Argentine President Javier Milei — nicknamed El Loco (“the Madman”) for his radical right-wing politics — is looking at a possible impeachment over a cryptocurrency scandal now that the memecoin he advertised has collapsed. The incident is the first major setback for the eccentric, libertarian Milei, who had successfully maintained positive news coverage and high approval ratings. While Elon Musk is only just beginning to plot how to shrink the U.S. federal apparatus, Milei has been taking a chainsaw to the Argentine government and budget for over a year. The Argentine leader claims that the country needs to “go through hell” if it is to heal its economy. However, the hottest part of the “hell” may be over: inflation is on the decline, the economy is growing again, and the poverty rate, which spiked at the beginning of the period of reforms, is decreasing again.

Content

What happened to Argentina's once-stellar economy

Milei's chainsaw: amputation therapy

Inflation has fallen, but for how long?

Champion of the poor?

Dollarizing the economy

What the people think

Memecoin scandal: opposition demands impeachment

What happened to Argentina's once-stellar economy

As economist Simon Kuznets said, there are four types of economies: developed, developing, Japan, and Argentina. Long before his time, a century and a half ago, Argentina was one of the world's richest nations, with a GDP per capita on par with those of Great Britain and the U.S. and exceeding that of Spain, its former metropolis. However, Argentina soon slipped from the cohort of developed nations in a dramatic turn that made Kuznets single it out as a separate type of economy.

Much of its decline is attributed to the political instability that began in 1930, when a military junta took power, ending seven decades of civilian constitutional rule. Between 1930 and 1981, the country survived seven military coups.

Juan Domingo Perón, a former military officer who was elected president three times, had a hand in reverting the country’s economic achievements. His left-populist movement, known as Peronism, had the support of labor unions, the poor, and the working class. The Peronists won 10 of the 14 presidential elections in which they participated. Trying to protect workers from foreign competition, they advocated for economic isolationism and restricted international trade, which had been a key to Argentina's wealth. As a result, Argentina's share in global exports declined year after year.

Meanwhile, Argentina's main domestic problems were uncontrolled government spending and expensive social programs that the country could not afford. Decades of energy and transportation subsidies aimed at protecting the poor caused all sorts of economic distortions and drove the country into bankruptcy. Paradoxically, the subsidies imposed by leftist politicians only fueled inflation, hitting their main beneficiaries — the poor. The government had to print money for new subsidies, thereby deepening the vicious circle of inflation.

Uncontrolled government spending and social programs that Argentina could not afford drove the country into a series of defaults in the 2000s

In 2001, Argentina defaulted on $100 billion in debt, setting an anti-record for a sovereign default. By 2020, the country had defaulted eight times. Frustrated with the deplorable state of their economy, Argentines had a change of heart in the 2023 presidential election, voting for Javier Milei, a self-proclaimed anarcho-capitalist who promised at least some kind of solution — albeit a painful one. He summed up his plan as “taking a chainsaw to public spending.”

