Donald Trump’s approval rating has declined slightly following his first month in office. Many Americans now worry that the president’s actions could harm the economy — suggesting that perhaps they should have heeded the pre-election warnings of multiple Nobel laureates in economics. In typical fashion, the current president blames his predecessor, and his fellow Republicans call “Bidenomics” a scar on the U.S. economy. In reality, however, Trump inherited a country with record-high key indicators and no recession — despite widespread predictions of one from Wall Street analysts in 2023. Interestingly, statistics show that, contrary to popular belief, the Democratic Party has historically been better for the U.S. economy than Republican administrations.

Content

Biden’s economic record: GDP, stock market, and job growth

Stock market on the rise

Challenges: inflation and national debt

Democrats tend to be better for the economy

After his first month back in the White House, Trump has yet to fulfill any of his numerous campaign promises, and as a Reuters/Ipsos poll indicates, his approval rating has dropped. By late February, 44% of respondents approved of his performance, down from 47% at the time of his inauguration. Meanwhile, the share of Americans who disapprove of Trump has risen from 41% to 51%. Concerns over the economy are growing, with fears that higher tariffs could do significant damage. A majority (53%) now believe the economy is headed in the wrong direction, up from 43% at the end of January.

53% of Americans now believe the economy is headed in the wrong direction, up from 43% at the end of the previous month.

It was precisely the hopes for rapid economic growth and more business-friendly policies that secured Trump the support of entrepreneurs. Throughout his campaign, he blamed Joe Biden for fueling inflation. Yet in the weeks after Trump took office, consumer prices saw their highest increase in a year and a half. The outlook is only getting worse, with forecasts predicting that inflation will accelerate following Trump’s statements about raising tariffs on imports from China, Mexico, and Canada.

Biden’s economic record: GDP, stock market, and job growth

When Joe Biden took office in 2021, the country was still dealing with the fallout from the COVID-19 pandemic, which had led to a decline in real GDP. The Democrat focused his efforts on economic recovery, and by the time he handed power over to Trump, real GDP growth was back up to the 2-3% range.

