Arkady Rotenberg. Photo: RBC

Russia’s Federal Antimonopoly Service (FAS) has approved the sale of 100% of the shares of JSC Tatspirtprom, one of the country's five largest alcohol producers. The Kazan-based holding announced the news on Dec. 30. The buyer is JSC Rosspirtprom, a company linked to brothers Arkady and Boris Rotenberg, who are directly leveraging state resources to create Russia's largest alcohol holding.

What is known about the deal

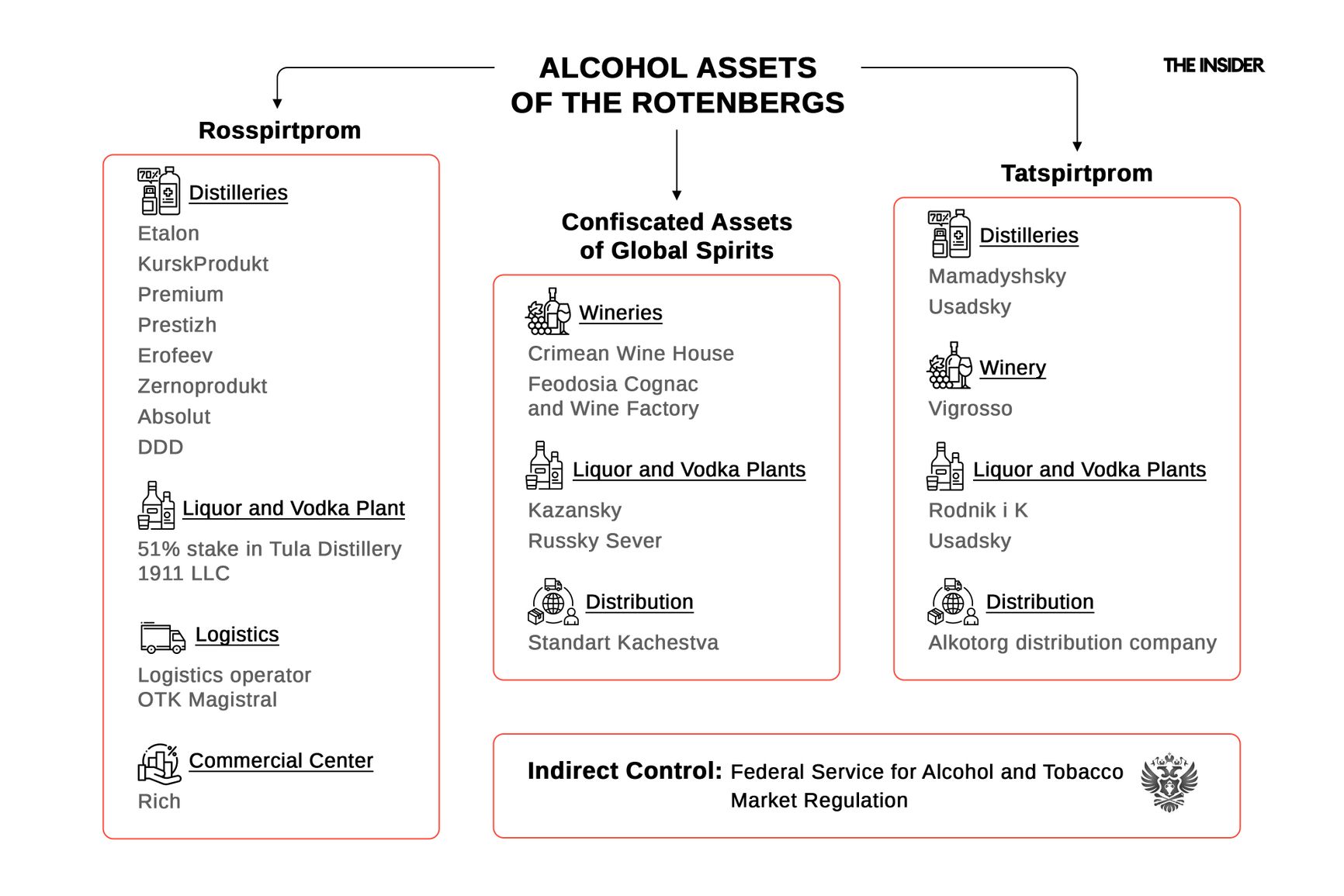

According to Tatspirtprom’s press service, the legally binding agreement was signed by JSC Svyazinvestneftekhim, through which the government of Tatarstan owns the Kazan-based holding. The transaction amount was not disclosed. Preparation for the merger of the two companies’ assets took about a year, with both parties stating that the legal entities will be retained and their specializations separated: Rosspirtprom will handle alcohol production, while Tatspirtprom will use the alcohol to produce vodka and other alcoholic beverages.

