Russia’s full-scale invasion of Ukraine is well into its third year, and finally, international sanctions are having a visible impact on Moscow’s imports of goods with potential military applications. An analysis by The Insider based on customs data shows that in 2024, Russia imported $7.7 billion worth of industrial goods — down from $11 billion the previous year — with some categories, particularly electronics, seeing tenfold declines. Even China, Russia’s main supplier of manufacturing equipment, is scaling back shipments. At the same time, new supply chains have emerged through the most unexpected countries, including Gabon, Haiti, and the Democratic Republic of the Congo. The reasons for the decrease vary: in some cases, Russia may have localized production or begun importing goods without making declarations, but the broader trend shows that a combination of declining funds and increased oversight are weakening Russia’s military-industrial complex.

Content

Decline in shipments

What’s gone missing?

Turkey, Cameroon, the UAE — and even Vanuatu: Who’s replacing China?

Why imports are falling — and how the West could tighten controls

Decline in shipments

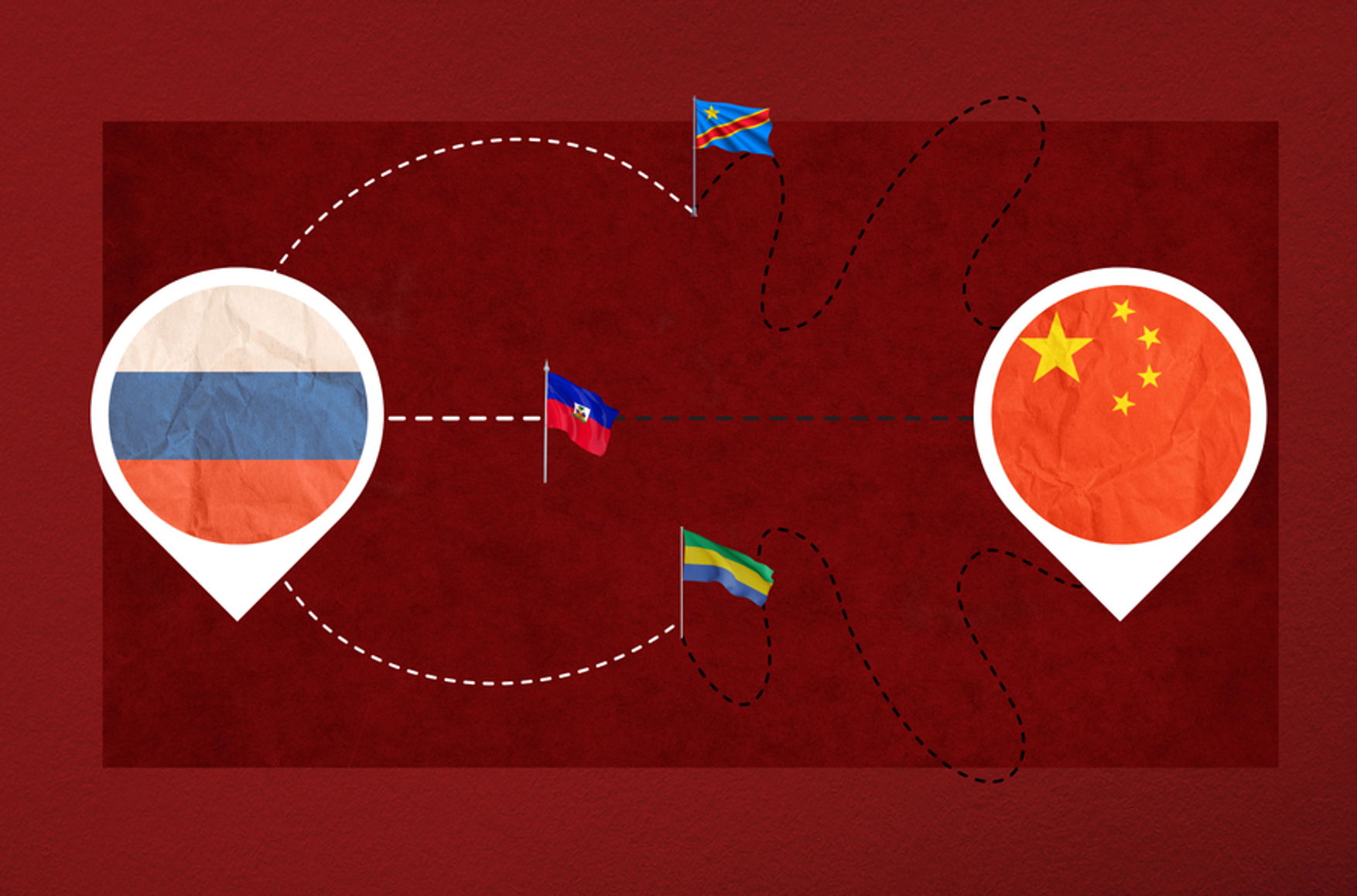

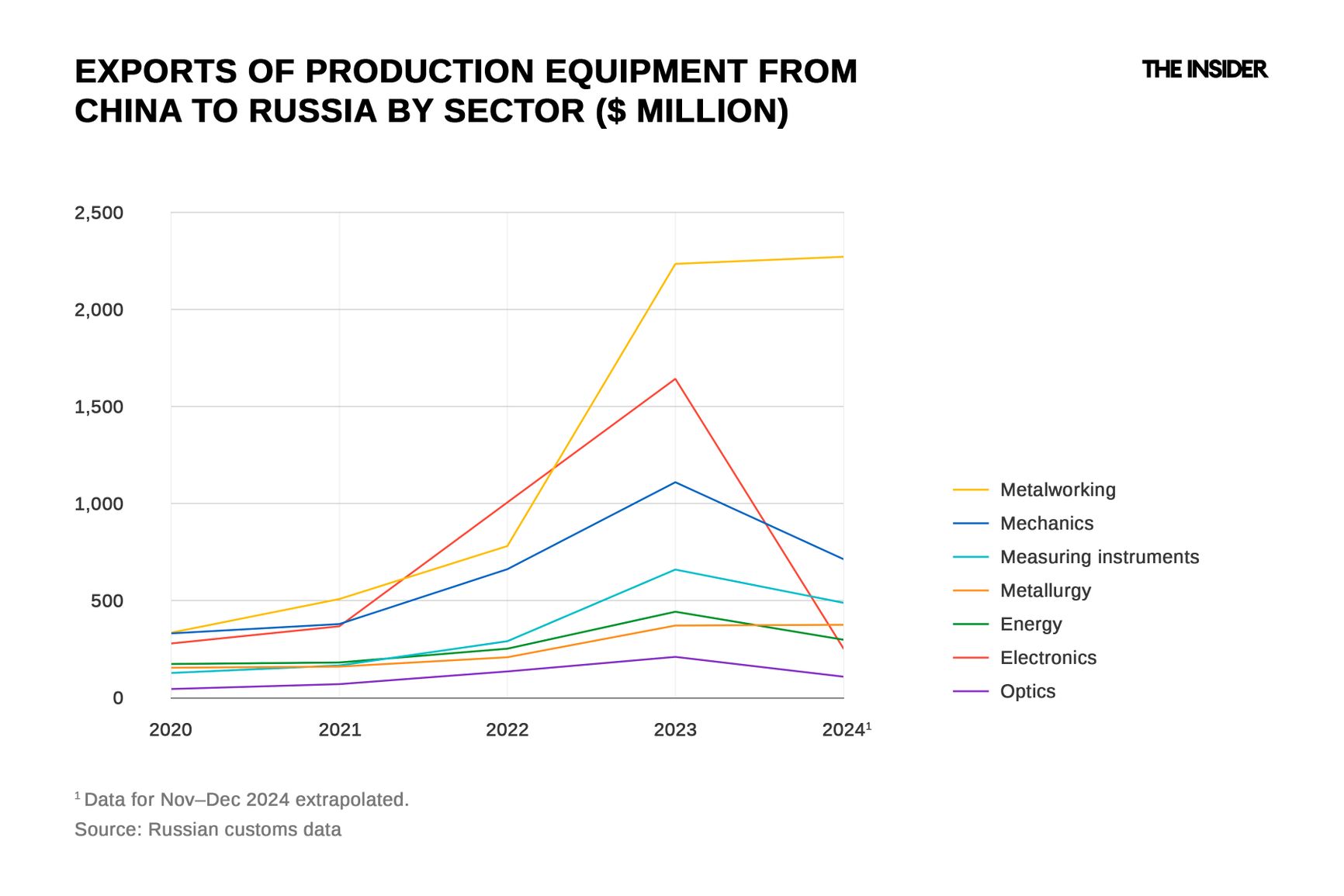

Trade restrictions targeting Western industrial equipment have finally begun to bite. According to Russian customs records, official deliveries from both China and other countries dropped more than tenfold in 2024. Overall, Russia’s imports of industrial equipment fell by roughly 50%.

In 2021, before the full-scale invasion of Ukraine, Russia was importing over $9 billion worth of industrial machinery every year. Despite sweeping sanctions imposed in the spring of 2022, imports initially surged as wartime demand for components, machinery, and tools increased — with China stepping in to meet Moscow’s needs. In 2023, imports peaked at over $11 billion, with $6.68 billion of that figure coming via China.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Over the past four years, China has become Russia’s main source of industrial hardware, with Russian technological supply chains that previously relied on Western countries and their allies being largely monopolized by Chinese firms. This partnership with Beijing was seen as a key safeguard for Russia’s military-industrial complex, allowing domestic factories to continue producing military goods as if nothing had changed.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Moscow’s partnership with Beijing was seen as a key safeguard for Russia’s military-industrial complex.

