“I really wanted Gazprom to become the world's most valued company,” Dmitry Medvedev said in 2007. Back then, he headed the company's board of directors, and at that what he said made sense, as Gazprom was third in the list of the world's most valuable enterprises. Fast forward fifteen years, and the narrative has shifted dramatically. Now, Gazprom meanders between the fourth and fifth hundreds, its dollar-denominated capitalization plummeting sevenfold, with no discernible floor. In the pecking order of Russia's corporate elite, Gazprom finds itself in an unexpected sixth place, trailing behind its own subsidiary, Gazprom Neft. Once a darling of investors for its lucrative dividends, Gazprom faced an unprecedented setback in 2022. Shareholders, accustomed to a quarter-century of financial returns, found their expectations dashed as the state seized control of the dividends. The outlook for the current year held no promise either, as Gazprom's primary business ventures spiraled into the red. The challenges extend beyond the obvious culprits of war and sanctions; they delve into the corrosive influences of rampant corruption and the aftermath of managerial incompetence.

Content

Pre-war Gazprom

During the war

Impact on Gazprom's revenues

Farewell to Europe

Why China won't help

Embezzlements and kickbacks. How systemic corruption eroded Gazprom

Pre-war Gazprom

Back in the late 1960s, Germany took the lead among Western nations in establishing cooperation with the USSR by striking a deal known as “Gas for Pipes.” As a result, moderately priced gas from Russia played a pivotal role in boosting key sectors of the German industry, including chemicals, construction, and food. Following Germany's lead, other European countries also became consumers of Russian gas. Half a century later, three-quarters of “Gazprom's” exports and a third of its total sales volume were directed to the European Union. The Russian company held a market share of approximately 40% in the European market. The mutual dependence seemed unbreakable.