Usadsky distillery of Tatspirtprom

Photo: Maxim Platonov / realnoevremya.ru

How a state-owned alcohol producer ended up in the hands of the Rotenberg brothers

Rosspirtprom was originally a state-owned enterprise managing the 18 alcohol factories owned by the government. Then, in May 2000, Vladimir Putin signed a decree establishing Federal State Unitary Enterprise Rosspirtprom. In practice, the enterprise became a tool for Putin’s old Leningrad judo sparring partner Arkady Rotenberg to gain control over a significant portion of Russia’s vodka market. This control is exercised through two channels: managing alcohol production and overseeing the alcohol market through the regulatory body.

Alcohol production in Russia is divided between two types of factories: distilleries produce alcohol, while liquor factories turn that alcohol into consumer beverages. Regulation of these factories and of the entire alcohol market is handled by the Federal Service for Alcohol and Tobacco Market Regulation: Rosalkogoltabakcontrol, or FSKATR (formerly RAR).

In the early 2000s Rosspirtprom quickly became one of Russia's largest alcohol producers, and its management has historically been connected both to FSKATR and to the Rotenbergs. The first head of Rosspirtprom was Sergei Zivenko, an acquaintance of both Arkady Rotenberg and Viktor Zolotov. In 2002, Zivenko was replaced by Petr Myasoedov, Major General of the Tax Service and a friend of the Rotenbergs’ parents. Four years later the position was handed over to Rotenberg protégé Igor Chuyan. Chuyan later headed the alcohol regulator, and the leadership of Rosspirtprom passed to Igor Aleshin, a former advisor to the manager of Rotenberg-affiliated SMP Bank. Aleshin later followed Chuyan’s path and also became head of Rosalkogoltabakcontrol.

Igor Aleshin

Photo: anticorr.media

The business press has been reporting on the Rotenbergs’ ties to Rosspirtprom since 2010. At that time, Vedomosti examined the financial statements of 11 of its factories and found that their management teams almost invariably featured representatives of a company affiliated with SMP Bank. Employees of NPV Engineering sat on the boards of directors of Astrakhan Liquor Factory, Mordovspirt, Bakhus (in Smolensk), Cherepovets Liquor Factory, Itkul distillery, and Yaroslavl Liquor Factory.

Between 2009 and 2012, the legal entities underwent a restructuring. In 2009, JSC Rosspirtprom was established, and in 2012 the state-owned enterprise was liquidated. Throughout this period, the Rotenbergs continued consolidating assets. In 2016, Rosspirtprom acquired eight distilleries from businessman Valery Yakovlev. A 4.5 billion ruble (around $77.5 million at the time) loan for this purchase was provided by Mosoblbank, which was under rehabilitation supervised by the Rotenbergs’ SMP Bank. Thanks to this deal, Rosspirtprom’s share of the alcohol market rose from 17% to 60%.

In 2024, the state company was put up for auction. At the end of 2023, Rosspirtprom’s assets had been valued at 10.9 billion rubles ($138 million), with net profit of 560 million rubles ($7 million). Rosspirtprom already accounted for nearly 40% of the country’s alcohol production. The auction result was therefore all the more surprising, as its sole participant — and winner — offered a bid of 8.3 billion rubles ($105.4 million), which is 23% below the starting price.

The new owner of Rosspirtprom was Business-Alliance, a little-known limited liability company with an opaque ownership structure. Forty-nine percent of its capital belongs to Vladimir Akaev, a native of the Chechen village of Achkhoy-Martan. The remaining 51% is owned by LLC Opal, which in turn belongs to the Batman closed-end mutual fund, managed by Fin-Partner. In December 2025, The Insider obtained access to the fund’s internal financial documents and identified its sole contributor: none other than Arkady Rotenberg.

Russian state in the service of the Rotenbergs

Despite Rosspirtprom’s transition into private hands, individuals connected to the entity effectively control the state alcohol market regulator. A recent example, in which an unknown private company owner acts on behalf of the Russian Federation, was highlighted by the Telegram channel P’yany Master (lit. Drunk Master):

“…One fine day, the director of a major distillery receives a call from a high-ranking alcohol regulatory official. ‘Here’s the situation: starting today, for all matters concerning your enterprise’s operations, please refer to a person named Vladimir Akaev.’