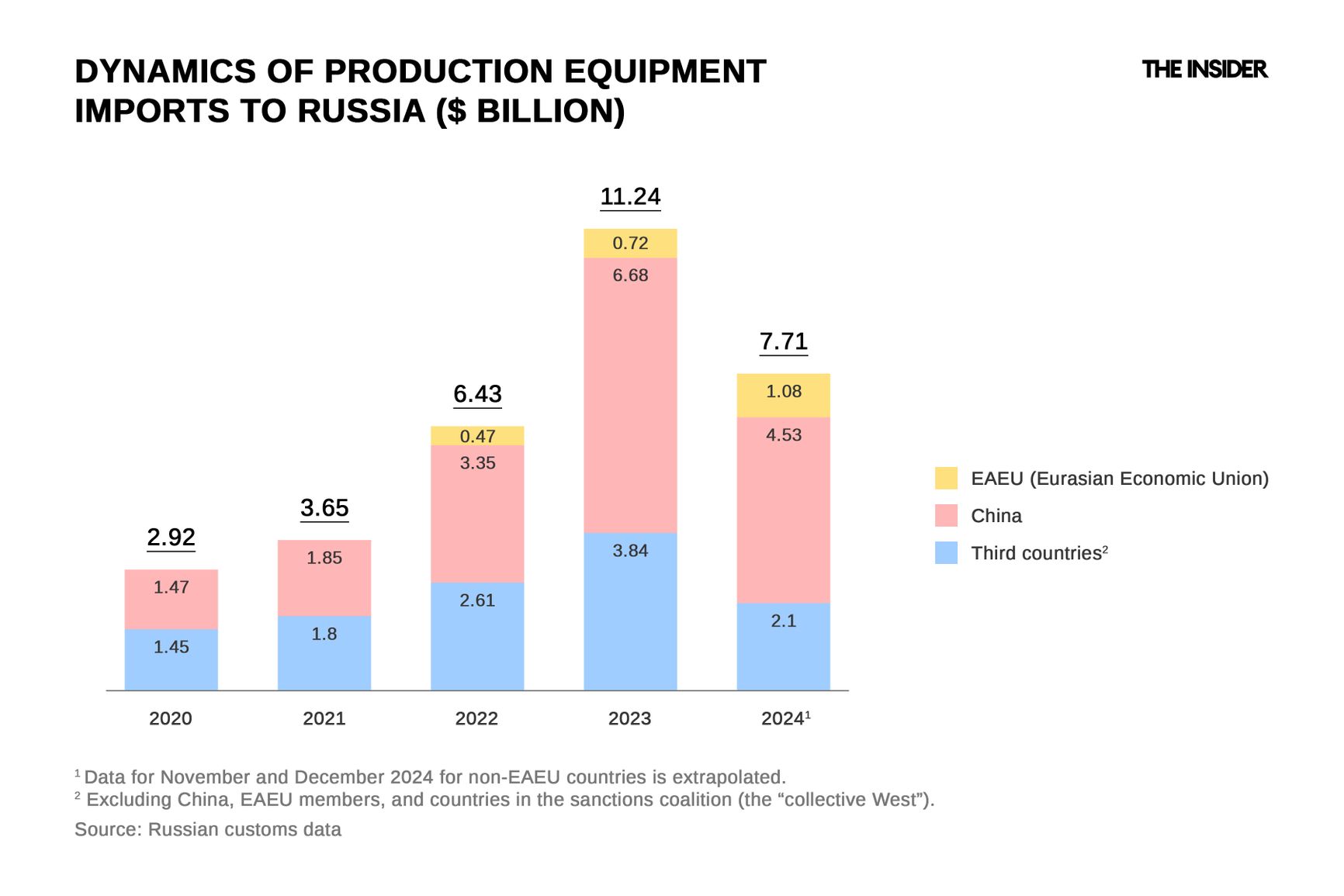

However, the latest customs data suggest Russia fatigue among Chinese manufacturers, intermediaries, and financiers is finally setting in. From 2020 to 2023, Russian imports of U.S., European, Japanese, and South Korean-made electronic components via China rose by a factor of 60. However, in 2024, they plummeted 17-fold. Declines are evident across nearly all industrial categories, including power systems, metallurgical equipment, optical elements, and mechanical components like transmission shafts, bearings, and centrifuges.

Only imports of Western-made metalworking machines and measuring instruments — from the EU/EEA, Switzerland, the UK, U.S., Canada, Australia, New Zealand, South Korea, Japan, and Taiwan — showed an increase. However, in total dollar value, imports of Western-made industrial equipment have fallen by 23% and continue to decline.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

The falloff includes not just Western equipment exported via China, but also goods made in China and itsSoutheast Asian neighbors. The decline is evident across all sectors except for metalworking.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

What’s gone missing?

As The Insider has documented in multiple investigations, finished weapons and military gear are imported into Russia in very limited volumes and only in niche categories. But the import of industrial equipment and components is critical to Moscow’s production of weapons and the continuation of the war.

Key imports previously included:

- Taiwanese, Czech, German, and South Korean metalworking machines

- German drills

- Israeli milling cutters

- Italian metallurgical lines

- Swedish and German coordinate measuring machines

- Swiss and American inertial navigation sensors

- German alignment lasers

- Australian optical processors

- Czech waterjet machines

- German and American oscilloscopes and signal generators

- U.S.-Taiwanese, French, and Dutch microchips

- American FPGAs (field-programmable gate arrays)

- Czech industrial furnaces

All of these are crucial for Russia’s defense industry in its production of artillery, firearms, drones, electronic warfare systems, and other military technologies.

Complex supply chains have long been employed to bypass embargoes and corporate bans, with industrial machinery typically entering Russia through three main routes: China, the Eurasian Economic Union (EAEU), and other non-Western countries including Taiwan, Israel, Singapore, Hong Kong, and Turkey. Despite their governments’ official positions, many of these states have often provided loopholes for the circumvention of sanctions.

By 2024, direct imports from countries strictly adhering to sanctions — such as the EU/EEA, Switzerland, the UK, U.S., Canada, Australia, New Zealand, South Korea, and Japan — dropped to negligible levels, below $200 million.

