In 2022, a set of basic foods in Russian shops has grown 16% more expensive year on year, despite the sagging demand even for staple items. Retailers observe that private labels, which are cheaper than their branded analogs, currently account for 10% of sales. Throughout 2022, the government has been trying to rein in retail markups to bridle food price growth. Manufacturers and distributors have found themselves between the rock and the tight spot, balancing between raising prices to avoid bankruptcy and keeping them stable to sustain demand and meet government requirements. One of the popular workarounds is to reduce the size of the packaging while maintaining the price – a trick commonly referred to as “shrinkflation”. Finding a one-liter carton of milk is a challenge; most blocks of butter weigh less than 200 grams; pasta has shrunk from 500 to 400 grams per bag, and even eggs are sold by eight or nine instead of the usual ten. The Insider has investigated how food packaging has shrunk in Russia over the last few years.

Content

Mass shrinkflation

Cream of the crop: How dairy packages shrank

“Russia is a generous soul”: How chocolate melted

Never a bad time for a beer: Watch it evaporate

Margins of error

Mass shrinkflation

The phenomenon is not unique to modern-day Russia. In her book Signals: The Breakdown of the Social Contract and the Rise of Geopolitics, American economist Pippa Malmgren writes that in the US, shrinking packages preceded the rise of conventional inflation in the 1970s. Following the crisis of 2008–2009, this technique once again comes to the forefront. American media reported the downsizing of Coke cans (thus, Coca-Cola introduced new, smaller cans and launched a supporting campaign), pasta boxes, sauces, cookies, and canned vegetables and fish. British manufacturers took even more drastic steps. For one, Toblerone bars and After Eights lost as much as 30 grams (15%) off the traditional 200-gram bar and box in 2010. In 2016, Toblerone shrank even further, down to 150 grams, causing an uproar in social media. The manufacturer eventually had to come forward and admit their attempt to cut costs.

Russian foods also started shrinking after the 2008 crisis. By the assessment of Gfk Rus, FMCG manufacturers reduced the size of their packaging by 7–20%, depending on the category, from 2012 to 2018. According to a 2019 survey by state-run pollster VTsIOM, almost three-quarters of Russians noticed the shrinking of foods, and 60% expressed their dissatisfaction with it.

Around the same time, Danone, Russia's largest dairy manufacturer, admitted that market players started downsizing packages after the 2008 crisis to avoid hiking prices. Marina Balabanova, the company’s vice president in Russia and the CIS, remarked that a difference of 30–50 milliliters is immaterial for the consumer. Meanwhile, confectionery manufacturer Mondelez (Oreo, Alpen Gold, Milka) announced that the shrinking of packages was driven by the trend of healthy living.

Unlike other countries, Russia features no correlation between shrinking food packages and the state assessment of inflation. The Russian Federal State Statistics Service (Rosstat) uses a methodology that suggests comparing prices per kilogram, liter, or standard (according to the agency) package. For instance, toilet soap is presumably sold in 100-gram blocks, shampoo in 250-milliliter bottles, and canned fish and meat in 350-gram cans. Therefore, if a manufacturer downsizes the package while retaining the price, Rosstat will still register an increase in the price per liter.

Rossiya chocolate bar, “Coffee with Milk” flavor

2011, 2014, 2022

According to Rosstat, food inflation in September 2022 bordered on 9% compared to the beginning of the year. However, prices for individual foods have shown a much higher growth. Like last year, price hikes affected mostly the cheapest items consumed by the majority of Russians. As The Insider estimated, the biggest food price growth since August 2021 was observed for oleomargarine and sugar (by 50%). Rice, frozen calamari (a cheap source of protein), and cookies became 36–38% more expensive, while prices for buckwheat and salt grew by 30% and 32%, respectively.

