China is increasingly dominating the Russian automobile market, now accounting for more than half of passenger car sales. Import growth is already up by a third since the beginning of the year, and it is continuing to rise — Chinese companies expect to sell ten times more vehicles in Russia in 2024 than they did in 2021. However, these automakers are reluctant to invest in local manufacturing plants, limiting themselves to large-unit assembly. As a result, the Russian automobile industry's reliance on China is deepening, and car prices are rising. This is not what the Russian government had hoped for, and it is now trying to remedy the situation through strict regulation. However, even these coercive measures are unlikely to persuade Chinese companies to make significant investments in Russia — the most-sanctioned country in the world.

Content

Pre-war successes and a record in 2012

China's swift market takeover comes without strings, yet cars are not more affordable for Russians

“Friendship” with an eye on sanctions

How is the Kremlin responding?

The exodus of Western car companies from Russia following Vladimir Putin’s full-scale invasion of Ukraine caught Kremlin authorities off guard. The government responded by confronting foreign businesses and devising a three-step plan to rescue the domestic automotive industry. The first step involved buying out foreign assets at minimal cost, then transferring them to state structures or Russian companies. The second step was to seek partnerships with “friendly” China to resume production based on Chinese brands — in exchange for opening broad opportunities to Chinese businesses in the Russian market. The final step aimed to establish a full cycle of car production with deep localization of key components in order to replace Chinese imports with Russian-made products.

These measures were intended to lead to so-called “technological sovereignty” and increase the share of Russian-made cars from 40% in 2022 to 83% by 2035. However, two years later, it is clear that the industry has been restarted and stabilized, but at the cost of comprehensive dependence on China, dooming the sector to slow and widespread decline, as noted by automotive journalist Sergey Aslanyan in a column for The Insider late 2022.

Pre-war successes and a record in 2012

Before the full-scale war, Russia's car industry had followed a trajectory similar to that of other industrialized nations. For the two decades leading up to February 2022, the Russian government imposed localization requirements and provided billions of rubles in subsidies to support the purchase of domestically produced vehicles, resulting in below-market-rate interest rates on car loans and leases. State support primarily benefited the largest Russian enterprises but was also extended to many Western companies through customs privileges for importing components and financial compensation for business development costs. As a result, in the 2010s, the share of imported cars in the Russian market quadrupled, while domestic production simultaneously grew, leading to the emergence of world-class plants and large industrial clusters.