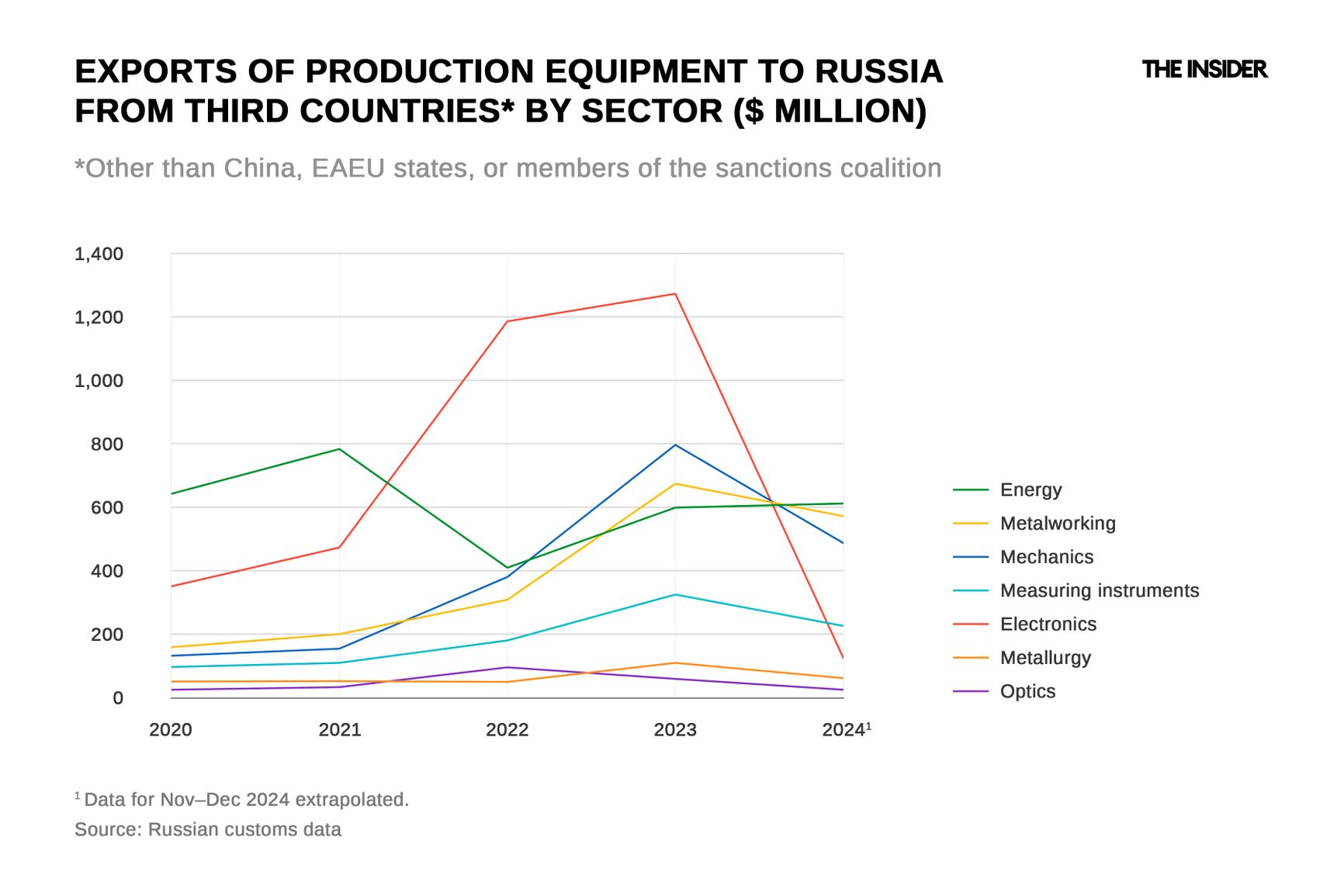

Customs data indicates that the rise in imports from third-party countries in 2023 and the subsequent collapse in 2024 occurred across nearly all sectors: mechanical engineering, electronics, metallurgy, metalworking, and precision instruments. The only exception in this category was energy equipment, which continued to grow slightly, while optics never showed meaningful growth.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

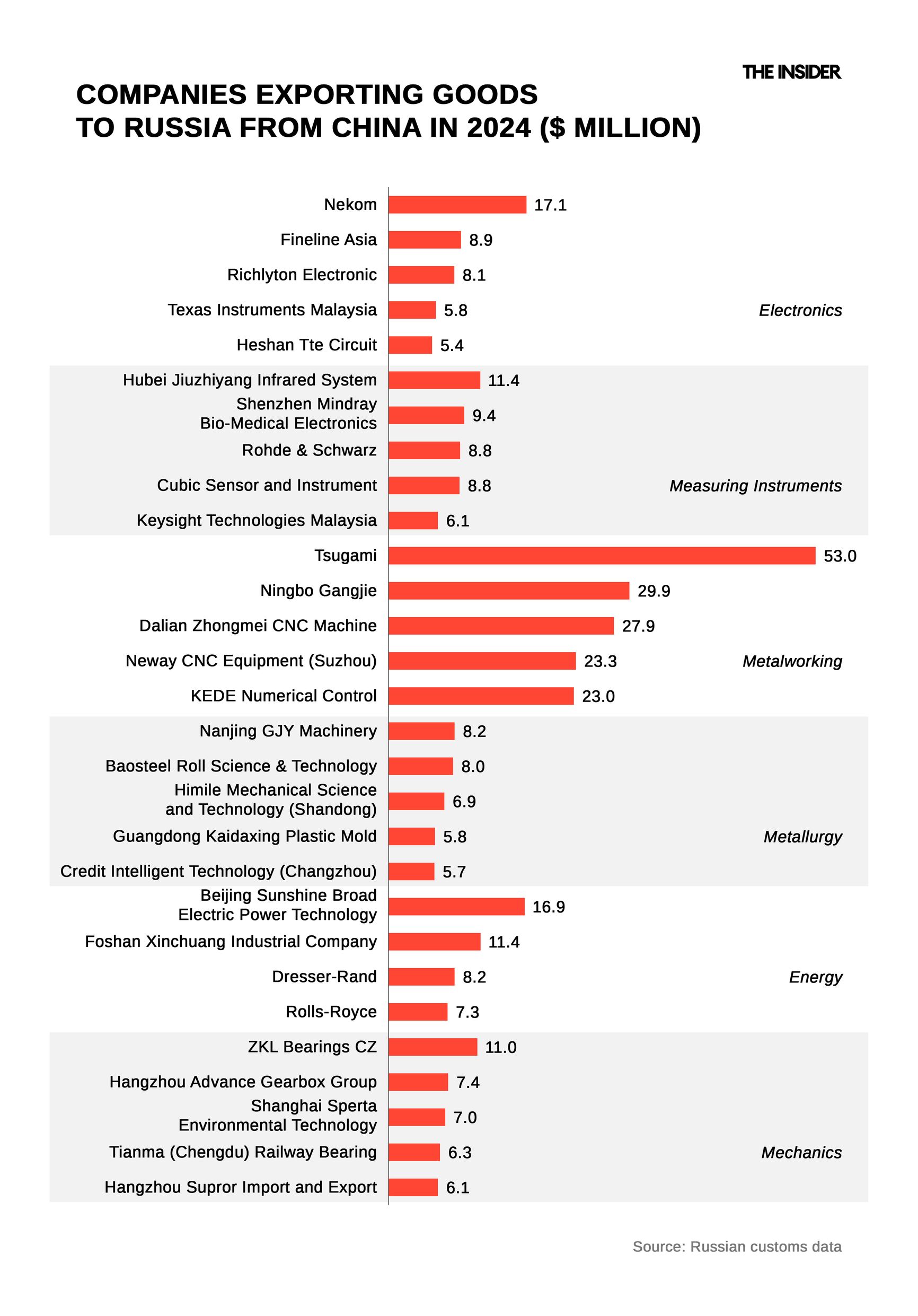

Now, however, declared imports of electronic components from China have nearly ceased. Until 2024, the contraband leaders were products from major companies like Analog Devices and Texas Instruments — vital suppliers to Russia’s military sector. But the landscape has shifted dramatically.