Milei's chainsaw: amputation therapy

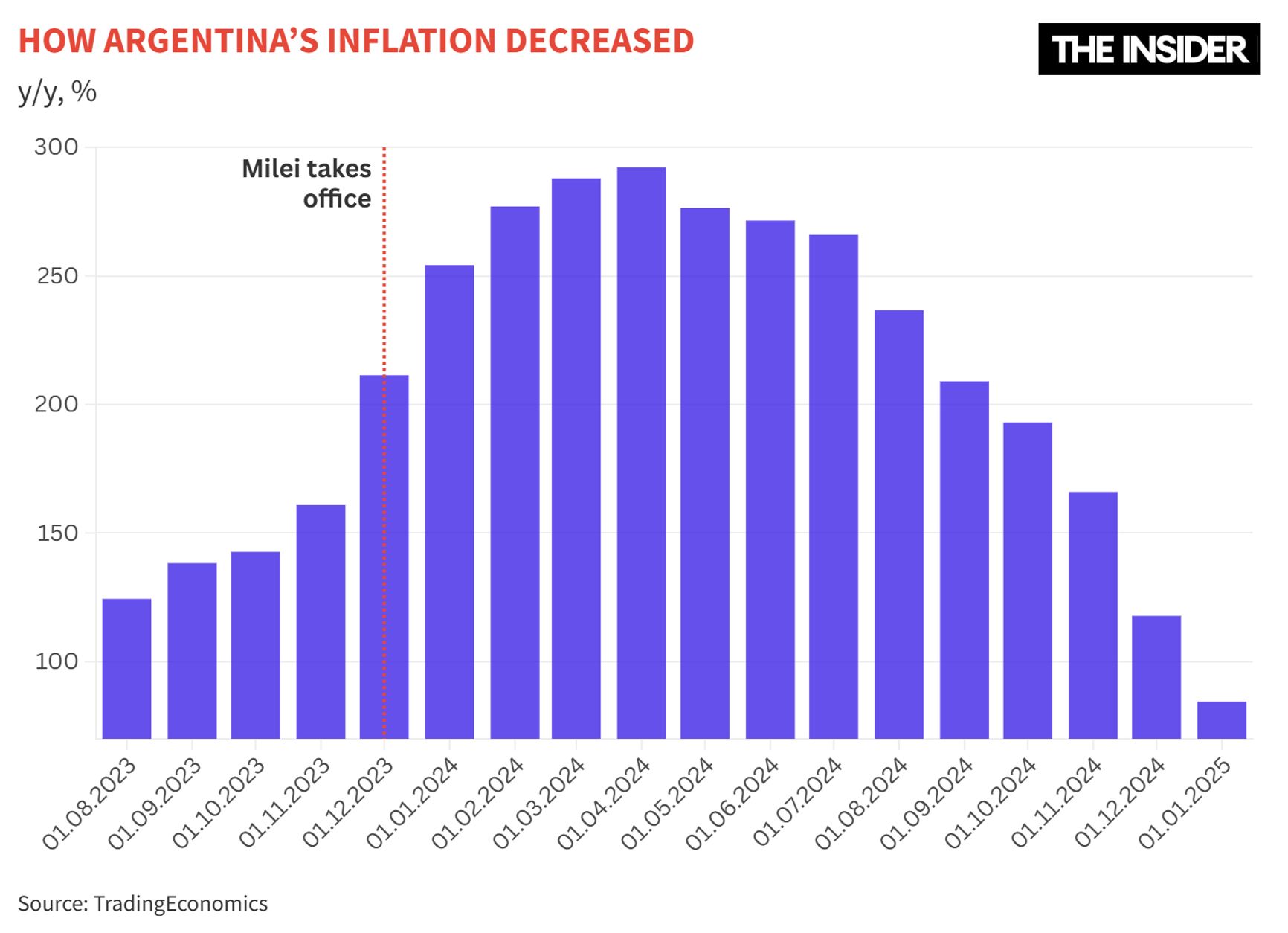

When Milei took office, Argentina's economy was in a truly catastrophic state: GDP per capita had stagnated since 2011, and inflation exceeded 211%. In pre-election polls, voters cited hyperinflation as their main concern.