From his words, it appeared that matters such as licensing, changes in production capacity, and other issues under the authority of the state regulator were effectively delegated to a private individual named Volodya Akaev.

We meet with Akaev, who attended the meeting alongside Dmitry Korneev (acting CEO of Rosspirtprom from January to August 2024). Akaev says: ‘I'm the one calling the shots now. Do you have any problems or proposals?’ Our issue concerned the regulator's refusals to increase the enterprise’s production capacity on contrived, formal pretexts. Akaev replies, ‘We won’t increase anyone’s capacity,’ but promised that there would be no problems under the current operating mode.

A month later, we get a field tax inspection, and another month after that, the enterprise is subjected to a demonstrative raid involving economic crime units and the alcohol regulator, with administrative charges filed against us and our license revoked…”

Even if that case is still unverified, there is documented evidence of the influence that privately-held Rosspirtprom exercises over state authorities. Its director, Andrey Dronov, simultaneously manages companies that are on the Russian state's balance sheet. In September 2025, the Commercial Court of the Moscow Region seized the alcohol holding Global Spirits from Ukrainian businessman Yevhen Cherniak. The holding included half a dozen enterprises with a combined annual turnover of over 10 billion rubles ($127 million): Crimean Wine House and Feodosia Brandy and Wine Plant in Feodosia, liquor factories Rodnik i K in Mytishchi and Russky Sever in Vologda, and the Standart Kachestva distribution company. The most well-known brands of these factories were the vodkas Khorta (formerly Khortytsa), Russky Sever, Morosha, and the brandy Shustov. Andrey Dronov became CEO of all these factories. Formally, these enterprises are on the balance sheet of the Federal Agency for State Property Management (Rosimushchestvo), but in practice, they and their profits are managed by the head of Rotenberg-owned Rosspirtprom.

Bacardi by Rotenberg

In the summer of 2025, Rosspirtprom became the majority owner of the Tula Distillery 1911. This enterprise handles contract bottling of two Bacardi brands using imported raw materials — a scheme that allows savings on excise taxes. On Sept. 5, 2023, the Tula Distillery received certificates of conformity for imported rum distillates and gin alcohol produced by Martini & Rossi S.p.A. The supplier was the Swiss company Tradall S.A., part of the Bacardi holding. The following month, the distillery obtained documents for its own branded products: Bosford gin and Bacardi Oakheart rum beverage. The first batch of Russian-bottled Bacardi was released on Oct. 12, 2023, when the Tula Distillery received EGAIS notification No. 03-00223005.

Contrary to its promises to exit the Russian market, the Bacardi holding not only remained in Russia but also captured significant market share left vacant by departing competitors. Revenue of LLC Bacardi Rus grew from 32.6 billion rubles ($413.9 million) in 2022 to 46.4 billion ($589 million) in 2024, setting a record in the company’s history of Russian operations. In addition to increased imports, the company localized production of its flagship brand by partnering with a Rotenberg-linked company.

The Rotenbergs’ alcohol assets

Rosspirtprom directly owns eight distilleries in North Ossetia, Kabardino-Balkaria, and the Tula, Kursk, and Novosibirsk regions, plus 51% of the Tula Distillery 1911, a commercial center in the city of Yefremov (Tula Region), as well as the main logistics operator for alcohol transportation — OTK Magistral.

At the end of 2024, Rosspirtprom’s assets were valued at 22.5 billion rubles ($285.8 million), while Tatspirtprom’s were valued at 30.7 billion rubles ($389.9 million). Even when using the most conservative estimates, Arkady Rotenberg’s companies are approaching the value of the largest market player, Novabev Group (formerly Beluga), which reported assets of 54.26 billion rubles ($689.4 million) as of Q3 2025.

Since the start of the full-scale war, Rotenberg-linked companies have consolidated into a large-scale holding. Its enterprises produce alcohol, transport it to liquor factories, process it into alcoholic beverages, grow grapes, bottle international brand drinks in Russia, and distribute their own alcohol products. The main driver of this business growth is the connection it enjoys with Russian authorities — who can suspend competitors’ licenses, paralyze the operation of their factories, or simply expropriate their assets.