Today, the leading exporter of industrial electronics to Russia is Hong Kong-based Nekom Limited, a little-known firm not among the global tech giants. According to its website, Nekom specializes in custom-printed circuit boards (PCBs). The next leading firms are Fineline Asia Ltd, Richlyton Electronic Limited (also based in Hong Kong), China’s Heshan TTE Circuit, and Inno Circuits Limited. Among Western firms, only Texas Instruments remains in the top five.

The data points to a shift in strategy: rather than importing branded components, Russia now appears to be sourcing pre-assembled, custom electronics from little-known PCB manufacturers on demand. At the same time, the overall market has seen a steep decline. In 2024, electronics imports from China — regardless of origin — dropped from $1.6 billion to just $260 million.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Rather than importing branded components, Russia now appears to be sourcing pre-assembled, custom electronics from little-known manufacturers.

Among measuring instruments imported from China, Chinese manufacturers top the list, but German firm Rohde & Schwarz ranks third, and U.S.-based Keysight Technologies ranks fifth — both companies have previously been linked by The Insider to military-grade devices like oscilloscopes and signal generators, essential for testing and configuring electronic warfare systems.

Of the top 100 firms exporting measuring instruments from China to Russia, 25 are non-Chinese, accounting for about one-third of all exports in that category. For comparison, in 2021, imports in this sector totaled just $160 million, and only 11 non-Chinese firms made the top 100.

As for metalworking equipment — lathes, milling machines, and CNC centers — two brands from the democratic world dominate: Japan’s Tsugami and South Korea’s Hyundai Wia, accounting for a combined 21% of all imported production tools from Western countries. Tsugami has led exports to Russia via China in both 2023 and 2024, outpacing all other Western brands. From 2021 to 2024, its shipments increased by roughly 150 times.

However, in previous years, Chinese brands were the most notable: Neway CNC in 2023, General Technology Group Dalian Machine Tool in 2022, and Jinan Bodor CNC in 2021. Japanese Tsugami’s record in 2024 represents a rare instance of Western machinery imports into wartime Russia outpacing the delivery of Chinese equipment.

Still, when it comes to metallurgical equipment, non-Chinese manufacturers are almost entirely absent. Among the top 100 brands imported into Russia in this category, only three are non-Chinese, and they account for just 4% of the total volume.

This suggests that in sectors like smelting, forging, and rolling, Russia and China have nearly achieved self-sufficiency. Japanese precision multi-axis CNC machines continue to be in demand, though China appears to be gradually improving the quality of its own metalworking machinery

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

In sectors like smelting, forging, and rolling, Russia and China have nearly achieved self-sufficiency — although Japanese CNC machines continue to be in demand.

A distinctive feature of the energy sector is the disproportionately large impact of one-off shipments (including of used equipment). In 2024, companies like Dresser-Rand and Rolls-Royce appeared in the top five energy firms supplying Russia — almost entirely due to a major collection of individual shipments, many of them previously reported by The Insider. Notably, Ukraine’s Motor Sich (Zaporizhzhia) made it into the top 20 brands exporting from China to Russia — indicating that shipments intercepted by the Security Service of Ukraine (SBU) in 2022 seemingly continued by inertia into 2024.

In the mechanical devices sector — which includes bearings, centrifuges, and transmission shafts — the leader was Czech company ZKL Bearings. Other top 20 brands in this category are mostly Chinese, with two exceptions: India’s Bharat Forge Limited and Japan’s Akita Kaihatsu.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