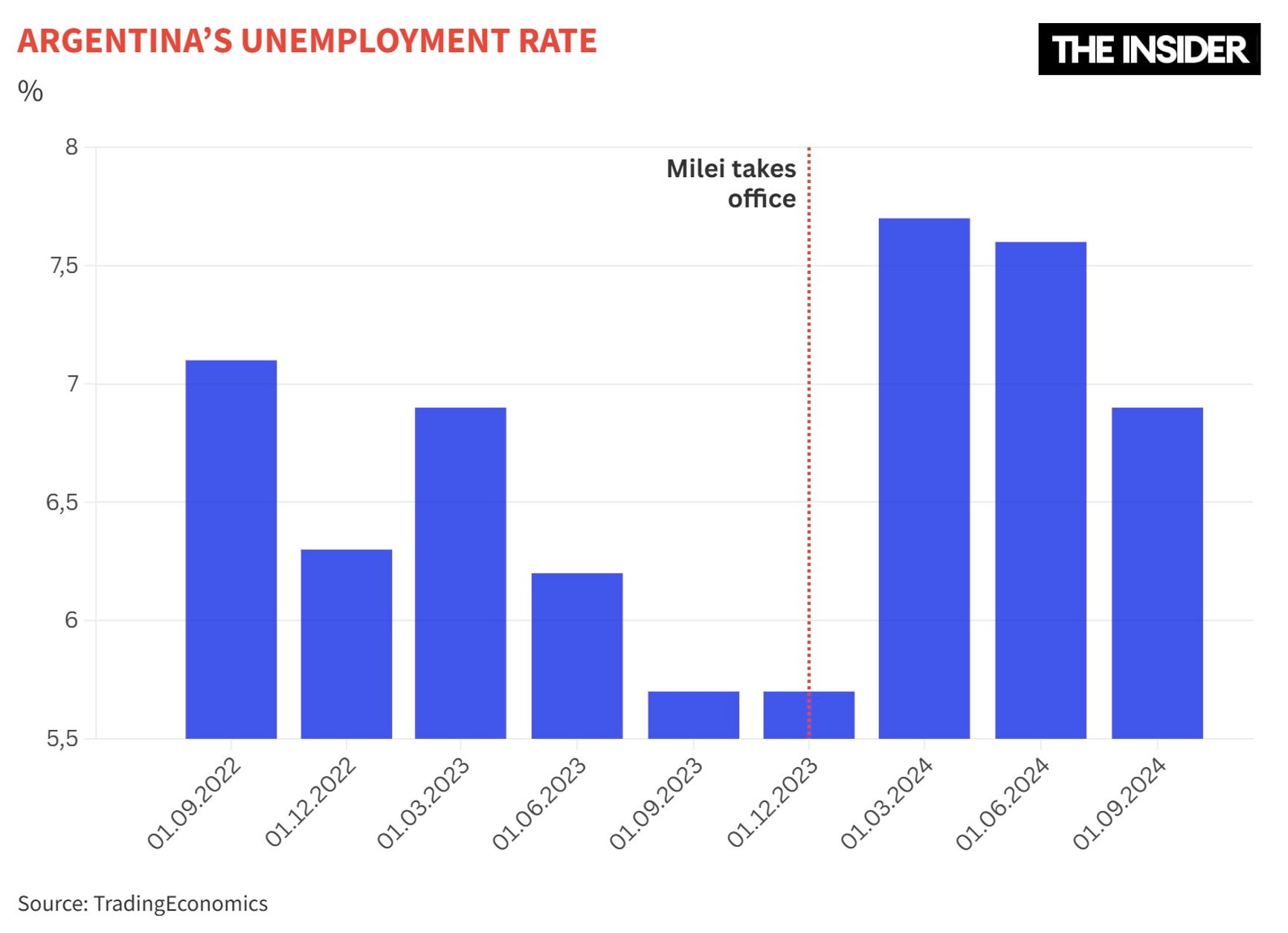

In one year, Milei indeed reduced budgetary spending from 44% to 32% of GDP. In doing so, he more than sliced the number of ministries from eighteen to eight — and that figure includes the newly established Ministry of Deregulation and State Transformation. Social benefits and subsidies, including on food, energy, and public transportation, also ended up on the chopping block. Milei suspended the vast majority of public works and stopped payments to provincial governments. The public sector laid off 35,000 workers, and the wages of those who remained grew slower than inflation, as did pensions. Almost all government infrastructure projects have been suspended too, with a view to funding them privately in the future. These measures were taken under the slogan “no hay plata” — “there is no money” — a phrase of Milei's that went viral online.

Meanwhile, Economy Minister Luis Caputo, a former Wall Street trader, directed his efforts towards shutting down the “printing press.” The IMF also demanded fiscal discipline, making it a condition for further debt restructuring negotiations. The $44 billion loan and the necessary incremental reforms were agreed upon back in 2018 under President Mauricio Macri, but no reforms followed.

The chronically depreciating peso, which Milei said “is worth crap” in his election campaign, has strengthened significantly in the past six months. Milei also managed to bring $18 billion into the financial system thanks to a generous tax amnesty that encouraged Argentines to take dollars stashed under mattresses or in foreign banks and inject them into the economy.