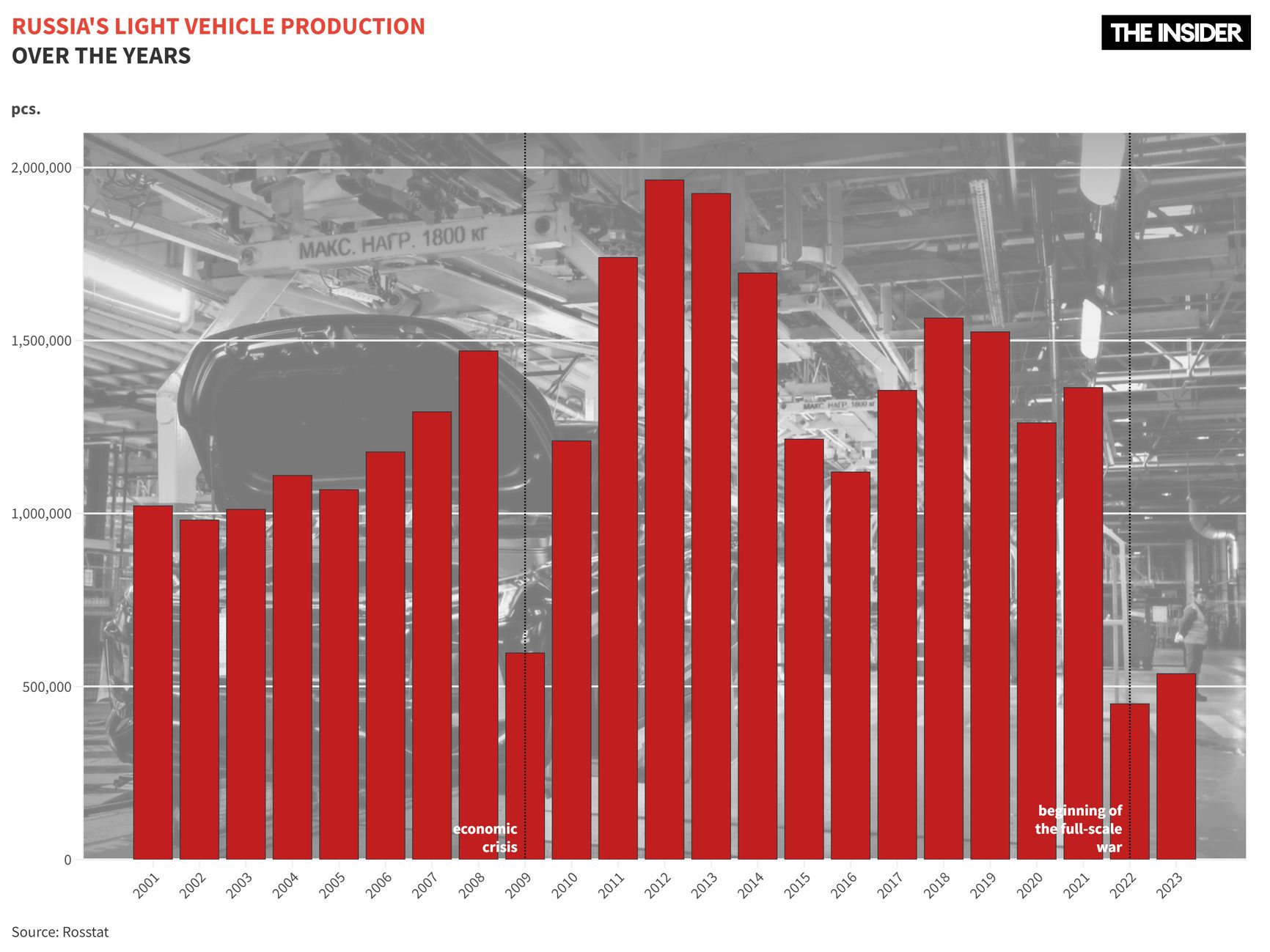

In 2012, the Russian car market reached a record high, with over 2.92 million vehicles sold. At the time, manufacturers believed the growth was sustainable and long-term. However, the record set in 2012 was never broken — the market soon entered a prolonged recession, exacerbated by the sanctions related to Russia’s occupation of Crimea, the Covid-19 pandemic, and, ultimately, the full-scale invasion of Ukraine.

Despite the decline in sales, production in Russia was not directly affected. Western car manufacturers continued their operations and did not stop making investments in the country. Nearly all of them committed to new obligations by signing ten-year special investment contracts (SPICs) with the Russian government. A total of 14 SPICs were signed in the automobile industry — including five rather large ones.

Before the war, these Western companies managed to fulfill at least part of their commitments. For instance, Daimler opened a full-cycle automobile plant in the Moscow Region and, together with KAMAZ, started producing truck cabins in Naberezhnye Chelny. Mazda also localized engine production in Vladivostok.

Aerial view of the Haval factory in Russia’s Tula Region, opened in 2019

Chinese automakers, in contrast, have done almost nothing of the sort in Russia — with the lone exception being Great Wall Motor (perhaps best known for its Haval brand), which built an automotive plant in the Tula Region and signed a SPIC in 2020 to localize production of key auto components.

China's swift market takeover comes without strings, yet cars are not more affordable for Russians

The departure of Western companies after February 2022 led to the shutdown of plants, with sanctions creating significant challenges in sourcing components. The largest post-Soviet decline in the domestic automobile industry quickly followed.

Within two years it became clear that the Chinese have their own views on the Russian market — views that are notably at odds with the objectives of the Russian government.