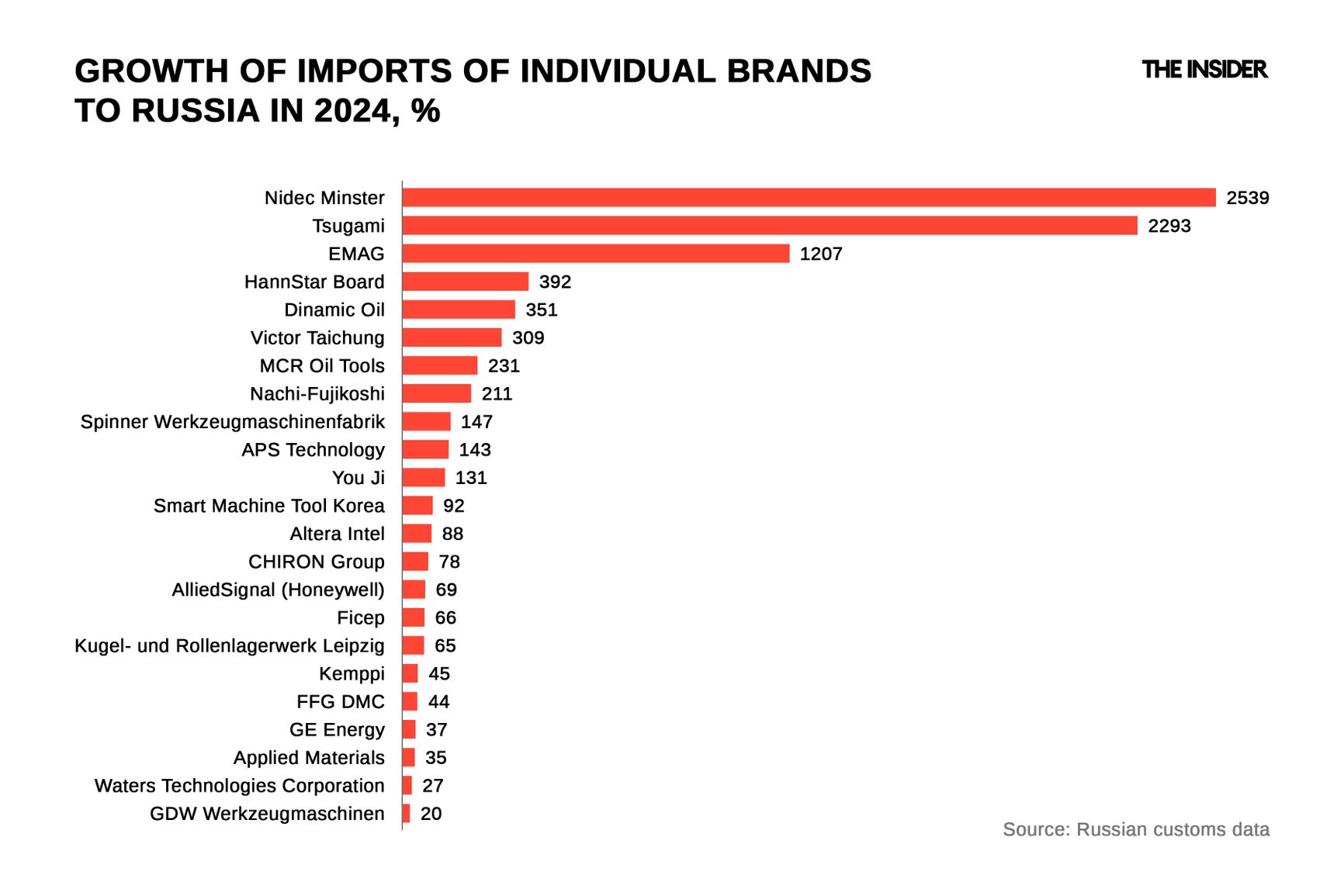

Nevertheless, certain companies from nations labeled by the Kremlin as part of the “collective West” have seen a marked increase in shipments to Russia. Among those with the largest growth in 2024 compared to 2021 was hydraulic press manufacturer Nidec Minster Corporation (U.S.), which saw exports rise 26-fold. The growth among metal-cutting machine manufacturers was slightly less pronounced — the aforementioned Tsugami Corporation (Japan) recorded a 24-fold increase, Germany’s Emag GmbH posted a 13-fold rise, Taiwan’s Victor Taichung Machinery Works grew fourfold, and Spinner Werkzeugmaschinenfabrik, another German firm, saw a 2.5-fold increase.

In the electronics sector, the highest growth was recorded by Taiwan’s electronic boards producer Hannstar Board Technology (Jiangyin) Corporation, which expanded its exports to Russia fivefold. Exports of industrial robots from Japan’s Nachi-Fujikoshi tripled, while shipments of drilling equipment from Aps Technology (U.S.) grew by a factor of 2.5.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Turkey, Cameroon, the UAE — and even Vanuatu: Who’s replacing China?

As imports of production equipment through China decline, who’s stepping in to fill the gap? According to The Insider, 2024 saw a rise in imports from post-Soviet Eurasian Economic Union (EAEU) countries, while smuggling from the West increasingly relied on exotic, opaque, and unpredictable routes through remote tropical nations.