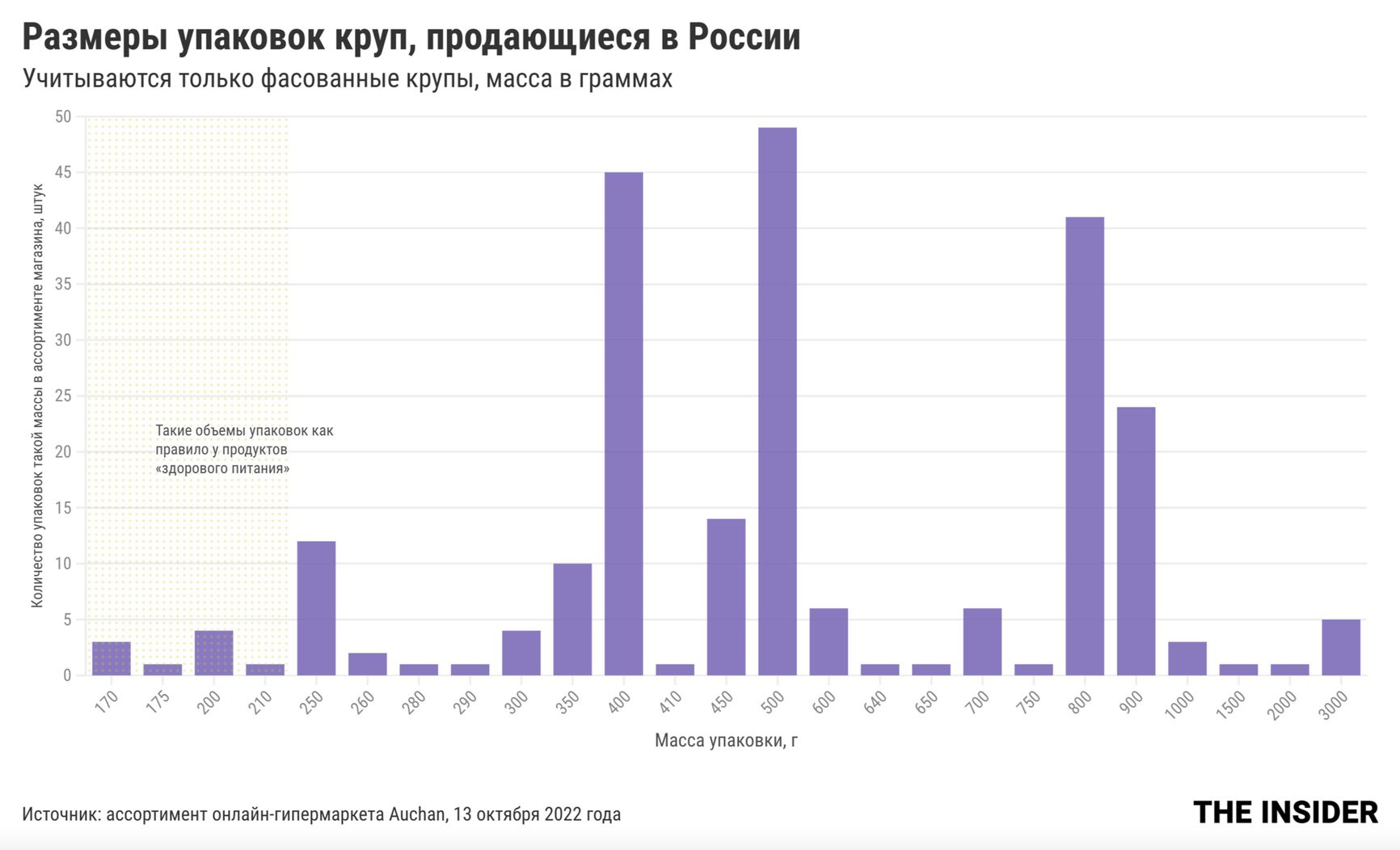

The average price for a kilo of white rice in Russia is 115 rubles ($1.86), and a kilo of buckwheat costs 134 rubles ($2.17), Rosstat reports. However, one-kilo packages are a rarity. Analyzing the catalogs of major retail chains in 2020-2022, The Insider learned that most groats are sold in bags of 400, 500, 800, and 900 grams. In the last two years, the sizes have become more diverse: 450 or even 410 grams, 300 grams or 10-40 grams less, 700, 650, and 600 grams. This is exactly how shrinkflation works: food packages “lose weight” inconspicuously, a few percent at a go.

The sizes of groat bags sold in Russia. Horizontal: Net weight, g. Vertical: Quantity in stock, pcs. Dotted area: sizes typical of "healthy" groats

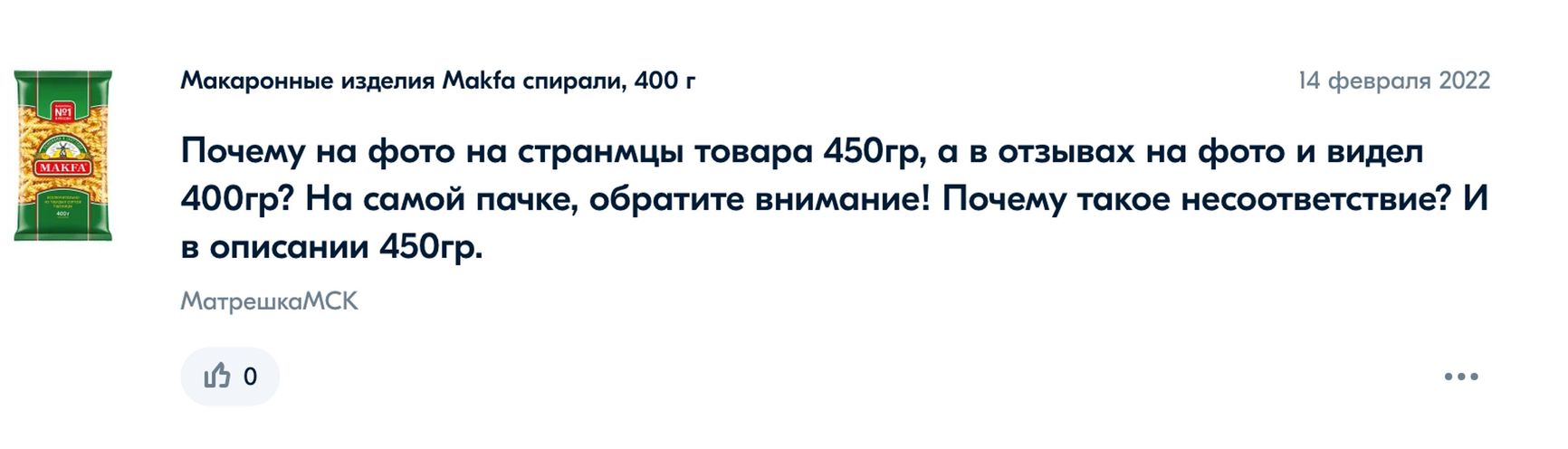

Thus, Makfa started selling pasta in 400-gram bags, as compared to 450 grams earlier. This inconsistency was noticed by consumers at the Ozon online marketplace.

In February 2022, Ozon users noticed that, while the marketplace offered 450-gram bags, they were actually delivered 400-gram bags. This caused the manufacturer to change the description of the item, specifying that a standard bag now weighed 400 grams.