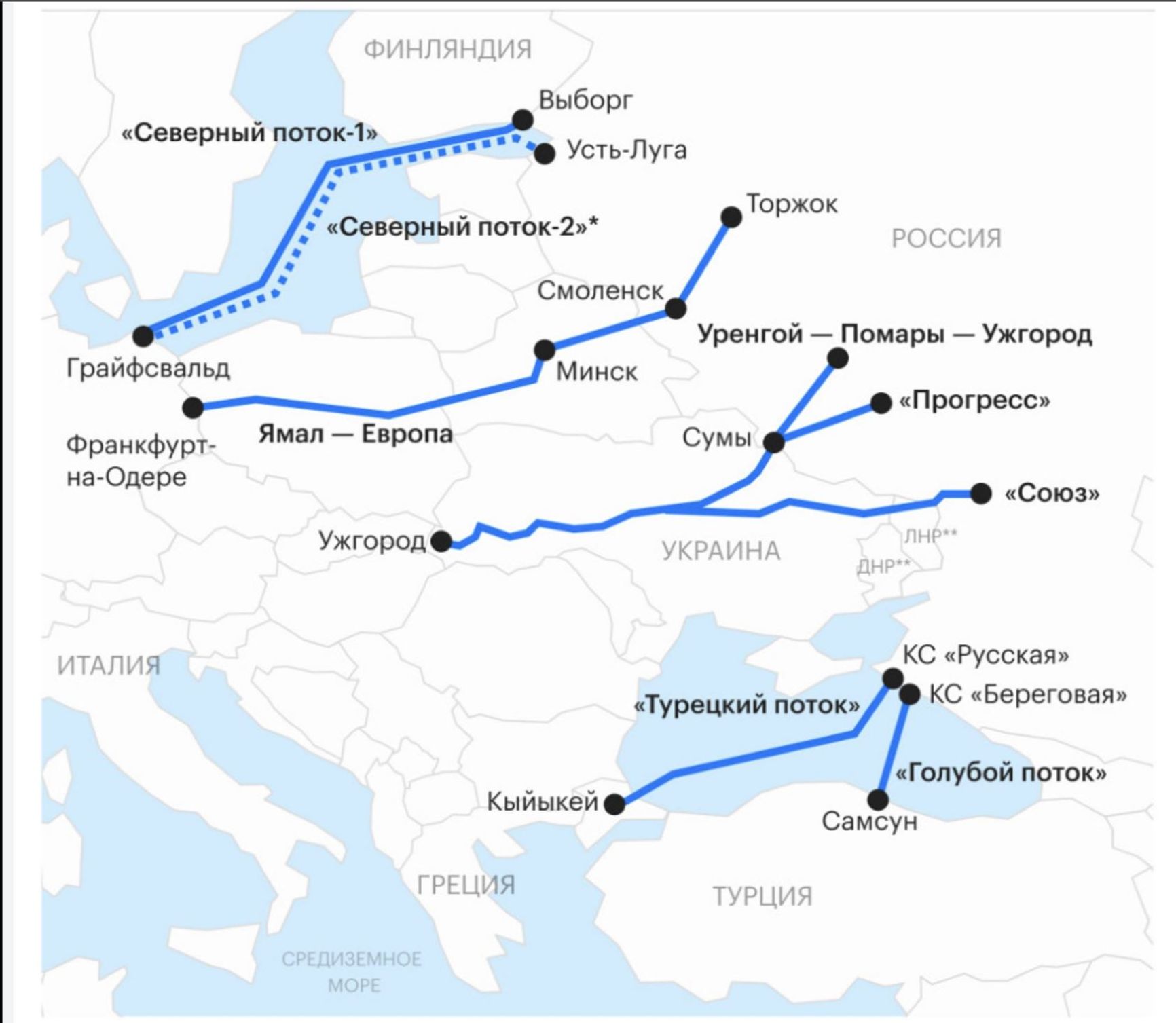

Up until the commencement of the full-scale invasion, Gazprom supplied approximately 150 billion cubic meters of gas to Europe annually through several routes:

- Nord Stream 1 traversed the Baltic Sea floor to Germany (with a capacity of 55 billion cubic meters for two lines).

- Yamal–Europe passed through Belarus to Poland (33 billion cubic meters).

- Ukraine's gas transportation system accounted for 40 billion cubic meters.

- The TurkStream branch supplied Southeastern Europe (20 billion cubic meters).

A duplicate of the first Nord Stream pipeline with similar capacity (55 billion cubic meters), Nord Stream 2, awaited certification from the German regulator.

Pre-war Gas Deliveries from Gazprom to Europe

Infographic by RBC

During the war

In the first year of Russia's invasion of Ukraine, the export of Russian gas to Europe, according to the Oxford Institute for Energy Studies, decreased to 63 billion cubic meters. This year, only 22 billion is expected—comparable to the levels of Algeria and Azerbaijan—while Norway emerged as the largest gas supplier to the EU.

In the initial months after the onset of the war, Russia attempted to exert pressure on Europe by restricting gas supplies under various pretexts. “Western opponents have issued so many sanction documents that they themselves got confused and fell into their own sanction trap,” explained Gazprom's CEO, Alexey Miller. As a result, by June 2022, exports through the Nord Stream were reduced by 60%.

On September 2, citing turbine malfunctions, the Kremlin halted the export through Nord Stream, ostensibly aiming to use it for political leverage. However, by September 26, three out of four Nord Stream lines were damaged due to sabotage. It turned out there was nothing left to blackmail with: Gazprom physically could not resume supplies as infrastructure restoration is a lengthy and expensive process.

Simultaneously, the Russian authorities dealt a blow to Gazprom's European business by demanding a switch to ruble settlements with clients from countries deemed “unfriendly” by Russia. Almost none of the “unfriendly” nations agreed to this. While contracts with most European consumers formally remain in effect, deliveries under them have ceased.

The modest volume of gas that Gazprom continues to supply to the EU is routed through Ukraine's gas transportation system (providing gas to Austria, Hungary, Slovakia, and Ukraine through a so-called virtual reverse) and TurkStream (serving Hungary, Serbia, Greece, North Macedonia, and several non-EU countries).

Impact on Gazprom's revenues

Export to distant foreign markets constituted a significant portion of Gazprom's revenue, as prices for Europe differed from those on the domestic market and former Soviet republics by multiples. China, which has become the largest importer of Russian gas, also pays considerably less. While the average price for a thousand cubic meters in Europe and Turkey in 2022 was $984, China paid only $277, as calculated by Bloomberg. In 2023, the difference will narrow but remain substantial: $502 compared to $297.

In 2022, Europe and Turkey paid an average of $984 for a thousand cubic meters of gas, while China paid $277

At the peak of the panic triggered by the onset of the war, the price for a thousand cubic meters in Europe soared to over $3,800, almost 20 times the average for preceding years. These extremely high prices allowed Gazprom to conclude 2022 favorably. Net profit, according to international financial reporting standards, amounted to 1.2 trillion rubles. It was less than the super-successful 2021 (over 2 trillion) but close to the pre-pandemic level. “The positive results confirmed the stability of all types of the conglomerate's activities,” Gazprom's Deputy Chairman of the Board, Famil Sadygov, was happy to comment. However, in 2023, the landscape changed, and there was no cause for celebration.

Switching to liquefied natural gas (LNG) and reducing consumption, Europe successfully weathered the winter without Nord Stream. By mid-November 2023, a thousand cubic meters cost just over $500, and the average annual price may even be lower, according to Fitch.

As a result, Gazprom's core business became unprofitable this year. This had only happened in the crisis years of 1998 and 2020. The overall profitability of the conglomerate is essentially supported by Gazprom Neft.