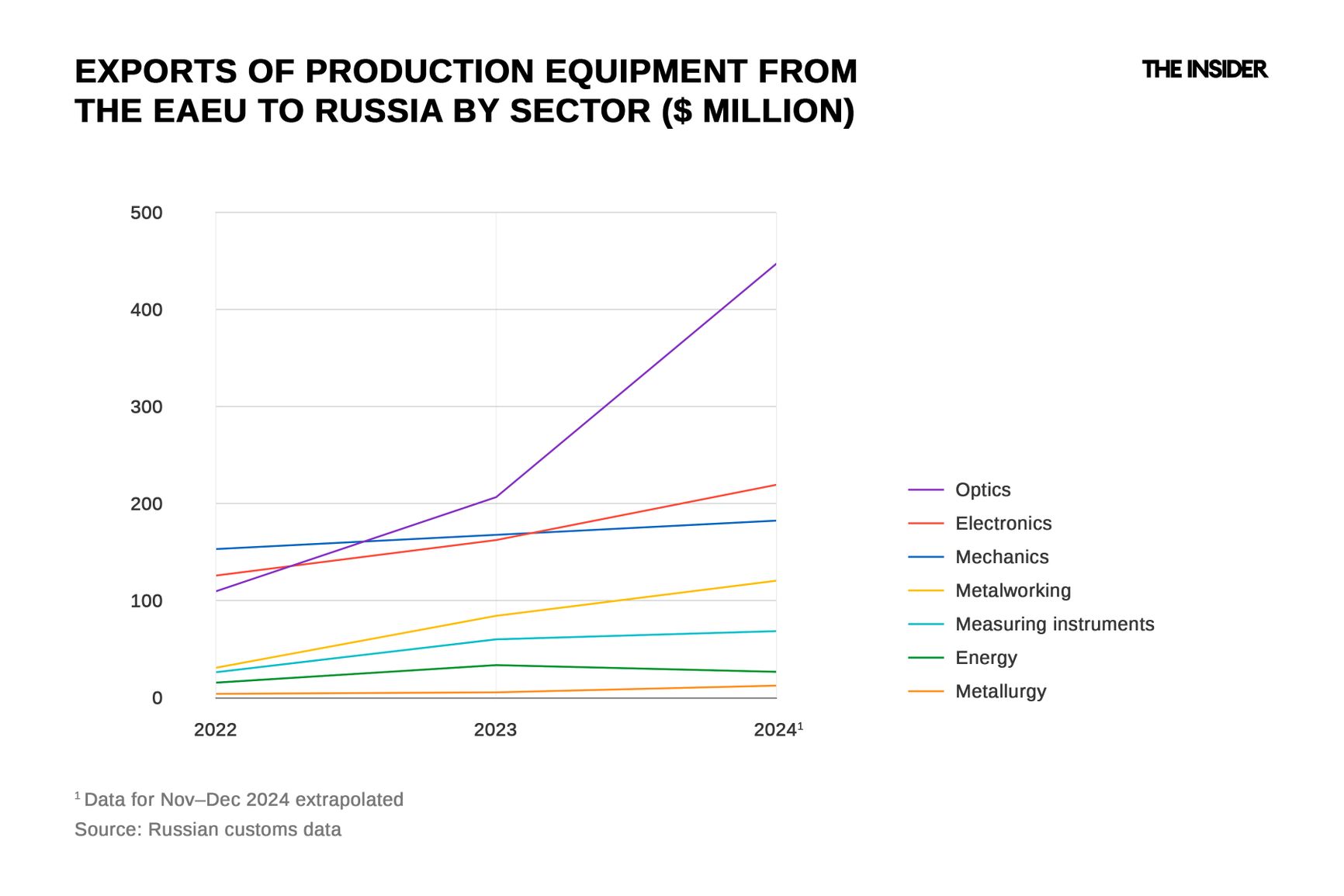

EAEU countries posted growth across all sectors except energy in 2024. However, in absolute terms, these figures remain small compared to imports from China and third countries. Optical devices were the only standout: Belarus supplied Russia with over $440 million in optical sight components, including $160 million worth of Sosna-U multi-channel gunner sights used in tanks.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Among third countries — those friendly to the Kremlin but outside China and the EAEU — a notable share of exports consisted of Western power systems. The overall leader in all categories of production equipment imported into Russia was CFM International (France–U.S.). IAE International Aero Engines AG (Switzerland) ranked third, and General Electric (U.S.) ranked twelfth. Specifically, aircraft engines and generators from these firms were delivered to Russia.

Metalworking equipment also remained prominent, with Emag Salach GmbH (Germany) and Jyoti CNC Automation Ltd (India) taking the fifth and sixth spots, followed by Bharat Fritz Werner Limited (India). Major volumes were also shipped by bearing manufacturers FKL DOO Temerin (Serbia) and SPZ-Bearings (Uzbekistan).

Surprisingly, few electronics producers from friendly nations made it into the top 20. Only Taiwan’s HannStar Board Products, and U.S. firms Honeywell International Inc. and Intel Corporation were present.

This stood in sharp contrast with previous years. In both 2022 and 2023, Intel led all third-country exports to Russia, with $476 million and $235 million, respectively. By 2024, its exports fell to just $7 million, dropping it to 17th place.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

