U.S. President-elect Donald Trump has vowed to boost domestic oil production and lower fuel prices. However, the measures he proposes for the oil sector are unlikely to cause a dramatic shift in global prices — or to significantly impact Russia's budget, says Sergey Vakulenko, a senior fellow at the Carnegie Center for Russia and Eurasia in Berlin. That said, some of Trump’s other policy proposals, particularly his promise to raise import tariffs, could have a more profound effect. By starting a large-scale trade war with China, Trump could severely disrupt global trade, reduce international shipping, and spark an economic crisis — exactly the sorts of developments that really might ultimately lead to a sharp decline in oil prices.

During his presidential campaign, Donald Trump enthusiastically championed the slogan “Drill, baby, drill,” vowing to permit oil exploration in Alaska's Arctic National Wildlife Refuge as part of an effort to bring down gasoline prices. Mike Pompeo, a Trump ally who served in the once-and-future president’s first administration, painted an even broader vision, stating, “This will fire up the U.S. economy, drive down prices and shrink Mr. Putin’s war-crimes budget.” Pompeo also emphasized Trump’s intent to rebuild ties with Saudi Arabia and use the relationship with Riyadh to drive Russia out of global energy markets.

Why Trump's oil policies won't crash prices

However, Trump’s stated goals contain an inherent contradiction. Oil production in the U.S. cannot expand significantly when prices are low, as the average cost of extracting shale oil remains relatively high. These costs vary across regions: some wells can be profitable at $45 per barrel, while others require prices of $70 or more. When prices and future expectations are high, drilling increases. Conversely, when prices are low, drilling activity decreases.

For Trump’s policies to make a meaningful impact, they would need to significantly lower costs for American oil producers, but the sort of regulatory intervention this would require is largely impossible in the U.S. Unlike many other countries, the federal government in Washington has limited influence over the operating costs of extraction companies, and the U.S. has virtually no specific taxes on oil production. In other nations, governments often cut oil taxes to encourage production — in the U.S., there is nothing to cut.

Granting permission to drill in Alaska’s Arctic National Wildlife Refuge also lacks the scale and, more importantly, the speed to serve as a major stimulus. This isn’t shale oil, which can ramp up production within six months to a year when prices are high or expected to rise. The Arctic Refuge is a remote area, and developing oil production there would take several years. Current projects in the region are still in the geological exploration phase. Developing the area would require building extensive infrastructure, including roads, power lines, a network of oil-gathering pipelines, and a processing facility. Additionally, a production pipeline would need to be built to connect to the Trans-Alaska Pipeline System. In other words, it would be a massive undertaking that likely could not pay off before Trump’s second term in the Oval Office ends.

Allowing drilling in Alaska’s Arctic National Wildlife Refuge also lacks the scale and, more importantly, the speed to act as a major stimulus

Economist Oleg Itskhoki once suggested that the U.S. administration could guarantee oil companies temporary profitability by promising that domestic prices wouldn’t drop below $80 per barrel for a year, even if global prices collapsed. However, one year is too short a timeframe for American oil producers if prices are expected to fall significantly afterward. Wells cannot reliably pay off within a single year of guaranteed high prices, as their payback period typically spans several years. Perhaps more importantly, it is doubtful that Trump would adopt such measures, as they clash with the principles, philosophy, and ethos of American fiscal and economic policy. The gap between the guaranteed and actual prices would have to be covered by the federal budget, an approach Congress would never approve.

On the foreign policy front, surprisingly, Trump has more leverage than he does over the domestic economy. He is well-versed in pressuring world leaders and steering them toward compromises. Notably, in 2020, Trump managed to bring Vladimir Putin and Saudi Arabia to the negotiating table during their oil price war, threatening that if Saudi Arabia did not cooperate, the U.S. would cut off all military support to the kingdom. This occurred just six months after the Houthi attacks on Abqaiq and Khurais oil facilities, which had halved Saudi production — a development that madeTrump’s arguments particularly persuasive. These negotiations culminated in the May 2020 agreement on significant production cuts.