The tax amnesty has encouraged Argentines to inject dollars hidden under mattresses and abroad into the economy

This reduced the demand for dollars on the black market and eased the pressure on the exchange rate.

Inflation has fallen, but for how long?

Thanks to all these steps, Milei achieved the country's first budget surplus in 14 years: at the end of 2024, it amounted to 1.76 trillion pesos, or 0.3% of GDP. The primary budget balance — surplus minus debt repayment — amounted to 10.41 trillion pesos, or 1.8% of GDP.

Most importantly for Argentines, Milei's austerity policies have helped to drive down inflation. In his first year as president, monthly inflation shrank tenfold, from 25.5% to 2.7%. Of particular note is the slowdown in food price inflation to an astonishing 0.9%.

The question is how long it will be possible to keep inflation low. The slowdown in price growth was partly the result of a drop in consumer demand, caused by both the economic downturn and the reduction in state support ordered by Milei. To keep inflation low in the long run, after demand rebounds, Argentina will need to increase the supply of goods and services.

Since the current slowdown in inflation is due to falling consumer demand, will the authorities keep it down when the economy starts to recover?

Another risk lies in the potentially overvalued peso. The Milei government has so far maintained the currency restrictions inherited from the previous government and has been setting the official exchange rate: the peso was devalued by 50% in December 2023 and then depreciated by 2% each month thereafter. However, with monthly inflation exceeding 2%, the real exchange rate is on the increase. Argentines realize the power of the peso: every day around 55 buses take shoppers to Chile, where goods can be as much as 70% cheaper.

But what is good for such spontaneous importers is bad for exports and economic growth. In addition, while currency restrictions are a necessary ingredient in MIlei's system, they discourage investors, who need the opportunity to freely withdraw the money they invest in Argentina's economy. If Milei lifts currency restrictions and lets the peso exchange rate float freely, the Argentine currency will very likely depreciate, triggering a new round of inflation and thereby nullifying Milei's main economic achievement so far — possibly collapsing his approval ratings.

Champion of the poor?

According to Milei, he has tried to deliver ordinary Argentines from the most painful measures, directing them mainly against the state apparatus. But cutting subsidies, pensions, and jobs could not go unnoticed, especially in Latin America’s most expensive country.

Early in 2024, Argentines' utility bills rose by 200% and the share of those classified as poor rose to 53% — from 40% in 2023 — the sharpest jump in two decades.

Some signs indicate that Argentina is nearing the end of the most painful phase of Milei's chainsaw surgery. Consumer spending and manufacturing activity are on the increase, and wage growth has been outpacing inflation for the past several months. Argentina climbed out of recession in the third quarter of 2024, with GDP adding 3.9% from July through September — the country's sharpest quarterly growth rate in four years — 14 years if one puts an asterisk on the post-lockdown recovery. The World Bank predicts that growth will continue in 2025, rising to over 5%.

With inflation falling from a peak of 25.5% a month and wages regaining some of the ground lost, estimates suggest the poverty rate had fallen to 36.8% by the end of the second half of last year, which is 4% lower than before Milei took office. Economic growth is likely to further alleviate poverty and unemployment, even if it will simultaneously increase inflationary pressures.

Dollarizing the economy

One of Milei's most radical proposals was to dollarize the Argentine economy. While the idea has yet to be implemented, the president appears intent on following through.

The Argentine government is working with major banks and payment companies to take two key steps: launch dual-currency bank cards so Argentines can make payments in dollars, and authorize banks to provide dollar loans in all sectors of the economy. The rationale behind this initiative is to bring into circulation dollar revenues, which surged after the tax amnesty.

However, in light of MIlei's recent successes, many doubt whether the country needs such a radical measure. If inflation has already slowed markedly, the currency has stabilized, and the economy is growing, why deprive the Central Bank of its leverage and effectively surrender control of monetary policy to the United States?