Cream of the crop: How dairy packages shrank

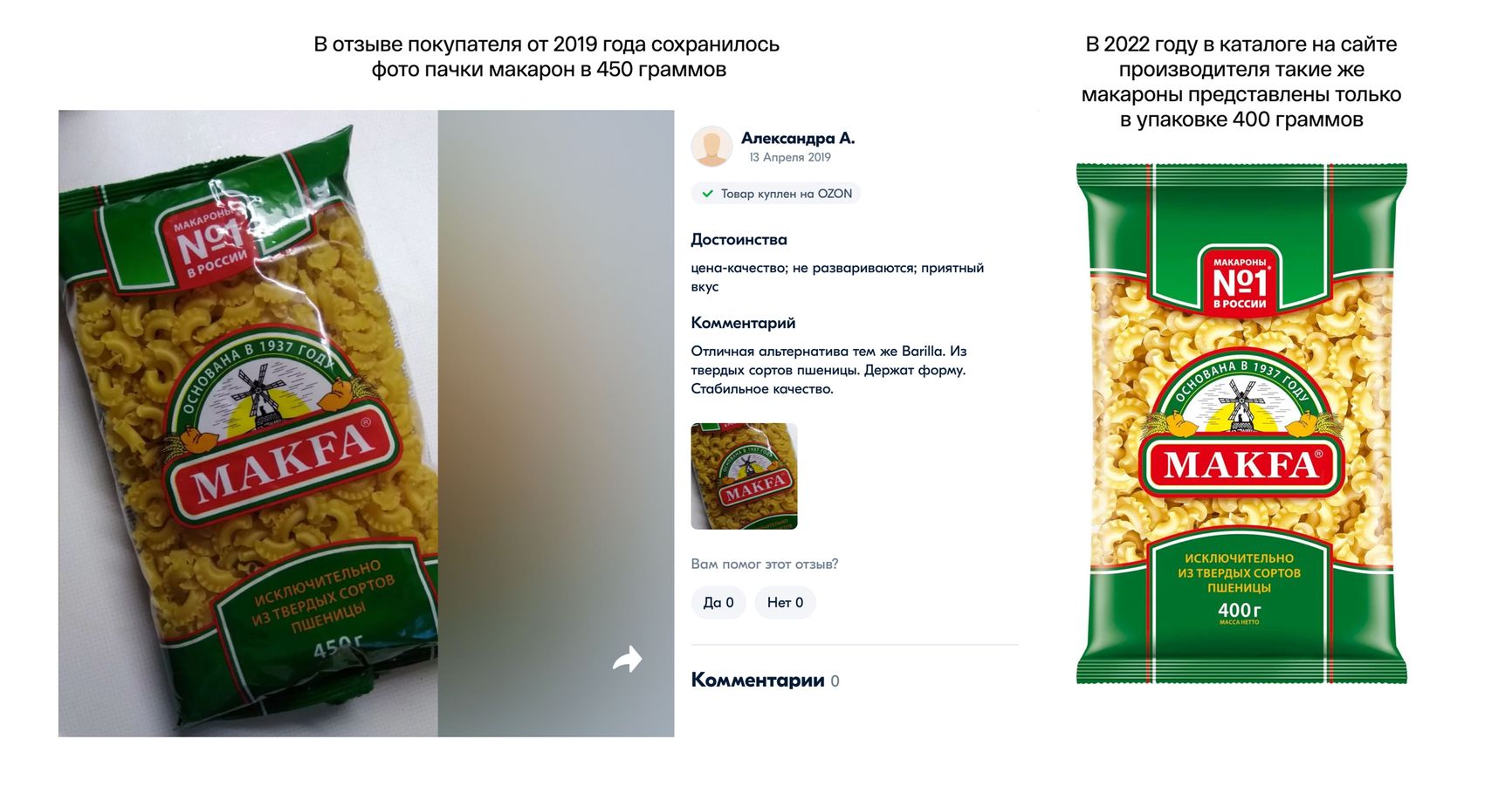

Dairy products illustrate the gradual package downsizing particularly well. Manufacturers continue using the same tare for the goods. Without carefully studying the label, a consumer might fail to notice that their milk or kefir bottle contains less of the substance every few months. Russian chain store catalogs suggest that Activia yogurts have lost several dozen grams in the last few years. In the spring of 2022, the manufacturer even introduced smaller bottles with a new design and the caption “Bargain”.

Left: Magnit special offers, July 13-26, 2016. Right: The same yogurt at Ozon marketplace, in a bottle containing 30 grams less, October 13, 2022

Another trick by Danone was to introduce a new, smaller cup for Activia yogurts, adding a caption “Bargain” (a screenshot from the Auchan online catalog, October 13, 2022)

Other Danone products are shrinking too. In 2022, Prostokvashino sour cream is sold in 300-gram containers, as compared to 315 grams (in the same containers) in 2020–2021 and 350 grams five years ago.

Shrinking Prostokvashino sour cream: 350 grams in February 2016, 315 grams in February 2020, and 300 grams in October 2022