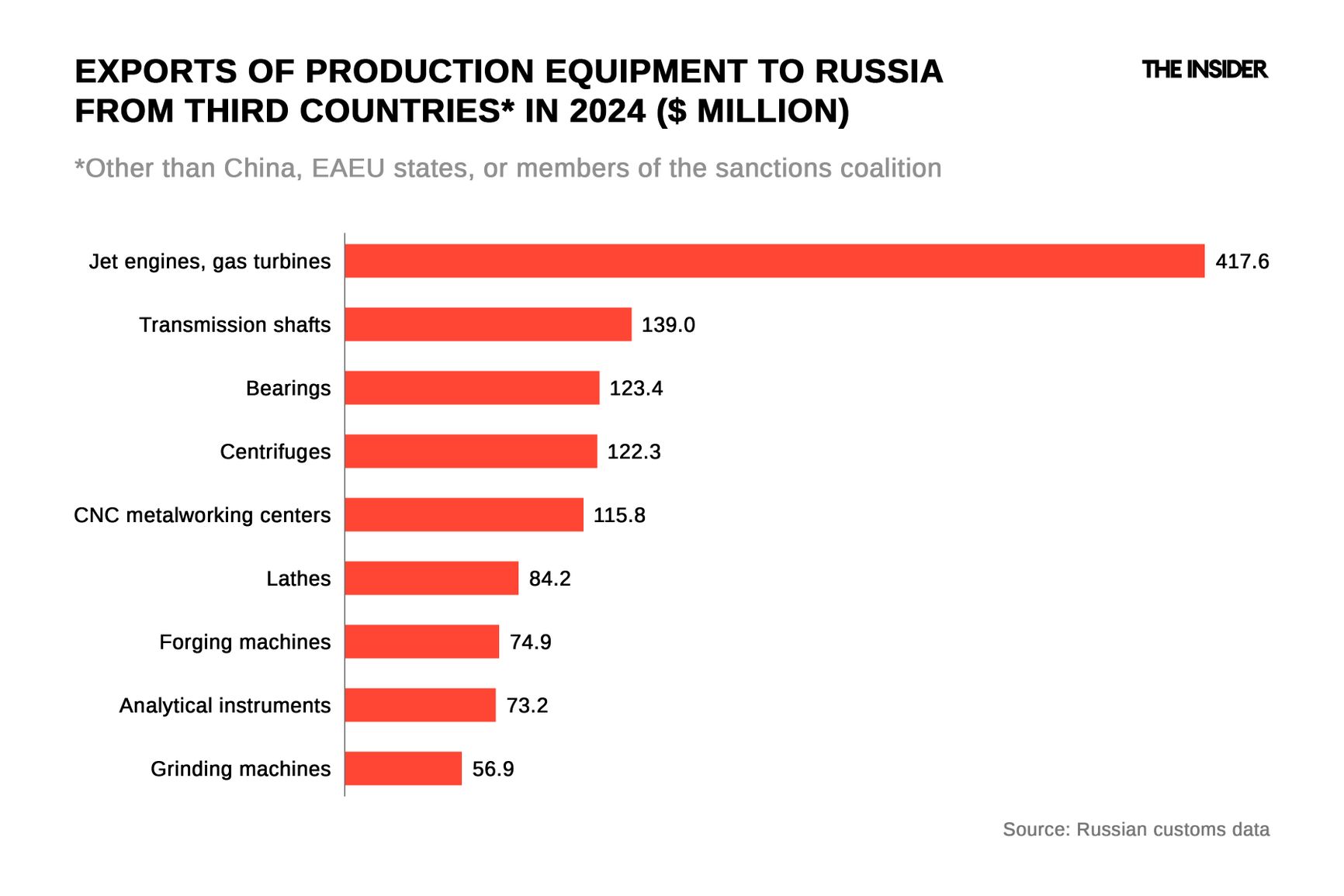

By equipment type, the top imports from third countries in 2024 consisted of turbojet engines, transmission shafts, bearings, centrifuges, metal-cutting and forging machines, analytical instruments, and grinding machines.

Notably, integrated circuits — long a staple of sanctioned shipments — didn’t even make the top 10 in 2024, with only $44 million imported. By comparison, in 2023, over $1 billion was spent on integrated circuits from third countries — double the amount spent on turbojet engines that year.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.

Integrated circuits — long a staple of sanctioned shipments — didn’t even make the top 10 in 2024, with only $44 million imported compared to $1 billion in 2023.

Turkey and Cameroon topped the list of countries with the largest growth in exports to Russia in 2024, and Gabon came in at an unexpected fourth overall. Export patterns varied widely: Cameroon, Gabon, Uganda, and Haiti exported specialized aviation equipment from CFM International and International Aero. Turkey became a key route for a wide range of goods, including metal-cutting machines (from Germany, Japan, and Taiwan), deep drilling equipment, and chemical flow control systems. The UAE emerged as a general-purpose hub for industrial equipment of all kinds.

Certain countries contributed mainly through single brands. Lithuania shipped only Italian Nuovo Pignone machinery, Sri Lanka supplied Honeywell aviation equipment, the Netherlands and Hungary sent GE Hungary energy systems, the Maldives exported aviation products from Pratt & Whitney, and Vanuatu supplied equipment made by South Korea’s Smart Machine Tool.

And of course, these data cannot tell the full story of sanctions evasion. Some shipments can be easily concealed — for example, small but high-value components like microchips can be smuggled in suitcases without customs declarations.

Why imports are falling — and how the West could tighten controls

By 2024, trade restrictions — through both embargoes and corporate policies — had led to a more than tenfold decline in official imports of industrial equipment from the democratic world into Russia. Excluding clearly civilian-use items like aircraft engines and power generators, the drop is even more dramatic.

Several factors explain the reduced imports via Kremlin-friendly countries:

- Shrinking funds for capital goods: more of Russia’s foreign currency revenues are being used to import consumer goods from China and Turkey, helping to keep inflation in check.

- Stockpiling and modernization: many production facilities were modernized by 2023 and can operate using equipment already in service.

- Tighter sanctions enforcement: manufacturers are increasingly vigilant in enforcing export bans.

- Growing risk aversion: China and other third countries are becoming more hesitant to export equipment to Russia, while Chinese banks are increasingly reluctant to process related payments. Only EAEU countries continue to show growth in this area, largely due to the relative ease with which they can facilitate covert transactions.

- Smuggling of small items: high-value goods such as electronic and optical components are now often smuggled without being declared.

In the current climate, when not resorting to outright smuggling, Russia’s military-industrial complex is likely spreading procurement across exotic jurisdictions, where nascent local industries can serve as cover.

Countries observing sanctions could further tighten controls by securing broader participation from Japan, South Korea, and Taiwan in embargo coordination and enforcement monitoring, increasing moral and reputational pressure on the few remaining corporations whose products regularly surface in Russia, and applying sanctions equally to Russia and EAEU countries in order to block re-export channels.

The EU, in particular, could introduce a “long-arm jurisdiction” model (similar to the U.S.), allowing it to impose secondary sanctions on Chinese banks for re-exporting European (not just American) goods.

This report does not analyze specific suppliers or buyers — unlike manufacturers — because after three years of war, the market has shifted almost entirely to small and mid-sized intermediaries. Cases of Russian production facilities directly importing goods have become rare. Resellers are cheap and easy to establish or shut down, meaning the list of intermediaries is in constant flux.

Three groups of countries were examined as sources of shipments: (1) China; (2) EAEU countries (Belarus, Kazakhstan, Kyrgyzstan, Armenia); and (3) third countries—meaning significant countries without an effective sanctions regime, including all other Asian nations except Japan and South Korea, the Balkan states, and economically significant African countries.

Only shipments worth more than $20,000 from China and non-EAEU countries were included in the analysis, while for EAEU nations, the threshold was set at $100,000.

The Insider has uncovered imports into Russia of sniper rifles; optical sights and thermal imagers; drones; equipment for tuning and calibrating electronic warfare systems; as well as clothing and footwear for use by the country’s military.

Russian customs code 9013809000 refers to other types of object detection and surveillance equipment, including optical reconnaissance devices used to locate shooters’ (snipers’) positions and determine their coordinates.

If we take the top 140 leading brands, which account for roughly 90% of total imports.

The investigation focused on imports of production equipment — including industrial machinery, spare parts and components, machine parts, and blanks — from the following sectors:

- Measuring instruments: mechanical and optical measurement tools, as well as testing systems

- Metalworking: including lathes, milling, drilling, grinding, gear-cutting, and electrical discharge machines, as well as hydraulic presses, forging machines, and equipment for laser or gas cutting and welding

- Metallurgy: casting and metal-rolling equipment

- Mechanics: centrifuges, bearings, and transmission shafts

- Optics: industrial lenses, microscopes, and lasers

- Electronics: microchips and chip production lines, radio components, and radar systems

- Power systems: boilers, generators, turbines, and jet engines

Only shipments valued over $20,000 were taken into account.