijing possesses the leverage to decimate Russia’s military-industrial complex without seriously affecting the Chinese industrial sector — or even the lives of Russian civilians — simply by halting the export to Russia of a few specific goods. These critical Chinese deliveries do not consist of sophisticated weapons systems, but of relatively simple components. Russia cannot quickly or easily manufacture these components at scale, and without them, its military would lose the capacity to maintain offensive operations in Ukraine at anything close to their current pace. The Insider has identified five key examples.

Content

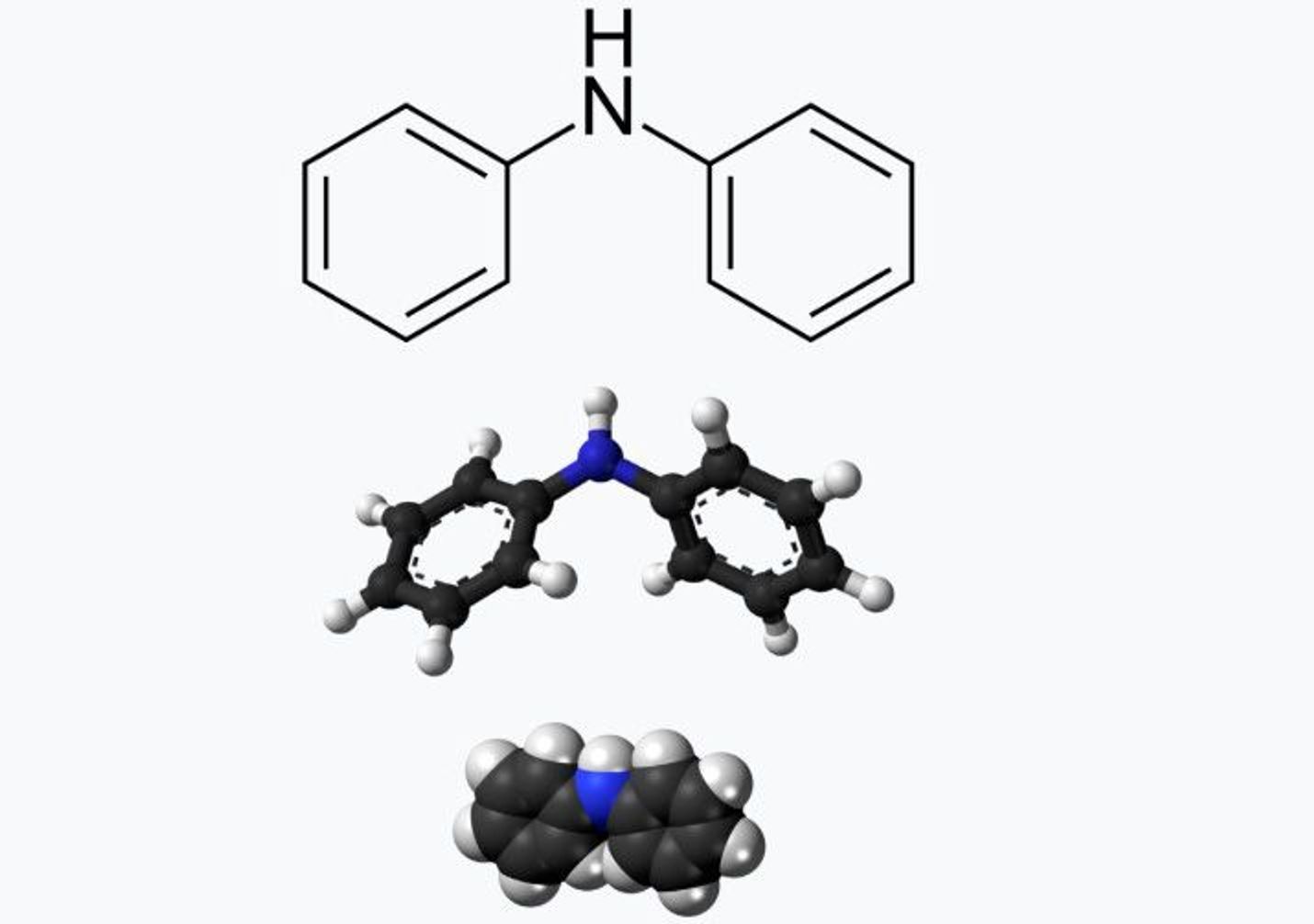

Powder stabilizer: Diphenylamine

Anti-jamming antennas

Electric motors (for FPV drones)