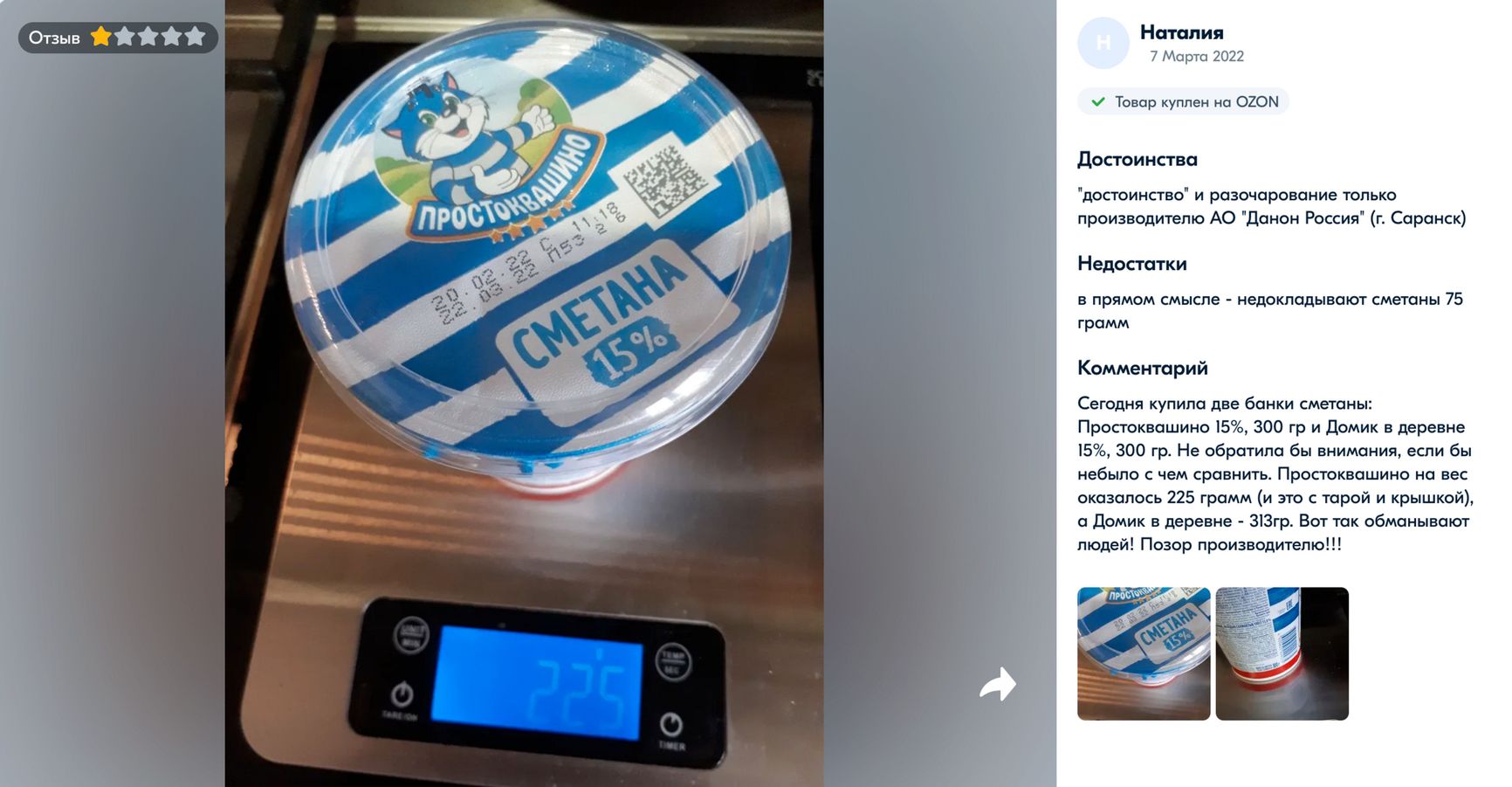

However, consumers assert that the manufacturer can no longer guarantee even 300 grams in 2022. The Insider has found a consumer review at the Ozon marketplace, which includes a photo suggesting there is even less sour cream in the container.

A screenshot of customer complaint at Ozon saying that she only got 225 grams of sour cream instead of 300 as per the label

Prostokvashino cottage cheese has followed a similar trajectory.

Left: 220 grams, February 2020. Right: 200 grams, October 2021

Photos from iRecommend.ru, an independent review platform

Danone is not the only dairy manufacturer to resort to such tricks. Molvest, the manufacturer of Vkusnoteevo products, is also shrinking its packages. Thus, its zero-fat cottage cheese has lost around 50 grams (14%) over the last five years, while showing a 40-percent price growth.

Left: 350-gram container, Magnit special offers, July 13-26, 2016

Right: 300-gram container, Auchan catalog, 13 October 2022

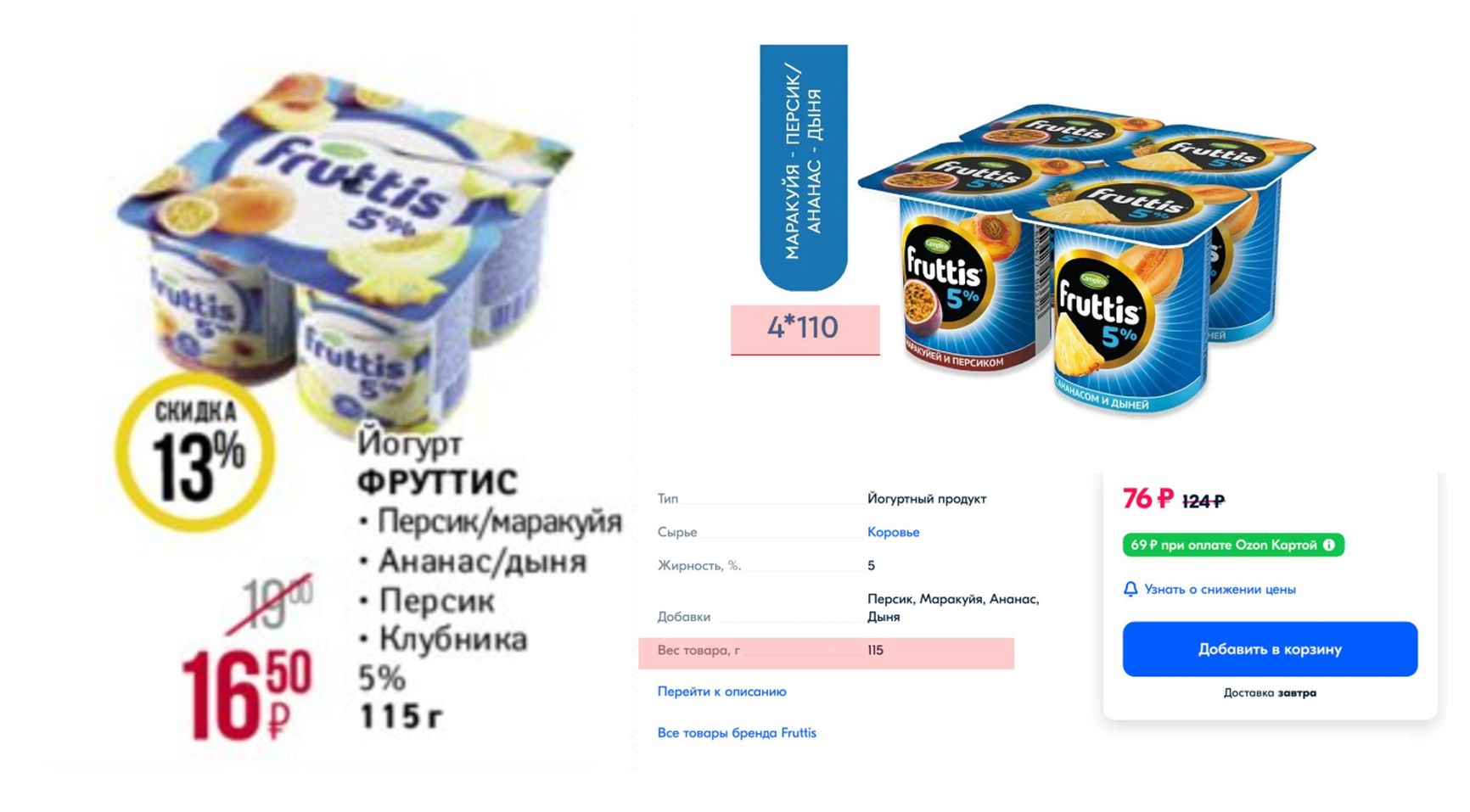

Fruttis yogurts have shrunk by five grams, with their prices almost unchanged. The manufacturer achieved this by tweaking the ingredients. This happened just a few months ago, so some of the retailers have not had the time to change the description on their websites.