Gazprom's core business became unprofitable this year; this had only happened in the crisis years of 1998 and 2020

Farewell to Europe

Gazprom has likely lost the Western European market forever. Although Vladimir Putin occasionally proposes resuming deliveries through the only surviving branch of the Nord Stream, he probably understands that this won't happen during the war. Even in the event of its conclusion, Gazprom would find it challenging to regain lost positions. Even if there is a change in power in Russia, the chances are slim.

The EU had approved the Fit for 55 energy transition strategy even before the war began, aiming for a radical reduction in gas consumption in favor of renewable energy sources. By 2030, the entire import is expected to be only 236 billion cubic meters. Furthermore, the events of 2022 demonstrated how risky it is to depend on a single supplier. Last winter, Europe did not freeze, but it paid a high price. According to the International Energy Agency (IEA), the rejection of Russian gas cost 270 billion euros due to rising prices.

Europe won't return to Russian gas, particularly due to the shift to renewable energy sources

Unlike Gazprom Neft and other oil producers that quickly redirected export flows to the East, Gazprom fell victim to the long-standing strategy dating back to Soviet times, focusing on expanding pipeline infrastructure westward. As long as pipes have not been laid in other directions, Gazprom is forced to accept falling sales and reduce production.

In 2022, Gazprom's production decreased by 20%, or more than 100 billion cubic meters, and in the first six months of 2023, it dropped by another 25%. The company never invested significant money in infrastructure for liquefied natural gas production, which could be shipped anywhere. It will be difficult to make up for the missed opportunities while under the sanctions. The construction of Gazprom's plant in Ust-Luga, which was supposed to process 45 billion cubic meters of gas annually and produce 13 million tons of LNG, has been put on hold because the U.S. contractor withdrew from the project.

Gazprom is left to do what it has always exceled at: laying new pipes. In the isolation that Russia has imposed on itself, there are few open directions.

Gazprom is left to do what it has always exceled at: laying new pipes

Why China won't help

Gazprom's main hopes are predictably pinned on China, which, according to the IEA forecast, is expected to account for nearly half of the world's gas consumption growth in the next five years. “Pipeline supplies to China may soon reach the levels we had for exports to Western Europe,” recently promised Alexey Miller. However, this seems unlikely.

The primary route for Russian gas exports to China is the Power of Siberia gas pipeline. In 2022, Russia supplied 15.5 billion cubic meters through it, and by 2025, volumes are supposed to reach the planned 38 billion. Gazprom could potentially deliver an additional 10 billion per year from the Shelf fields of the Sakhalin-3 project via the Sakhalin–Khabarovsk–Vladivostok gas pipeline, which will have a branch to China by 2027. However, this falls short of compensating for the 150 billion cubic meters lost due to the rift with Europe.

Miller could fulfill his promise if the Power of Siberia 2 gas pipeline is constructed, designed to transport 50 billion cubic meters of gas from the Yamalo-Nenets Autonomous Okrug to China via Mongolia. A memorandum for its construction was signed back in 2006, but there is still no final agreement.

On the one hand, China is interested in the project, as the gas supplied through Power of Siberia 2 is needed for the development of the country's depressed northeastern regions. On the other hand, China has taken note of Europe's bitter experience and is building a diversified supply system, with a significant role assigned to LNG, according to experts surveyed by Bloomberg.

China has taken note of Europe's bitter experience and does not want to depend solely on Russian gas

Moreover, China is in no rush. “It can afford to wait until 2025–2026 when significant new volumes of LNG from the U.S. and Qatar are expected to enter the market,” explains independent expert Sergey Vakulenko. “This may not only reduce prices but also make [major pipeline gas suppliers] Turkmenistan and Russia even more accommodating than they are now.”

Unlike China, Gazprom has no time to spare. Experts at the Oxford Institute for Energy Studies believe there are two to three years to restart the export strategy. Otherwise, to compensate for Gazprom's lost revenues, the government will have to raise gas prices for domestic consumers. This scenario currently seems the most realistic.

Embezzlements and kickbacks. How systemic corruption eroded Gazprom

Gazprom could have weathered geopolitical storms more easily if it were a truly efficient modern company, but systemic and widespread corruption hindered this. According to oil and gas analyst Mikhail Krutikhin, corruption not only consumed a significant portion of revenues but also led to strategically incorrect decisions:

PAO Gazprom is a powerful commercial company with control over 16% of global and 71% of Russian natural gas reserves. It has a monopoly on gas exports through pipelines from Russia and control over more than 175,000 kilometers of gas pipelines—the world's largest network. However, alongside the flagship and official Gazprom, another entity emerged, renowned not for labor achievements and commercial successes but for corruption.