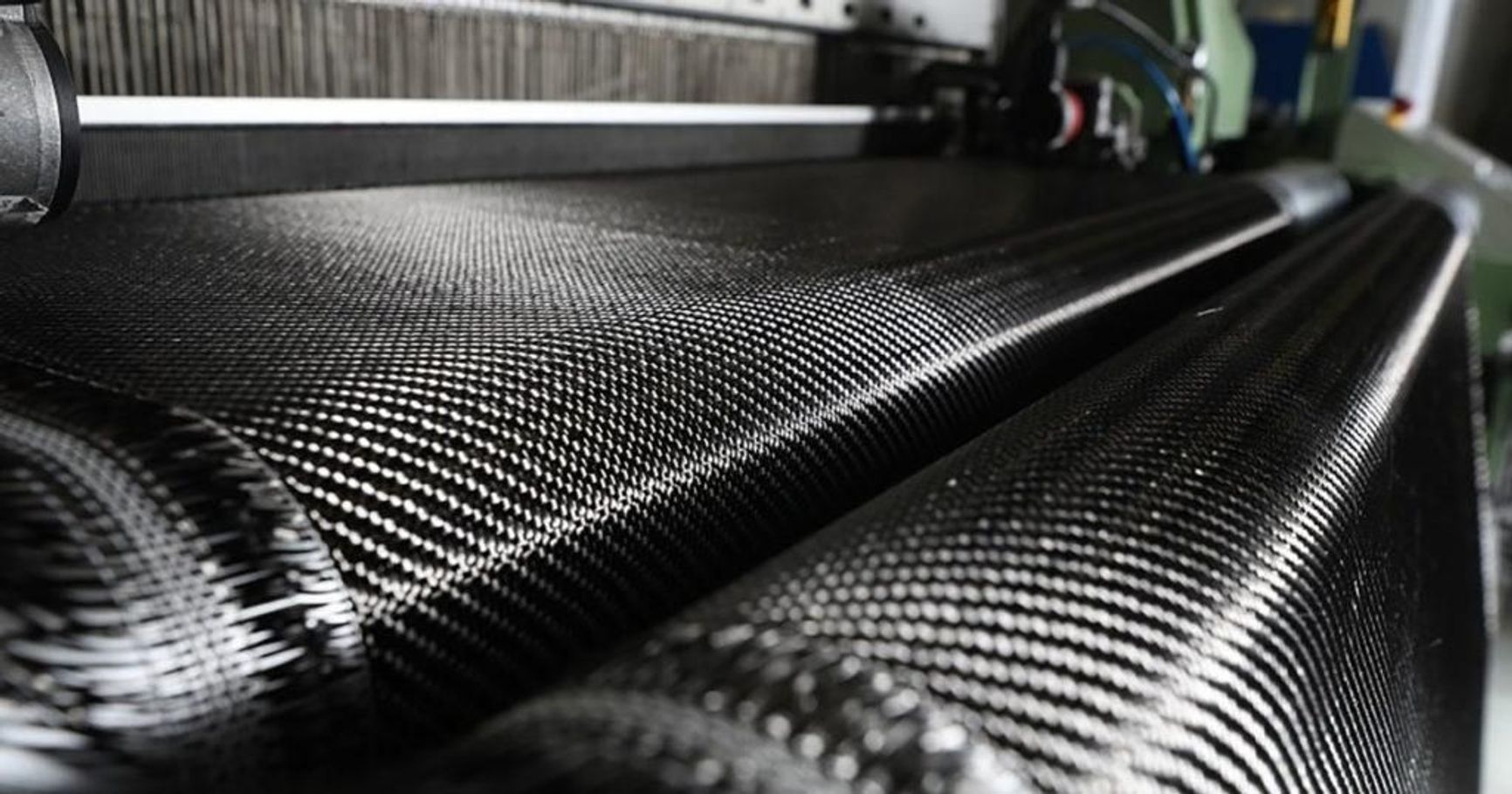

Carbon fiber

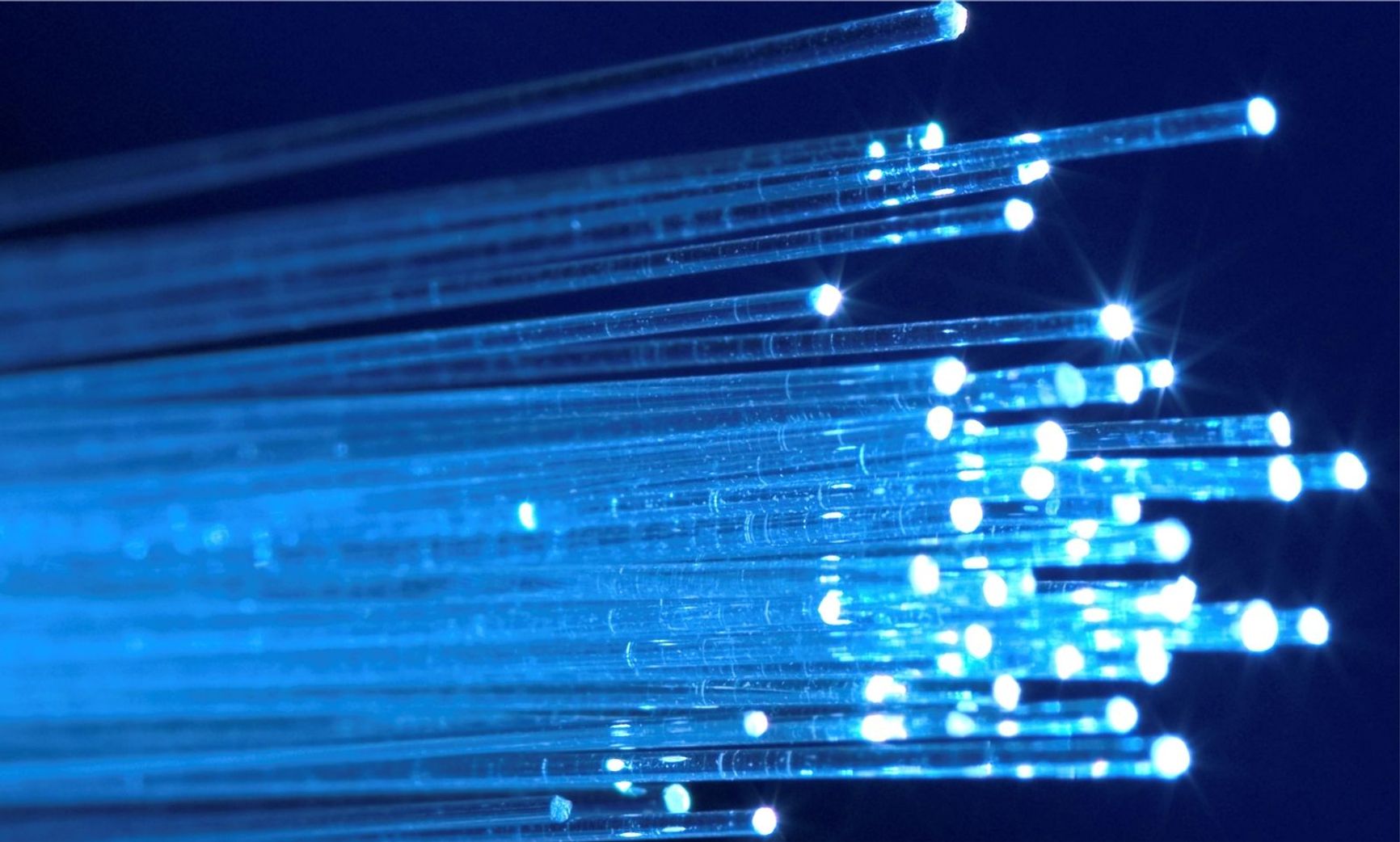

Fiber optics

Why Russia can’t just manufacture it all on its own

Russia’s military-industrial complex is heavily reliant on imports, and it is not just advanced Western technologies that are irreplaceable. Even basic components are largely imported, as manufacturing them domestically has long been economically unviable. In theory, Russia could produce most of what it needs, but in practice, setting up production for even a single category of item typically takes a year or more. And scaling up production for a wide range of components simultaneously is virtually impossible.

That means Russia can only respond reactively, replacing imports in specific areas when supply chains break down. Thanks to the fact that decision makers in Moscow rarely know in advance what critical components might be sanctioned next, unexpected disruptions can stall production for months — or even years — before domestic production is built or an alternative foreign supplier is found.