Left: Magnit special offers, July 13-26, 2016

Right: 5 grams less yogurt, Ozon, Ocober 13, 2022

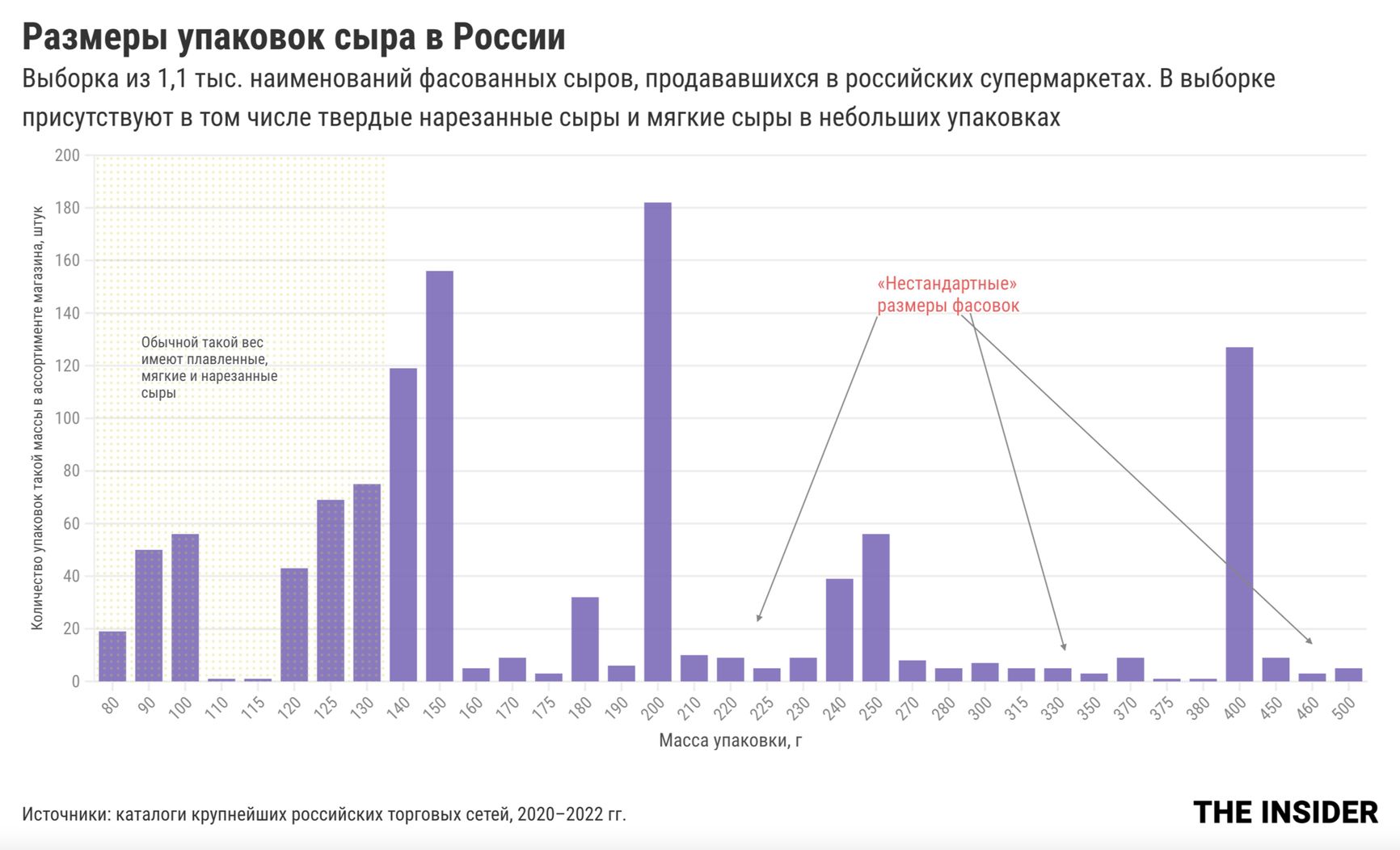

Hard and semi-hard cheeses are most frequently sold in blocks of 250 and 400 grams, but individual manufacturers offer varying package sizes: 370-380 grams, 270-280 grams (slightly less than 300), or 220-230 grams (a bit under 250). Sometimes even package sizes of the same manufacturer vary. Consumers are unlikely to notice the difference.

Cheese packaging sizes in Russia. The sample includes 1,100 types of cheeses sold in blocks and slices and soft cheeses sold in containers

Horizontal: Net weight, g. Vertical: Quantity in stock, pcs. Red: Non-standard packaging. Dotted area: package sizes typical of sliced, soft, and processed cheeses

Belarusian manufacturers have resorted to shrinkflation as well, with Brest-Litovsk dairy packages (made by OAO Savushkin Product) losing 5–10% of weight in the last six years.