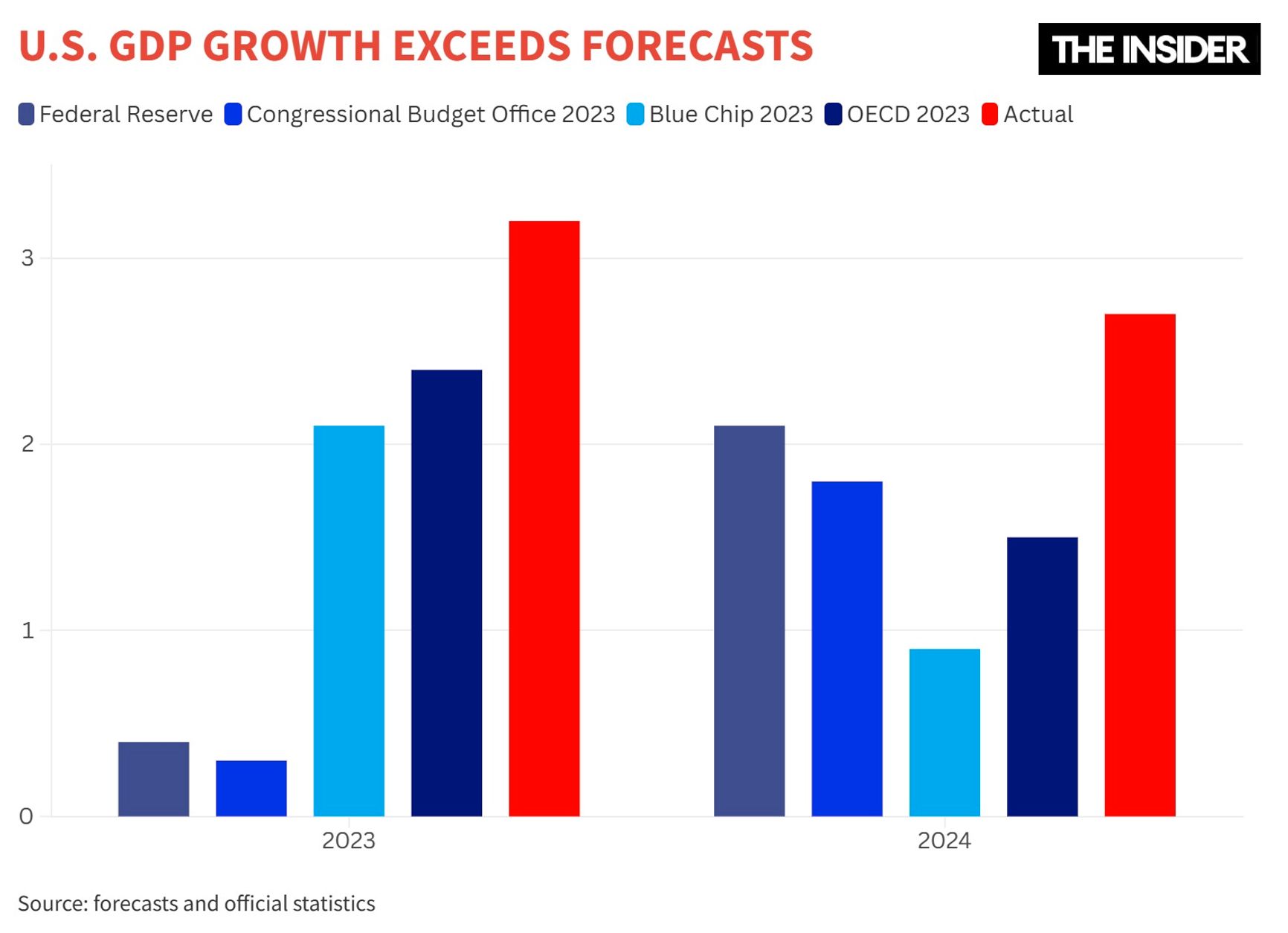

Throughout Biden’s presidency, economic growth outpaced forecasts. In 2023, U.S. real GDP growth was the highest among G7 countries, and preliminary estimates suggest it will maintain that position in 2024, surpassing the EU average by a factor of three. Under Biden, real GDP consistently exceeded potential GDP — the theoretical maximum output an economy can achieve with optimal resource use. This phenomenon, known as a positive GDP gap, indicates that the economy was operating at full capacity thanks to strong consumer demand, driven by steadily rising incomes.