The Insider has found that China’s role as a conduit for the illegal transshipment of Western precision technology to Russia may not be as significant as is often assumed. However, when it comes to low-cost, basic components and spare parts, China’s contribution to the Kremlin’s war machine is irreplaceable. Even halting exports of a single “minor” item — such as one that costs mere thousands of dollars — has the power to freeze a critical Russian production line for over a year. In the case of certain weapons systems, that could be decisive on the battlefield.

Even halting exports of a single “minor” item — such as one that costs mere thousands of dollars — has the power to freeze a critical Russian production line for over a year.

The Insider has repeatedly identified shipments of unique industrial equipment, new technologies, precision instruments, and rare raw materials from both West and East that likely support Russia’s military-industrial complex. And yet, it is the restriction of relatively unsophisticated technologies and materials — whose import into Russia is no secret — that could have the greatest potential to slow down Russia’s war machine.

Five examples are outlined below.

Powder stabilizer: Diphenylamine

Smokeless gunpowder is essentially nitrocellulose with additives that make it stable for storage and use. One of these additives, diphenylamine, is essential for stabilizing pyroxylin-based propellant. The Insider has confirmed that China is a key supplier of this chemical to Russia, covering at least half of its total demand.

Anti-jamming antennas

The Insider has previously reported on Russian imports of antennas from China — both from the Republic of China (Taiwan) and from the People’s Republic of China. These complex antennas consist of multiple elements that selectively receive signals from certain directions, allowing them to “filter out” jamming signals, thereby providing Russian troops with a means of countering Ukrainian electronic warfare systems on the battlefield. Without them, drones like the Shahed would be effectively blind.

Electric motors (for FPV drones)

The principle behind electric motors dates back to the 19th century. In drones, a common type of motor uses fixed coils surrounding a rotor embedded with permanent magnets. A simple control circuit creates a rotating magnetic field that powers the motor. Manufacturing such motors requires magnets, ball bearings, fine copper wire, some basic electronics — and, for mass production, wire-winding machines.

As The Insider has found, Russia is heavily dependent on Chinese electric motors for its drones. There is no known domestic production in Russia on a scale anywhere near sufficient to meet military demand. Meanwhile, The Insider previously reported that Russia was importing over $100 million worth of drone motors per year. The technology itself is not unique, but no other country currently produces these motors at the volume that China does. If Russia were to be cut off from these supplies for even a year, it would likely be unable to scale up domestic production quickly enough to meet demand, causing an immediate and severe impact on the battlefield — where drones have become a defining weapon of the war.

Carbon fiber

Carbon fiber is a modern material known for its strength and flexibility. In civilian use, it appears in fishing rods, ski poles, and other sporting equipment. But it’s also critical in industries like aerospace, automotive, and defense. In drone production, where lightweight and durable materials are key, carbon fiber is indispensable.

The Insider has found that Russia relies heavily on Chinese carbon fiber. Without it, not a single Shahed (“Geran”) drone could take off — and with it, those drones are lighter and therefore fly longer.

Fiber optics

The first commercially viable optical fiber emerged in the 1980s, revolutionizing communications. Over the past year, FPV drones that navigate using fiber-optic links have become a powerful force on open battlefields in Ukraine.

The Insider discovered that Russia is almost entirely dependent on China for both finished fiber-optic cable and for the raw material needed to produce it: quartz glass preforms. Russia does not manufacture preforms domestically, and its own optical fiber production may have been disrupted after a Ukrainian strike on a plant in Saransk. As a result, imported fiber optics have become even more critical.

Why Russia can’t just manufacture it all on its own

Up until 2014, Russia, like much of the world, followed a path of economic integration and deepened global division of labor. Most industrial technologies, especially those that are not high-end, are cheaper and more efficient to import than to develop domestically. After international sanctions were imposed in 2014 following Russia’s annexation of Crimea and its shootdown of civilian flight MH17, Vladimir Putin promoted a policy of import substitution. However, in the modern global economy, even industrial giants like China would struggle to remove themselves from international supply chains.

For Russia, which produces just 3% of global GDP — most of it based on natural resource extraction — the idea of full-scale industrial self-sufficiency was unrealistic from the start. After 11 years of sanctions, the Russian economy’s integration with the global economy has declined, but true import substitution in the defense sector has never materialized. As a result, the country remains heavily reliant on China and other foreign suppliers even for the most basic technologies, and this situation is likely to continue for years to come.