“Russia is a generous soul”: How chocolate melted

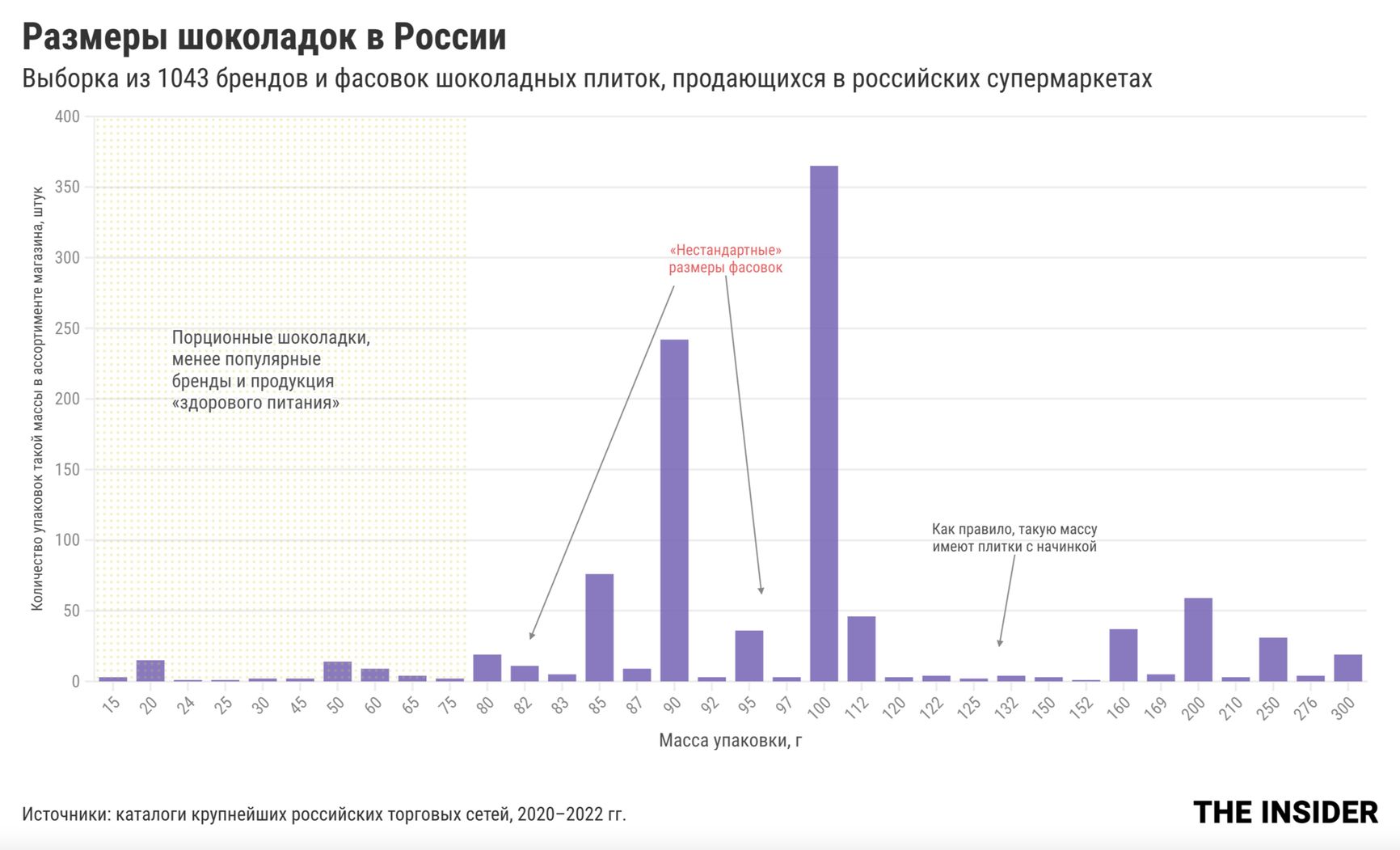

We applied a similar methodology to studying how chocolate bars have shrunk: while a random chocolate bar in any store used to weigh 100 grams, you would be hard-pressed to find such a bar in today's Russia, and if you do, it will most likely be from a foreign brand: Lindt, Toblerone, Ritter Sport, or Kinder. Among Russian brands, 100-gram bars are still manufactured by Uniconf Group, which brought together Soviet-era brands, such as Alyonka, Babayevsky, and Vdokhnoveniye.

Chocolate bars in Russia. A sample of 1,043 chocolate bar brands and sizes available in Russian supermarkets.

Horizontal: Net weight, g. Vertical: Quantity in stock, pcs. Dotted area: single-serve bars, less popular brands, "healthy" options. Red: "Non-standard" packaging. Black: Typical of filled chocolate bars

Meanwhile, the chocolate bars of Rossiya Shchedraya Dusha (which translates as “Russia is a generous soul”), owned by international giant Nestle, started melting long before reaching the mouths or even hands of their consumers. Over the last decade, Rossiya bars shrank from 100 to 82 grams, and their composition has considerably deteriorated: in March 2021, it already contained milk whey, and by August 2022, its cocoa percentage had dropped from 33% to 25%.

Rossiya chocolate bars:

April 2011, March 2021, August 2022

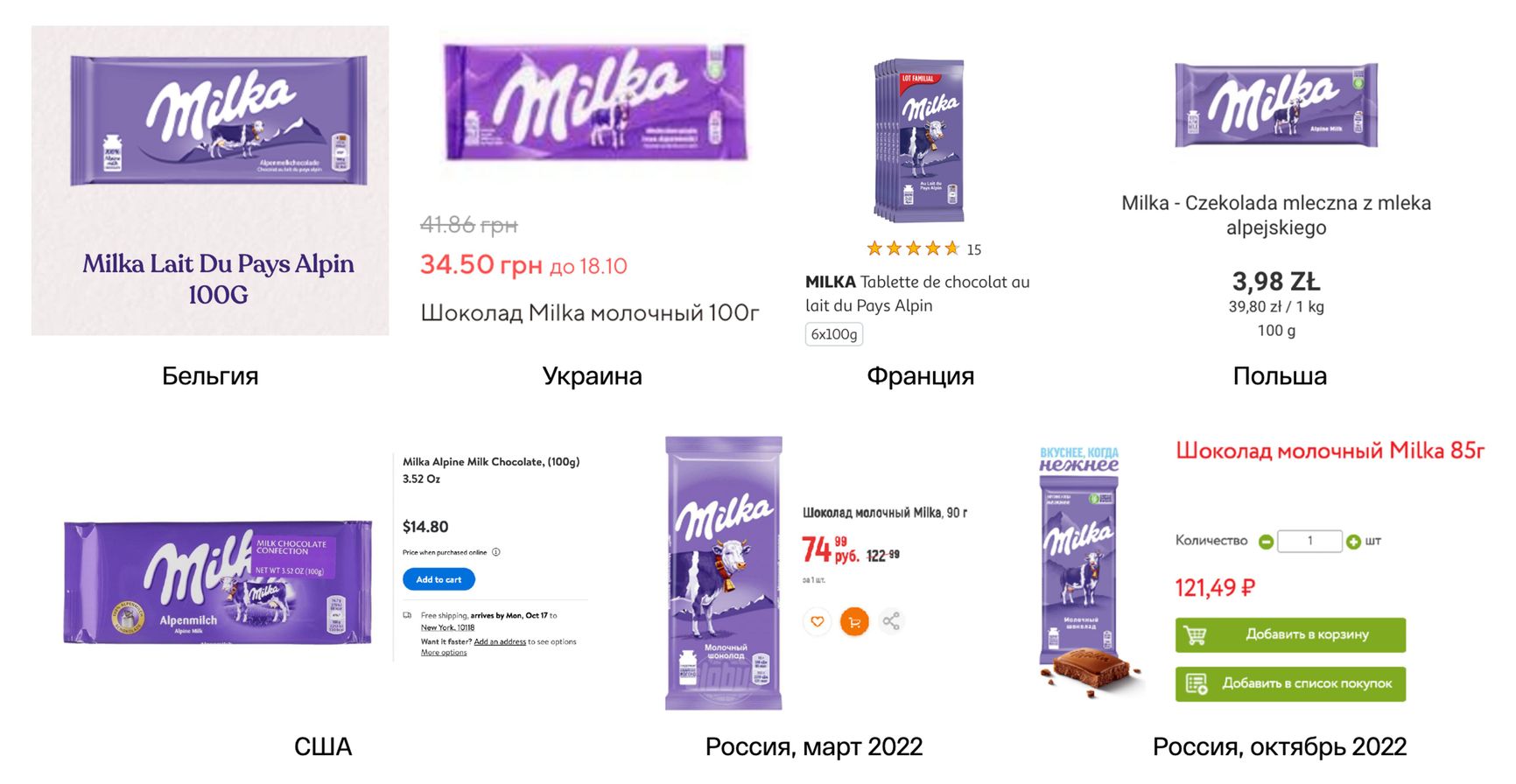

The same is true about Milka, an international brand whose chocolate bars you can buy anywhere across Europe and the US. A classic Milka milk chocolate bar (manufactured in Russia by Mondelez Rus) weighed 90 grams in March 2022 but shrank to 85 grams in October. While the manufacturer explained the change by the trend for healthy living, The Insider found out that the Milka bar had only shrunk at the company's Russian subsidiary. In other countries, a similar Milka bar still weighs 100 grams in October 2022.

Screenshots: the online catalogs of Globus, O’KEY (Russia), Auchan (Poland, France, Ukraine), Walmart (USA), and the manufacturer's official website (Belgium)

Admittedly, the bars of Alpen Gold chocolate (also manufactured by the Mondelez subsidiary in Russia) weigh less than 100 grams in other countries too.

Never a bad time for a beer: Watch it evaporate

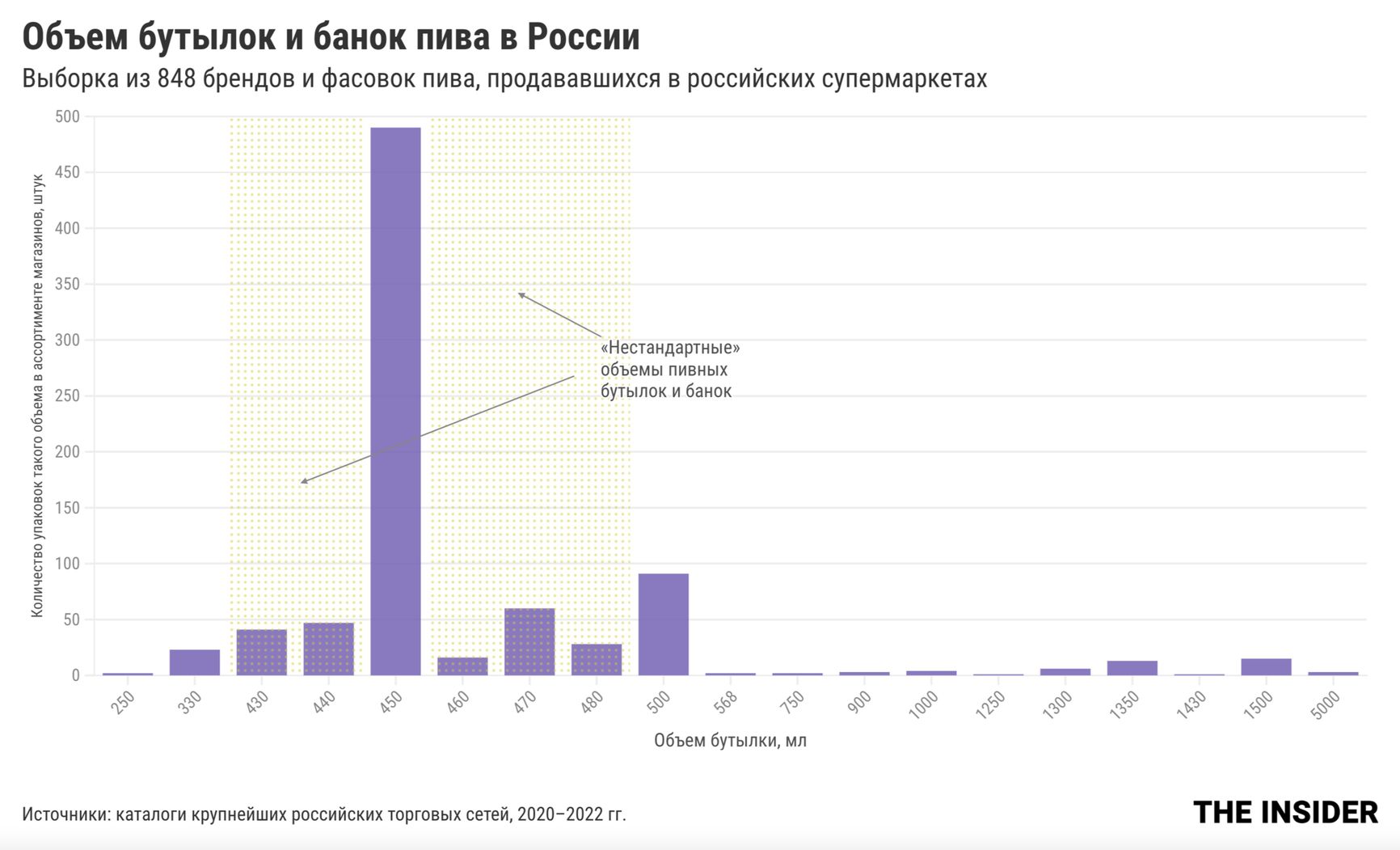

Beer bottles are getting half-empty as we speak. The once-standard half-a-liter bottle has long since turned into 450 milliliters. Starting since mid-2021, we saw the emergence of 440- or even 430-milliliter bottles. Thus, a Bud Light bottle lost 30 milliliters in 2021-2022, down to 440 milliliters. Stella Artois light beer is also sold in 440-milliliter bottles, as compared to the “honest” half-a-liter a year ago.