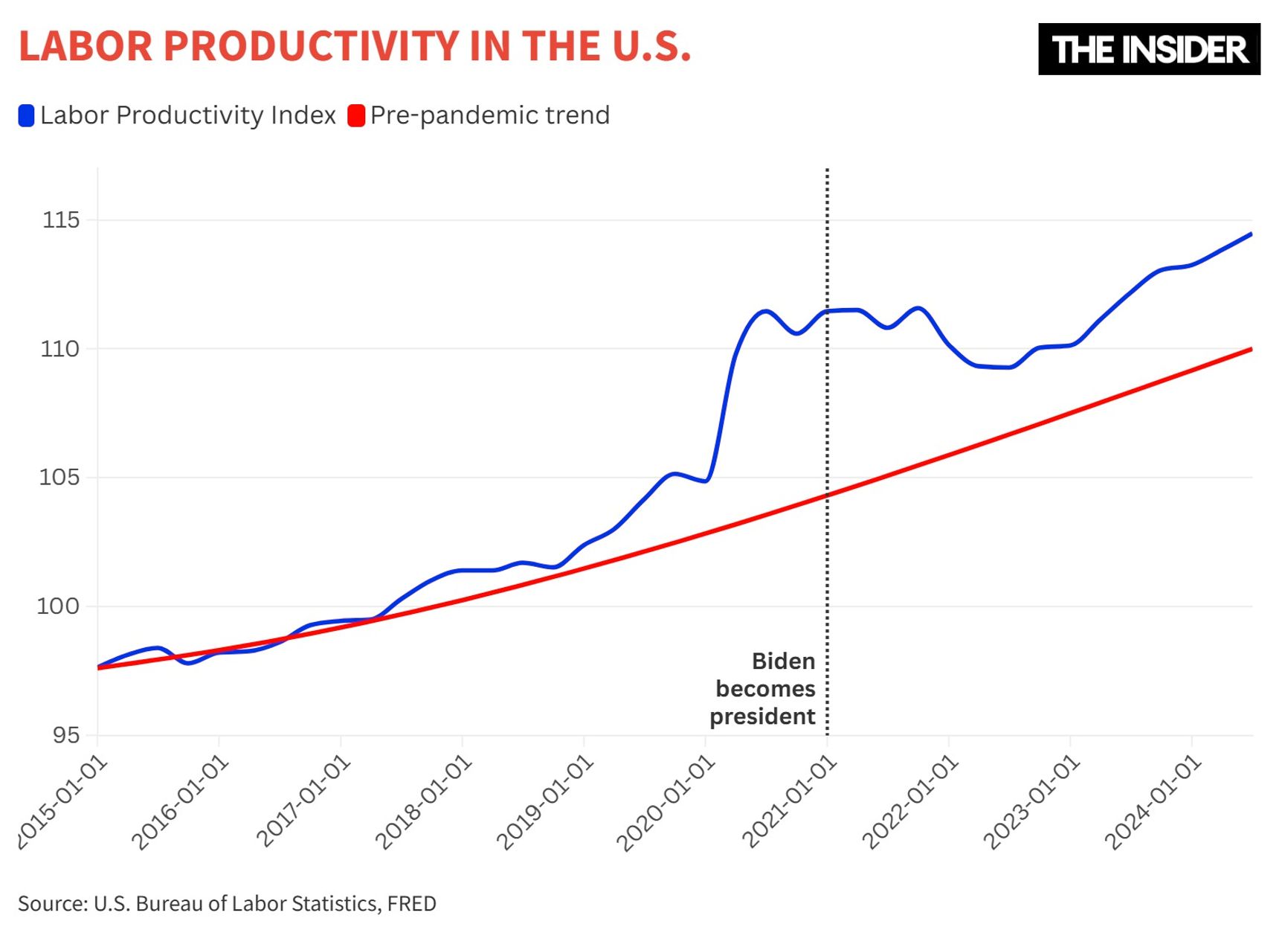

A dynamic labor market and rapid growth in new businesses helped reverse sluggish productivity, which significantly surpassed pre-pandemic levels at a time when productivity growth rates in the developed world were declining — in the European Union, the United Kingdom, and Japan, for example. According to McKinsey Institute estimates, maintaining high productivity growth over the next decade could increase total household income by $15,000.

Productivity and employment growth

The labor market has shown exceptional strength. Under the former administration, job growth was positive for 48 consecutive months — the second-longest streak in recorded history — making Biden the first U.S. president to oversee an economy that showed positive indicators in this category throughout his entire term.

Biden became the first U.S. president under whom job growth continued throughout his entire term.

Part of the success came thanks to the post-pandemic recovery. By the start of 2022, the U.S. had lost nearly 22 million jobs when compared to pre-COVID levels, but new ones began appearing almost immediately, and by June of that year, employment had already surpassed 2019 levels. Since then, the economy has added more than 7 million new jobs — nearly 240,000 per month, far exceeding the historical average of about 125,000 per month since 1939.

Biden achieved this success in part through a more lenient immigration policy. Rising immigration contributed to higher labor productivity and helped offset the structural decline in the American workforce caused by low birth rates and an aging population.

As job numbers grew, unemployment fell to a nearly 54-year low of 3.4% in January 2023. Overall, for 27 months under Biden, the unemployment rate remained below 4% — a streak not seen since Lyndon Johnson’s presidency. To be fair, the previous low of 3.5% was reached during Trump’s first administration, but his hardline anti-immigration policies prevented sustained success. By the time Biden took office, unemployment had risen to 6.8%. At the beginning of Trump’s second term, the rate stood at 4.1%.

A strong economy and a booming labor market led to a significant rise in household wealth. High inflation eroded a substantial portion of incomes in the first half of Biden’s term, but by the time power was transferred to Trump, inflation-adjusted and after-tax income growth were rising steadily. Household financial security also improved, with the ratio of total household debt to after-tax income declining between June 2022 and June 2024.