First, China aimed for massive car exports and a swift takeover of the Russian market. The results are evident:

- The share of Chinese cars in the Russian market surged from 9% in 2021 to 61% in 2023. In the first half of 2024, Chinese cars accounted for 59% of the mass segment and 80% of the premium segment by the number of units sold. China also leads in the share of sales revenue with Chinese brands accounting for more than 80% in 2023, with two Chinese companies, Chery and Haval, even beating out Lada-maker AvtoVAZ in that regard. Six Chinese brands ranked among the top 10 in sales volume, whereas none were on the list in 2021. Russian dealers have expressed concern over the influx of Chinese vehicles, fearing that the market in its current state will not be able to “digest” so many.

China’s Chery and Haval beat Lada-maker AvtoVAZ in terms of sales revenue in Russia in 2023

- High profit. By the end of 2022, seven major Chinese car companies had earned a record 79 billion rubles, comparable to the total profit of German and Korean manufacturers in 2021. The strong sales of Chinese cars in 2023 further boosted their profits, which totaled more than 63 billion rubles ($688 million).

- Export record. Thanks to the Russian market, China became the largest exporter of cars in the world, for the first time surpassing the United States in the number of cars sold. In 2024, Chinese companies aim to sell nearly 1.2 million cars in Russia, with optimistic projections reaching as high as 1.4 million. In the first half of the year alone, around 430,000 Chinese cars were sold in Russia out of a total market volume of 713,000.

Thanks to the Russian market, China has overtaken the U.S. and become the largest exporter of cars in the world

Secondly, Chinese car firms continue to develop their business in Russia despite making minimal investment. While Chinese companies act as partners, they have helped restart production in Russia through the simple large-unit assembly of their cars under different brands. The results are as follows:

- The former Renault plant in Moscow began assembling Chinese JAC cars under the Moskvich brand. It planned to produce over 50,000 cars in 2023 and more than 100,000 in 2024. However, the plant only produced 31,000 cars last year and reduced its production target for this year by 70% — to 27,000 cars — with prices set at twice that of the original expectation for the Chinese models. By the end of 2023, Moskvich reported a net loss of 8.6 billion rubles ($94 million), and its total debt rose to 42.6 billion rubles ($459 million).

- The assembly of the Lada X-Cross 5 was launched at the former Nissan plant in St. Petersburg, which was taken over by AvtoVAZ — with the only difference between theX-Cross 5 and the Chinese FAW Bestune T77 being the logo. However, after AvtoVAZ was added to the U.S. sanctions list, FAW suspended the partnership, halting the assembly of this model. The plant was subsequently transferred to Russian state ownership, with plans to resume assembly in partnership with China's Chery under a new brand, Xcite.

- At the former Volkswagen plant in Kaluga, which had been idle for more than two years, car production resumed in the summer of 2024. However, there is still no official information about the new owner's industrial partner, the models being produced, their level of localization, the production volumes, or project parameters. Industry rumors suggest that test batches of Chinese Chery Tiggo 7 Pro Max crossovers are being assembled, and Kaluga’s governor announced in June that a potential partnership with China's GAC Motor is in the works.

- GAZ Group's facilities in Nizhny Novgorod, which before February 2022 were used to produce Skodas, are preparing to launch the assembly of Volga cars that are essentially rebranded vehicles from China's Changan. The new lineup was recently presented to Russian Prime Minister Mikhail Mishustin, who remarked that “even their steering wheel is Chinese” while adding that he “wanted the steering wheel to be Russian.”

After inspecting the new Volgas — essentially rebranded models from China’s Changan — in May of this year, Russia’s PM Mikhail Mishustin remarked that he wanted “the steering wheel to be Russian”

Photo: Alexander Astafiev, TASS

The situation at other factories previously owned by Western car companies is similar. Chinese car manufacturers are not taking ownership of these assets, instead entering into SPIC agreements or making investment commitments to the Russian government.

China has thereby gained access to the vast Russian automotive market under the pretext of aiding in localization efforts, but in practice it continues to ship Chinese-made parts to Russia for assembly rather than actually moving full production to the economically isolated country. This means that while car production in Russia is recovering somewhat from its 2022 lows, it is doing so largely at the expense of assembled rather than locally-produced cars, an arrangement that offers a low level of added value and combined with highly uncertain future prospects.