The volume of beer bottles and cans in Russia. A sample of 848 brands and volumes available in Russian supermarkets

Horizontal: Tare volume, ml. Vertical: Quantity in stock, pcs. Dotted areas: "Non-standard" volumes of bottles and cans

It has been impossible to track the changes in the packaging of such popular beer brands as Staropramen, Velkopopovický Kozel, or Gambrinus because they are no longer available in Russia. In March, many Czech beer manufacturers ceased exporting to Russia because of the war in Ukraine. Beer imports from the UK, US, Belgium, Czechia, and Germany have been reduced to a trickle. In October, the Association of Retail Trade Companies (ACORT) reported a 40-percent decrease in the assortment of imported beers. The government is already considering authorizing the parallel import of alcohol because many Russians preferred foreign brands, and their absence on the shelves has cut a dent in retail chain income.

Margins of error

Studying catalogs of goods and the history of their packaging, The Insider has come across many examples of popular, more “standard” sizes of packaging (such as a liter of milk or oil, a kilo of rice or flour, 500 milliliters of beer, or 100 grams of chocolate) interspersed with smaller, uneven values. This is not the case with wines, pasta, mineral water, baby food, sweets, or pet food, but examples abound in dairy cartons, cups, and bottles, groat bags, sauces, chocolate bars, and canned foods.

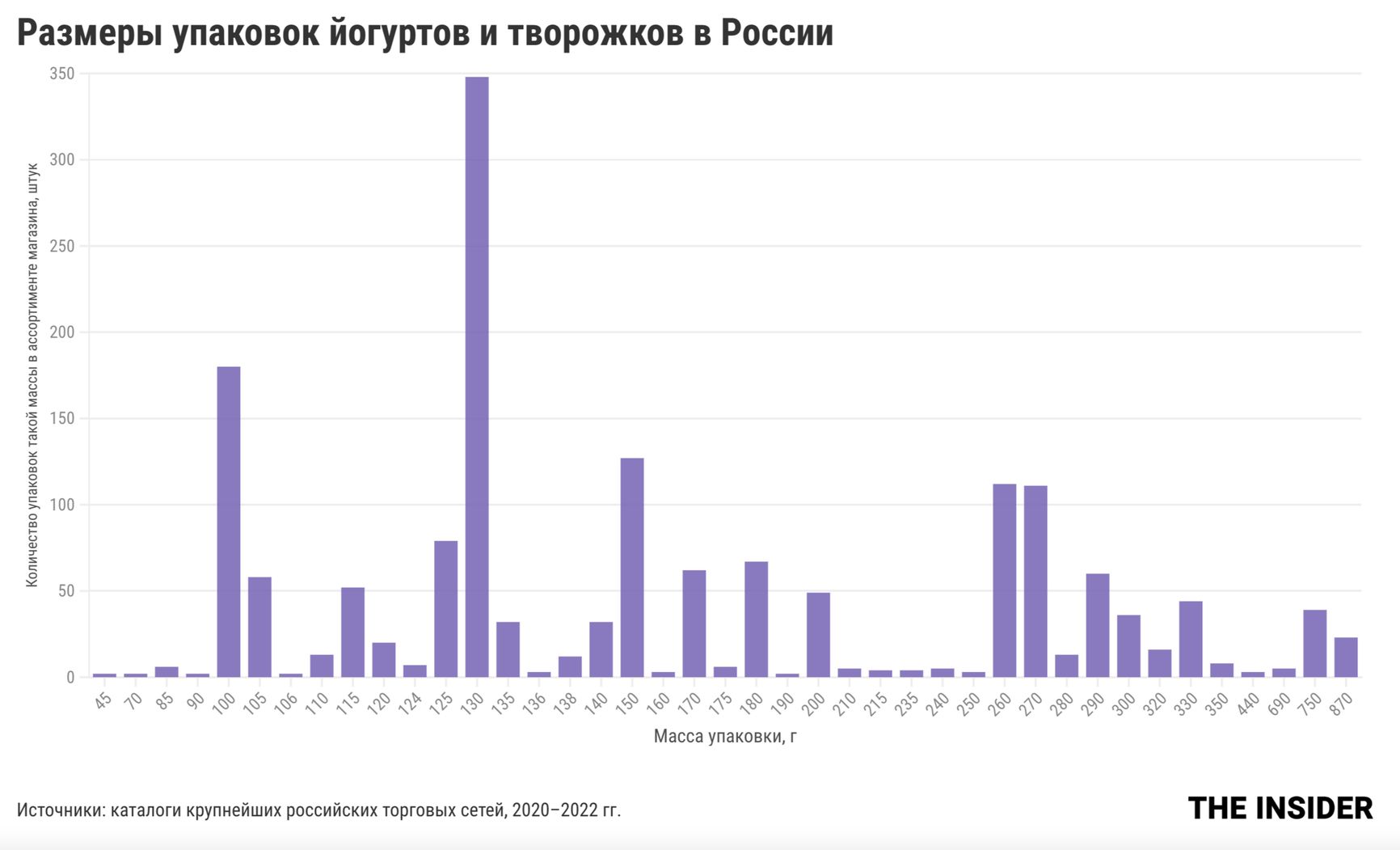

Yogurt and cream yogurt package sizes in Russia

Horizontal: Net weight, g. Vertical: Quantity in stock, pcs.

Milk bottle and carton volumes in Russia

Horizontal: Tare volume, ml. Vertical: Quantity in stock, pcs.

Mayo doypack sizes in Russia

Horizontal: Net weight, g. Vertical: Quantity in stock, pcs.

Size variations are more frequent in international food giants with manufacturing facilities in Russia and less frequent among Russia’s domestic manufacturers and imported goods.

One thing is certain: the shrinkflation tactic has its limits. Consumers may not notice a bottle of milk shrinking from one liter to 900 milliliters (especially if the tare is the same, just with a smaller amount of milk inside), but mistaking half a liter for a liter is impossible. At present, manufacturers have reached the limit of their package downsizing opportunities, which means they are out of options and will have to raise prices.