According to its advocates, dollarization is the economic equivalent of handing over the car keys to a non-drinking friend before a party — and the only sustainable way to keep inflation in check. If we consider the history of Argentina, a country where trust in institutions and the state has been undermined more than once, such a strategy becomes understandable.

Switching to dollars is like handing the car keys to a non-drinking friend before a party, Milei supporters say

Argentina has seen its share of political upheavals: in the past, officials who once promised to protect private savings later expropriated them, and voters once again favored populist leaders, even if their authoritarian methods inevitably led to economic crises. The lack of institutional stability remains a strong argument against blind trust in seemingly mild reforms. In a dollarized economy, the next populist will not be able to go ahead and simply print up whatever amount of money they want.

What the people think

At the time of MiIei's inauguration, his chances of success on the economic front appeared slim. Too serious were the problems, and too questionable was the path outlined by the new president. Milei was a hotheaded political outsider made famous thanks to flamboyant television appearances — he had no real experience in public governance. The president's party won only 39 out of 257 seats in Argentina's Chamber of Deputies, six of 72 seats in the Senate, and no governorships. Analysts predicted the disastrous end of his government (1, 2, 3).

Instead, Milei’s approval rating showed a steady incline during his first year in office — something his predecessors never accomplished, despite enjoying higher initial approval. Gallup data indicates that Argentines have become more hopeful about the future following the drastic anti-crisis measures Milei took immediately after the inauguration. For the first time since 2015, more than half of the respondents noted that their standard of living is starting to improve.

Argentines have become more hopeful about the future after Milei's tough reforms

Milei's approval ratings reflect a marked polarization: support for his policies is significantly higher among the wealthiest citizens, with 59% of the richest 20% of the population approving of his actions. Among the poorest, Milei is favored by 39%, which is still more than the previous president could boast. In other words, the reforms aimed at combating hyperinflation and fostering a free market transformation are perceived positively mainly by the affluent strata of society. Meanwhile, those who are less well-off still face many unsolved problems.

Milei's overall popularity can be attributed to skillful management of expectations. In his first speech as president and throughout the campaign, Milei did not understate the painful short-term effects of his economic reforms. He honestly warned that things would get worse before they could get better. Unlike his rivals, Milei did not build castles in the air but bluntly stated that Argentines would have to go through hell first.

Investors are also optimistic. JP Morgan's January 2025 country risk index for Argentina fell to its lowest level in seven years after the government announced a $1 billion bond buyback agreement with five international lenders to replenish the central bank's foreign reserves.

However, Argentina has already had many “successful” stabilization plans that ultimately failed. Milei will have to succeed simultaneously in economic growth, reserve accumulation, inflation control, and voter support before we can start talking about breaking the vicious cycle.

Memecoin scandal: opposition demands impeachment

The only major stain on Milei's reputation has been the ongoing $LIBRA cryptocurrency scandal. On the night of Feb. 15, the president posted a tweet promoting the memecoin: “This private project will aim to stimulate the growth of the Argentine economy by financing small Argentine businesses and startups.” “The world is looking to invest in Argentina,” the president added. Traders pounced on the memecoin, driving its market capitalization up to $4.5 billion — but it then plummeted on fears of fraud.

Bubblemaps, an online data visualization startup, claims the team behind $LIBRA is cashing in. “They already made $87M by removing USDC and SOL from liquidity pools,” Bubblemaps wrote. “$LIBRA is down 85% because the devs absorbed $87M of buy pressure into their pockets. $500M more to go.” The token gained about $1.1 billion in trading volume in a few hours and then collapsed.

Milei distanced himself from the project and deleted the tweet. “A few hours ago I posted a tweet, like so many other infinite times, in support of an alleged private venture to which I obviously have no connection whatsoever,” he wrote. “I was not informed about the details of the project, and once I was, I decided not to continue promoting it (that's why I deleted the tweet).”

But investors who have lost millions will take no consolation from Milei's belated epiphany. The opposition has already accused the president of fraud. MPs from the Union for the Homeland party are gunning to initiate impeachment proceedings. The Civic Coalition party believes that Milei's actions violated the law on the ethics of civil servants and the law on financial institutions.