Stock market on the rise

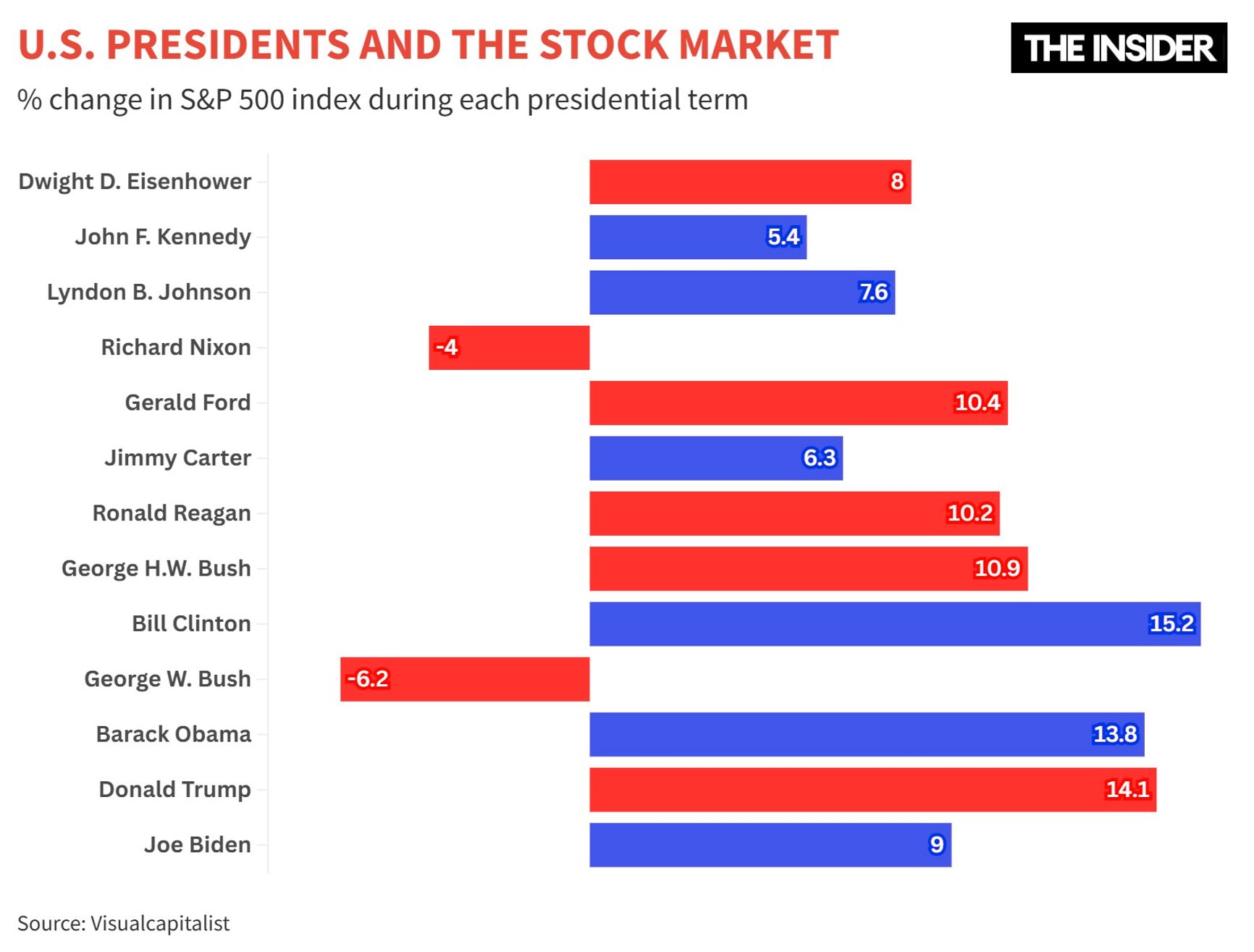

The new Trump administration inherited an exceptionally strong stock market — this despite the common belief that shares perform poorly under Democratic presidents. Over the past year, the S&P 500 has risen by more than 25% — one and a half times faster than in the year leading up to Biden’s presidency.

Defying stereotypes, Trump inherited an exceptionally strong stock market from the Democrats.

While Biden was president, U.S. stock indices showed significant growth — even when adjusted for inflation — regularly reaching new highs, boosting retirement accounts, and providing strong returns for investors. From Biden’s inauguration on January 20, 2021 on through to January 16, 2025, the total return of the S&P 500 (including dividends) was 66%. In the last two years of Biden’s presidency, the S&P 500 saw annual gains of more than 20% for the first time since the late 1990s.

Challenges: inflation and national debt

Key indicators — economic growth and jobs — look solid, but high inflation proved to be a major drawback. In June 2022, it hit 9.1% — the highest level since the early 1980s. Trump blames Biden’s policies for this.

“President Biden totally lost control of what was going on in our country but, in particular, with our high-inflation economy and at our border,” he said at the World Economic Forum in Davos. “The inflation rate we are inheriting remains 50 percent higher than the historic target. It was the highest inflation probably in the history of our country. That’s why, from the moment I took office, I’ve taken rapid action to reverse each and every one of these radical left policies that created this calamity — in particular, with immigration, crime, and inflation.”