Because of corruption, the grand Stokman project in the Barents Sea, jointly developed by Gazprom, Norway's Statoil, and France's Total, designed to capture up to 10% of the US gas market, ultimately failed. Officially, the main obstacles were said to include the unprecedented complexity and cost of the work, the Russian tax system, and, most importantly, the “shale revolution” in America, which left Stokman's gas without a market. However, everyone understood another significant reason.

“The exorbitant expenses associated with technology-related tasks prevented Gazprom personnel from engaging in their customary habit of exaggerating budgets for personal gain,” told me a former Statoil executive. “Moreover, oversight from international partners eliminated such prospects. Because Russian officials lacked any personal financial stake in the project, they restrained the Stokman initiative.”

In projects where foreign witnesses did not hinder Gazprom, estimates were inflated, and a significant portion of the budget was misappropriated by corrupt officials using such simple methods as embezzlements and kickbacks. According to Mikhail Korchemkin of East European Gas Analysis, the cost of laying an average kilometer of Gazprom's gas pipelines was three times higher than projects abroad similar in terms of complexity and conditions.

It cannot be said that corrupt practices made their appearance only in May 2001 with the arrival of Alexey Miller, Putin's “right hand man” since his days in the St. Petersburg mayor's office. (Remember businessman Maxim Freidzon's story about how Putin used to write bribe amounts on a piece of paper, while “Leshka Miller used to actually take the money”?) The previous head of Gazprom, Rem Vyakhirev, gained notoriety by transferring company assets to his friends and even attempting to take control of up to 30% of Gazprom. His successor elevated the level of corruption practices, bringing them to a prominent state level.

Under the new leadership, the company began spending colossal amounts on mega-projects that were inherently unprofitable, such as Power of Siberia, a new gas transportation corridor from Yamal, the Sakhalin-Khabarovsk-Vladivostok pipeline, and so on. Understanding the motives of the initiators of such undertakings is difficult unless you consider the interests of contractors who were handling the billions allocated by Gazprom: figures close to Putin such as the Rotenbergs, Kovalchuks, Timchenko, and others. Perhaps these contractors parasitized on Putin's geopolitical illusions, whether he dreamed about exporting gas to China, bypassing Ukraine with Nord Stream and South Stream, or gaining control over the Arctic, and pushed lucrative and absurd ideas to the president. Or perhaps Putin was just a part of these schemes.

Contractors parasitized on Putin's geopolitical illusions

In industry circles, a narrative circulated about Putin summoning the owners of four companies engaged in pipe production. His demand was clear: initiate the production of large-diameter pipes for gas pipelines, positioning it as a move to “replace imports” from Germany, Japan, and Ukraine. The entrepreneurs were taken aback by the staggering capital required for such an endeavor, especially considering the apparent lack of demand in Russia to justify such substantial expenditures. As the story goes, the President assured them that demand would materialize, and subsequently, a series of Gazprom mega-projects unfolded, seemingly serving only the interests of those skilled in misappropriating allocated funds.

This turn of events proved advantageous for both pipe manufacturers and gas pipeline builders. The expenses for these financially burdensome and unprofitable projects, however, were and continue to be covered from Gazprom's coffers. These funds, including revenues from gas exports that could have contributed to the federal budget and societal needs, instead went toward projects that appeared to primarily benefit embezzlement experts. Essentially, Gazprom functioned as a conduit for transferring state funds (given it's partly owned by the state but personally controlled by Putin) into the pockets of the president's associates – be they contractors or Gazprom executives.

Fulfilling the President's wishes at the expense of Gazprom's funds is handsomely rewarded. The financial rewards for Miller and his inner circle witnessed unchecked growth, irrespective of the company's actual performance. Concurrently, non-productive expenses escalated – whether directed towards a skyscraper in St. Petersburg, sports clubs domestically and internationally, self-promotion endeavors, or dishonest media outlets. The Board of Directors, originally designed to oversee management in the shareholders' interests, had long transformed into a mere formality and a gravy train for Putin's loyalists.

Fulfilling the President's wishes at the expense of Gazprom's funds is handsomely rewarded

The seemingly endless mismanagement of funds is proving increasingly detrimental to Gazprom, especially considering the company's shift away from its primary export market in Europe under the president's directive, leading to a reduction in production. The likelihood of dividend payouts is diminishing, as Gazprom must now allocate funds to complete the Power of Siberia project and potentially initiate yet another exorbitantly expensive megaproject—Power of Siberia-2, as instructed by Putin. Despite the lack of Chinese interest in this venture, Putin appears undeterred.

The personal oversight of Gazprom by Putin, with Miller considered merely a “messenger” conveying presidential directives to the board, continues to be a source of enrichment for opportunists. However, this leadership is steering the “national treasure” toward financial ruin.