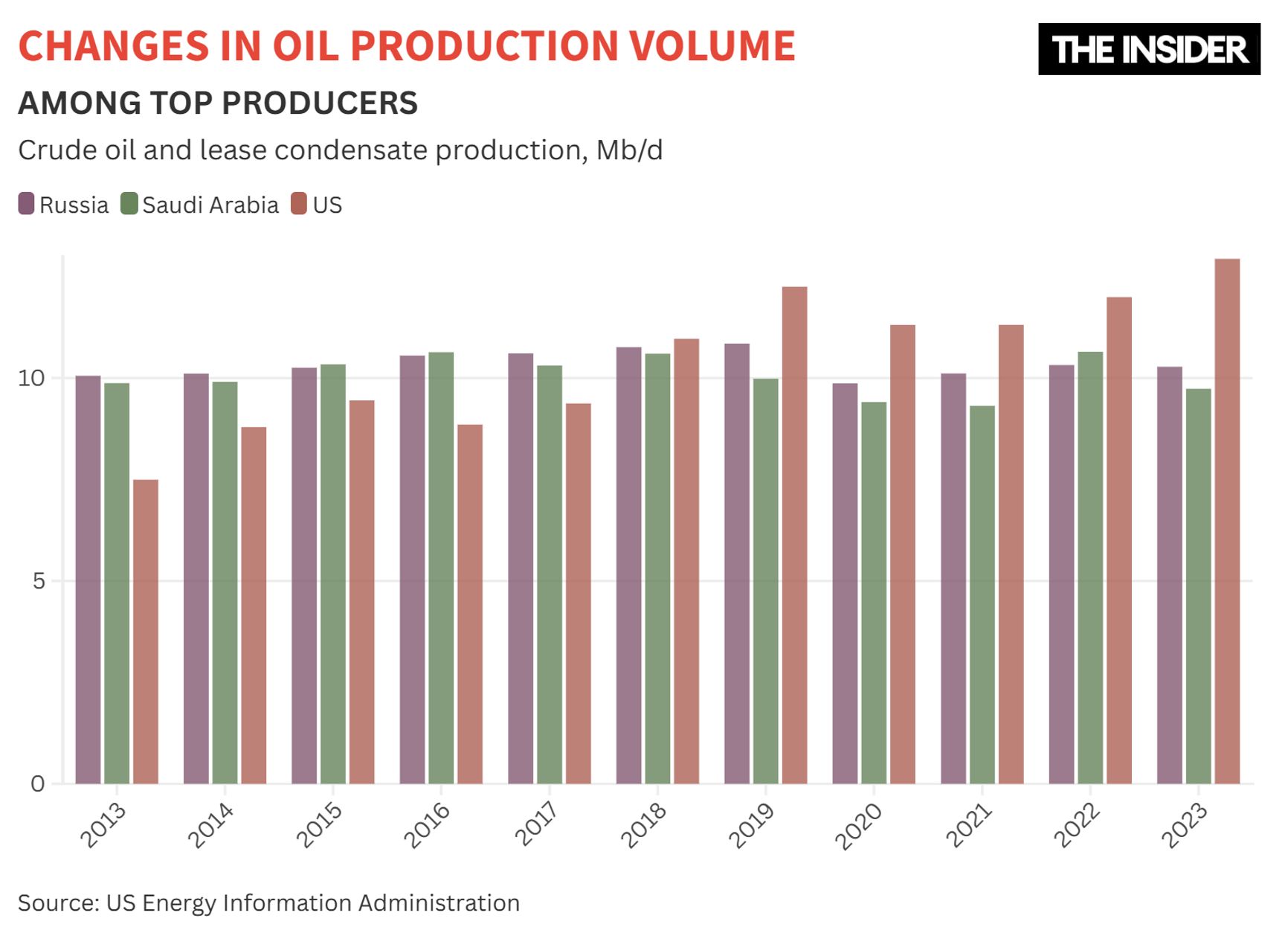

In the Saudi-Russia case, Trump played the role of a broker, pushing the parties to discuss issues already in their interest. However, it is far from certain that Trump could now push through Pompeo’s proposed plan for U.S.-Saudi cooperation, which includes replacing the current, largely ineffective oil price cap on Russia with a total embargo on Moscow’s oil. The problem lies in the inability of the U.S. and Saudi Arabia to ramp up production sufficiently to cover Russia’s exports — 7.5 million barrels per day.

The U.S. and Saudi Arabia are unable to ramp up production sufficiently to make up for Russia’s oil exports

Saudi Arabia’s spare production capacity is currently estimated at around 3 million barrels per day, with the UAE potentially holding an additional 1 million barrels per day. However, these countries are unlikely to raise production to the maximum, and even in the unlikely scenario that they agreed to help the U.S. attempt to replace Russian oil on the market, it is unclear where the remaining millions of barrels would come from.

Other oil-producing countries have even less capacity to increase production. While output in Guyana and Brazil is expected to grow, that increase is needed in order to meet rising demand and offset declines in production elsewhere. Even if we assume the hypothetical embargo on Russia would not be universal — and that 1.6 million barrels per day would continue to flow to China — this would still leave 6 million barrels per day to replace. Even this figure is unattainable under current circumstances. The math does not add up.

Additionally, Saudi Arabia’s interests cannot be ignored. Saudi leaders understand that trying to capture Russia’s market share through a price war is virtually impossible due to Russia’s low production costs. While Russia will face high costs for expanding production and maintaining output at peak levels in the coming years, the slow decline of its existing fields is relatively inexpensive to sustain, and if Saudi Arabia were to approach Russian oil buyers with an offer to sell at a lower price, Russia would still likely be able to undercut the deal. In such circumstances, it would make more sense for the Saudis to focus their efforts on competing with shale and deepwater producers — who are predominantly American.

How Trump could still crash oil prices

Despite his relative constraints, Donald Trump still has the power to take actions that pose a threat to the profitability of oil producers — not by increasing supply, but by reducing demand (and not due to the green energy transition). Among Trump’s economic promises during his campaign was a plan to sharply raise import tariffs. He intends to revoke China’s most-favored-nation trade status, which would automatically increase tariffs on goods from the country to 40%. Trump has even discussed rates as high as 60%.

If the returning U.S. president follows through on his campaign rhetoric in this regard, a strong response from China is almost certain. Beijing would likely raise tariffs on U.S. goods in return, and other countries could follow suit, as Trump plans to raise tariffs for them as well (to around 10%). This would trigger global tariff wars and lead to a fragmentation of world trade, creating an economic shock far greater than the trade battles of Trump’s first term.

The result would be a contraction in global trade, reduced international shipping, and a new economic crisis. Historical parallels can be drawn to the 1929–1933 Great Depression, which was exacerbated into a global economic collapse by a cascade of protectionist measures from major economies of the time. Such crises are often accompanied by a dramatic drop in demand for energy resources.

The Great Depression was exacerbated into a global economic collapse by a cascade of protectionist measures

While a scenario as extreme as the Great Depression remains unlikely today, Trump has the tools to create a crisis comparable to the 2008 Great Recession. During that period, oil prices fell nearly fourfold, albeit for a relatively short time.