Trump claims President Biden “totally lost control of what was going on” in the U.S.

In contrast to Trump, nearly all economic experts agree that placing the blame for rising prices solely on the Biden administration is unfair. First, inflation was influenced by large fiscal stimulus packages passed during Trump’s presidency in response to the pandemic (Biden later expanded the stimulus). Second, the inflation surge was a global phenomenon, with the U.S. being just one of many developed countries experiencing rising prices after the economic disruptions caused by the virus. The peak occurred in mid-2022, after which inflation began to slow.

Rising prices hit Americans hard, especially those living paycheck to paycheck. Even after inflation was brought under control and real income growth returned to pre-pandemic rates, prices merely increased at a slower pace. As a result, public perceptions of the economy continued to deteriorate. This disconnect — in which economic indicators look strong on paper, but consumer sentiment remains weak — has been dubbed a “vibecession.”

Nevertheless, Trump inherited an economy with moderate inflation — an annual rate of 2.7%. His first administration had inherited an inflation rate of 1.8%, while Biden took office with inflation at 1.2%.

Biden's most notable legislative accomplishments — the American Rescue Plan (ARPA), the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS Act — have begun to revitalize the U.S. economy by attracting investment in key sectors, such as semiconductor chip manufacturing, road repairs, and accelerating the transition to green energy. However, it will be years before such initiatives yield their full results, and in the meantime, they have added trillions of dollars in federal spending.

The national debt reached $36.2 trillion in mid-January, driven by the combined impact of fiscal stimulus measures initiated by both Biden and Trump and by the tax cuts passed under Trump in 2017. Trump may well push for another tax cut this time around, but in the future, the country will likely have to take difficult measures, such as raising taxes, cutting federal programs, or a combination of both.

Before Trump’s inauguration, Treasury bond yields began rising, partly due to concerns that the U.S. may face difficulties in servicing its debt in the coming years. When national debt levels climb, investors begin to question the country’s ability to meet its obligations on time. While the risk of a U.S. bond default remains extremely low, rising debt increases the perception of risk. To compensate for this, investors demand higher yields. This isn’t solely Biden’s fault — Trump also spent heavily on COVID relief measures — but bond markets are now signaling concern.

Despite these worries, the consensus among economists is that Trump inherited an exceptionally strong economy. It’s not surprising, then, that the most common advice economists give Trump (1, 2, 3, 4) revolves around the principle of “do no harm.”

Economists unanimously advise Trump: “Do no harm.”

Democrats tend to be better for the economy

For several decades, the Republican Party has positioned itself as being the country’s more competent steward on economic issues — calling to reduce bureaucracy, cut taxes, and avoid interfering with the affairs of investors. Democrats, according to this logic, are often accused of increasing social spending and expanding government involvement in the private sector — moves that businesses must ultimately pay for. More recently, such intervention has been extended to environmental protections, which also raise costs for many companies.

However, economists suggest that the image of strong Republican economic governance is a myth, unsupported by real statistics. “The superiority of economic indicators under Democrats compared to Republicans is almost universal,” concluded Princeton University scholars Alan Blinder and Mark Watson in 2013.

Since the end of WWII, the average annual GDP growth rate under Democratic presidents has been 3.26%, while under Republicans it was 2.75%. Under Democrats, the average unemployment rate was 5.52%, while under Republicans it was 6.33%.

It is widely believed that, due to soaring inflation and unmanageable interest rates, Jimmy Carter was an economic failure, writes Jeremy Glover, a lawyer at Brand Law Group in Washington. However, Carter inherited a country grappling with stagflation and made efforts to overcome it, partially succeeding by achieving significant investment growth. Ten of the last 11 recessions began under Republican administrations and ended under Democratic ones, Glover points out. Since the end of World War II, the U.S. has spent 113 months in recession, with 102 of those months coming under Republican presidents. According to Glover's calculations, since the end of World War II Democrats have created 77 million jobs, while Republican presidents have created just 33 million.

These figures do not account for the party affiliation of the majority in Congress, which could skew the results. Furthermore, the reasons behind the success of Democratic presidents remain unclear to economists. There is no evidence that their advantage can be attributed to superior monetary or fiscal policies, notes Nobel laureate Paul Krugman. “On average, Democrats seem to have been luckier than Republicans with regard to oil prices and technological progress.”