Car production in Russia is recovering at the expense of assembled rather than localized cars

This recovery exemplifies “growth without improvement,” which does not affect the actual well-being of Russians. Vehicles have not become more affordable for Russia’s population, and by the end of 2024, the average price of a new car is expected to exceed 3 million rubles ($32,780), with both new and used car prices rising to 1.5 times higher than they were in February 2022.

Russia’s “relaunched” Moskvich 3 (left) is a JAC Sehol X4 assembled in Moscow using kits purchased from a Chinese partner

Photo: RTE

“Friendship” with an eye on sanctions

Chinese businesses are treading cautiously, mindful of the heightened risk of sanctions. This risk escalated significantly after nearly all major Russian automakers (AvtoVAZ, Moskvich, Sollers, KAMAZ, and GAZ Group) were added to the U.S. Specially Designated Nationals and Blocked Persons list (the “SDN List”) — the most severe type of sanction administered by Washington. Companies from third countries that cooperate with these sanctioned entities face the possibility of secondary sanctions — which are already having an effect.

Chinese business strategies in Russia can be broadly grouped into three approaches:

- Participation in production localization projects, followed by withdrawal when sanction risks emerge. This strategy is followed by the aforementioned FAW (the Weichai Engine Corporation), which stopped supplying gas engines to the KAMAZ plants in Russia’s Naberezhnye Chelny and Neftekamsk after KAMAZ was placed on the SDN list.

- Involvement in localization projects, but only with partners not on sanctions lists. Chery, for instance, partners with the unsanctioned new owners of the former Hyundai plant in St. Petersburg, Volkswagen plant in Kaluga, and Daimler plant in the Moscow Region. Other Chinese brands, such as Kaiyi, BAIC, SWM, and Dongfeng, assemble their cars at the unsanctioned Avtotor plant in Kaliningrad. This allows them to easily suspend the supply of assembly kits — as well as the partnership in general — if their Russian partner is sanctioned, minimizing their own risks.

- Taking part in localization projects and bearing sanctions risks. Some companies, like JAC, continue partnerships with sanctioned Russian automakers such as Moskvich, KAMAZ, and Sollers, while Haval is in talks with the sanctioned AvtoVAZ to supply engines for Lada cars. However, their commitment to these projects may waver depending on the U.S. Treasury's stance on imposing secondary sanctions.

These strategies are further complicated by difficulties in payments for car supplies, components, and spare parts, making Russia an important sales market — but not a priority for investment and long-term business development. Chinese manufacturers have much more to lose in global markets than it does to gain in Russian.Chery sells around 500,000 cars annually outside China (with exports reaching 937,000 in 2023), FAW at least 400,000, and Dongfeng about 250,000.

Chinese companies are deeply embedded in global supply chains, supported by billions of dollars in financial transactions, which could become inaccessible if they fall under secondary sanctions.

The Lada X-Cross 5 — a rebadged Chinese FAW Bestune T77 — on the assembly line of the former Nissan plant in St. Petersburg

Photo: rg.ru

How is the Kremlin responding?

Chinese expansion has become so extensive that the Kremlin is considering drastic measures to protect its domestic market. For example, the government is planning an unprecedented annual indexation of the recycling fee, which is applied to every car in Russia but is partially or fully subsidized for locally produced vehicles (depending on the level of localization). According to the proposed document, by 2030 this fee could increase to 6.3 million rubles (approx. $68,800) for some models. The fee will essentially act as a tarriff barrier, with Moscow expecting it to incentivize Chinese businesses to develop production in Russia.

Such hopes might not have been unfounded — if only Russia were not embroiled in a war, were not the global leader in sanctions, and were not dealing with a single major player whose trade dominance has reached dangerous levels.

Given that these conditions are likely to remain in place for a long time to come, Russian authorities should prepare for a future in which their automotive industry relies on simple assembly operations while its consumer market is dominated by imported Chinese cars, its factories remain starved of investment, and the price paid by its citizenry continues to go up.